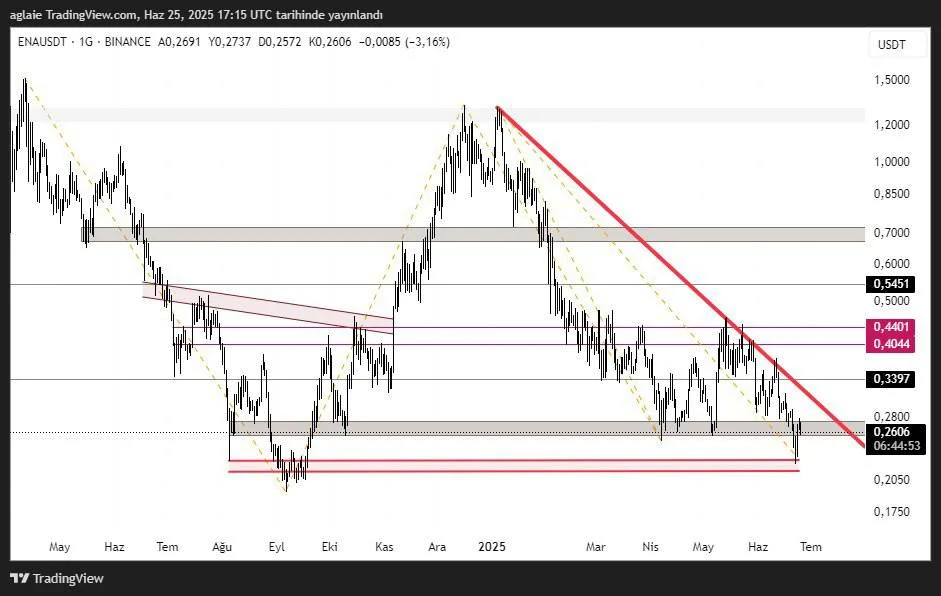

Ethena (ENA) Technical Analysis

ENA is currently trading at a very critical level while it is moving within the downtrend. The price zone of $0.26–$0.24 is the last line of defense, and it is where buyers outperformed sellers in the past.

We can expect a pullback to the zone of $0.20–$0.21 if the price is broken downwards from this area; yet, the strong buy reaction at current levels is likely to increase the probability of an upward reversal from this support area.

The first target area above we have is $0.28–$0.30, and above it there is $0.3397, which is very important as it is both a past resistance level and a contact area in the downtrend. Should the price break above these levels, then we can talk about the levels of $0.4044 and $0.44401 respectively. For a stronger rise of the price, we need to see closings above the level of $0.5451.

In summary, we can say that ENA is currently trying to hold above a strong support zone, from which a reaction could trigger a rally, but it is of great importance that the price break the downtrend. Otherwise, the downtrend might carry on.

These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, the user is responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during the transactions.