The bridges between the cryptocurrency world and traditional finance are getting stronger every day. One of the projects that draws attention at this intersection is Ondo Finance. Aiming to combine the solid structure and institutional-level products of traditional finance with the transparency and accessibility offered by blockchain technology, Ondo Finance undertakes a pioneering mission in this field.

If you are one of those who say, “Let my crypto investments have more secure and tangible foundations,” the answer to the question of what Ondo is may appeal to you.

Definition and Origin of Ondo Finance

In its most basic form, Ondo Finance is a platform operating in the field of tokenization of real-world assets. In other words, it converts traditional financial assets such as US Treasury bonds into digital tokens and enables them to be traded on the blockchain. Such products, which are normally accessible only to large financial institutions, traded in certain time zones and involve complex processes, are now accessible from everyone's wallet, 24/7. This transformative idea lies at the heart of the question of what Ondo Finance is: Making corporate financial products accessible to everyone.

Ondo’s main purpose is to provide investors in the crypto ecosystem with access to fixed-income products in the closed world of traditional finance. In response to the high volatility inherent in crypto assets, it offers users a safer, more transparent, and predictable investment option by moving the returns of stable instruments such as US Treasury bonds to the blockchain.

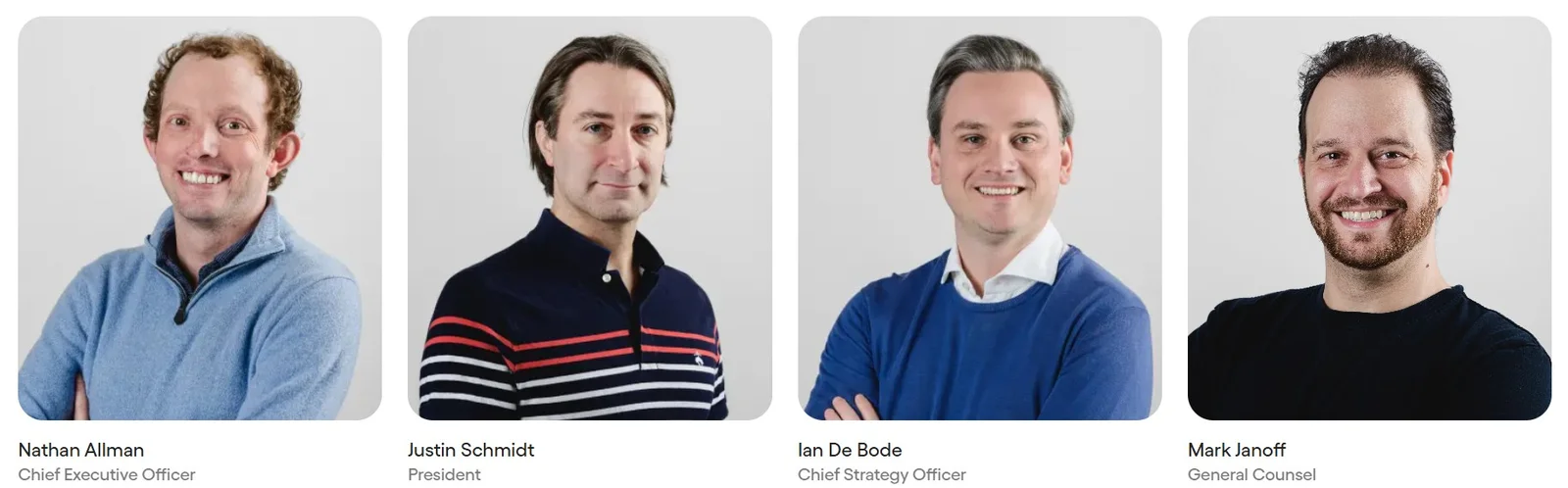

The platform was founded in 2021 by Nathan Allman. Allman stands out as an entrepreneur with a vision to bring together the world of traditional finance and blockchain. Ondo’s team is full of experienced names from institutions such as Goldman Sachs, Facebook, and Microsoft; they bring together both the discipline of traditional banking and the innovative aspects of DeFi. This multifaceted team structure allows the platform to establish a healthy balance between stability and innovation.

The ONDO token, which is at the center of the ecosystem, is not just a cryptocurrency; it is also a governance tool. The answer to those who ask what does Ondo token do is clear: ONDO gives the user a say in shaping the future of the platform, while also playing an active role in the services and incentive mechanisms within the ecosystem.

Ondo Finance’s mission is to make financial services more accessible, transparent, and efficient by leveraging the power of blockchain technology. This goal aims to overcome the limitations of traditional finance, such as slow, expensive, and limited transaction hours, while also addressing DeFi’s challenges of connecting to the real economy and heavy reliance on stablecoins.

