A notable movement occurred on the Bitcoin network on Monday. A wallet that hadn't made any transactions for approximately 13 years transferred nearly $85 million worth of BTC in a single transaction. On-chain data shows that the wallet moved all of its assets accumulated during 2012–2013 to another address. This period coincides with Bitcoin's early stages, when prices were fluctuating between $50 and $100.

909 BTC moved

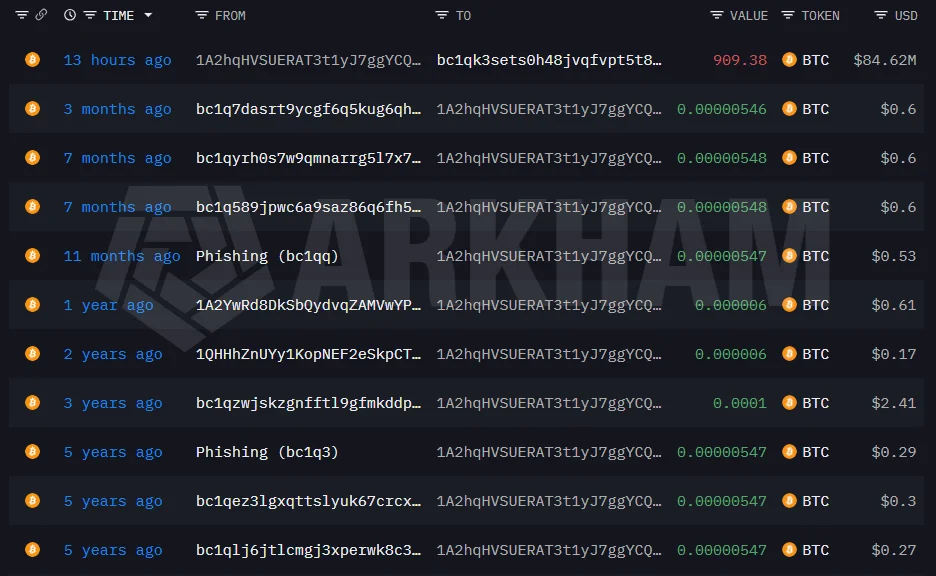

According to on-chain analysis, the address starting with "1A2hq…pZGZm" moved a total of 909.38 BTC after approximately 13 years. The entire transfer was sent to a single new address, a Segwit wallet appearing as "bc1qk…sxaeh," around 4:17 PM local time on Monday. Data reveals that this address has no other transaction history to date. It is currently unknown who owns the wallet or what the purpose of the transfer was.

According to information shared by the blockchain intelligence platform Arkham Intelligence, the wallet in question made regular purchases between December 2012 and April 2013. During that period, the price of Bitcoin sometimes dropped to $13, while it rose to approximately $250 within the year. Compared to today's prices, this transfer represents an extraordinary increase in value for its owner after a decade of waiting. Such "dormant wallet" activity is generally closely monitored in the crypto market. The reactivation of addresses from the early years of Bitcoin, particularly those associated with the so-called Satoshi era, is interpreted differently by market participants. Some investors see these movements as profit-taking by long-term investors, while others point to the possibility that assets are simply being moved to new addresses for security reasons. Similar examples were seen during last year's rally when Bitcoin reached record highs. Some large wallets that had been inactive for a long time made headlines by releasing large amounts of BTC into the market. In a remarkable event in July 2025, a Bitcoin whale liquidated over 80,000 BTC on the market, making a profit of approximately $9 billion. It was publicly reported that these sales were conducted through the institutional investment bank Galaxy Digital.

The impact of the latest transfer on the market currently appears limited. As of Tuesday morning, Bitcoin was trading at $91,188. This price indicates a stabilization zone following the sharp drop triggered over the weekend by escalating trade tensions between the US and the European Union. Analysts emphasize that while individual wallet movements can create volatility in the short term, macroeconomic developments and institutional flows are more decisive in determining the overall trend.