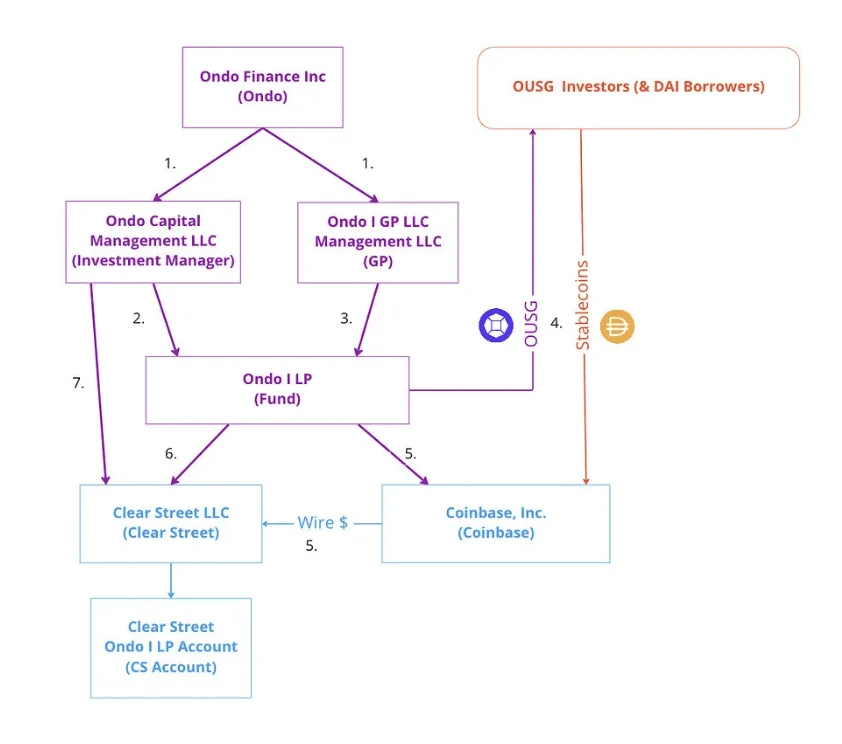

Ondo Finance is divided into two main structures: asset management and technology. The asset management arm designs and oversees tokenized products, while the technology arm is responsible for developing the decentralized protocols that support these products. This dual-structure system allows Ondo to both mimic traditional financial instruments and benefit from the advantages provided by blockchain.

At this point, it is necessary to emphasize the importance of the concept of real-world asset tokenization. Tokenizing assets such as real estate, commodities, or securities on the blockchain makes these assets more liquid, transparent, and accessible. It reduces transaction costs by eliminating intermediaries and offers a more direct value transfer opportunity. Ondo’s focus is particularly on the US Treasury bond market, which exceeds $31.5 trillion. This huge market creates a huge growth area for the platform.

Today, high interest rates make short-term Treasury bonds quite attractive in terms of investment. With its blockchain-based structure, Ondo democratizes access to these assets and offers users a stable passive income opportunity.

In short, Ondo Finance is one of the most innovative platforms in this field, bringing the solid assets of traditional finance to the blockchain and offering fixed-income DeFi options to both individual and institutional investors.

Ondo Finance History: Major Milestones

Ondo Finance set out in 2021 with the vision of bringing together traditional finance and decentralized finance. In its early stages, the focus was on protocol development and product launches. In September 2021, an important partnership was announced with Yield Guild Games (YGG), a pioneering project in the NFT and gaming space. Within the scope of this partnership, the vaults offered by Ondo provided one-sided, risk-controlled investment opportunities in liquidity pools on decentralized exchanges. For example, it became possible to earn returns by making one-sided YGG investments in the ETH/YGG Sushiswap pool. At the same time, other users could also earn fixed ETH returns from these liquidity pools, while the risk of temporary losses was minimized. These vaults aimed to offer ETH returns with a fixed APY of 25% and YGG returns with a variable APY of up to 615% (excluding temporary losses). The three-day open subscription window for participants, which began on October 1, marked Ondo’s first serious entry into the market with controlled-yield vaults.

2022 was a turning point for Ondo Finance. The token sale held on CoinList attracted great attention and raised $10 million from more than 18,000 participants. This showed that Ondo had gained community support at an early stage.

During the same period, Ondo’s steps towards integration with the giants of the traditional finance world accelerated in line with its institutional investment DeFi vision. The OUSG fund, based on the ETF managed by BlackRock, was one of the most concrete examples of this collaboration. In addition, partnerships were established with institutions that manage over $1 trillion in assets worldwide, such as Franklin Templeton and Wellington Management.

The ONDO token was officially launched at the beginning of 2024. During this period, the ONDO token began trading on platforms such as RocketX Exchange as part of the listing process on major exchanges. The token, which was previously sold on CoinList in 2022, thus became widely accessible.

Over time, Ondo has become a leader among RWA DeFi projects. Yield-generating stablecoin yield systems (such as USDY) and tokenized treasury products (such as OUSG) have brought the platform to the center of the RWA market.

Collaborations with traditional financial institutions such as Coinbase, BNY Mellon, Citi, JP Morgan, Morgan Stanley, State Street and StoneX also supported Ondo's "institutional-grade finance" discourse. Some of the strategic steps Ondo has taken recently are as follows:

- Integration with Ripple and XRP Ledger in January 2025 made OUSG available to institutional users via this network.

- In February 2025, Ondo became the first Ondo RWA provider to join Mastercard’s Multi-Token Network (MTN). This collaboration enabled Mastercard’s banking partners to evaluate their idle cash via OUSG.

- Integrations with blockchain projects such as Injective, Solana, and Cosmos (Noble) strengthened Ondo’s multi-chain compatibility.

- The partnership with Pendle Finance enabled Ondo products such as USDY to be used in yield protocols and increased the compounding potential of RWA tokens within DeFi.

All these developments not only provide an answer to the question of when Ondo coin was released, but also reveal why it has become such an important actor in the RWA field. With the transfer of traditional financial products to the on-chain, support with legal compliance and a wide integration network, Ondo builds a solid bridge between the real world and the blockchain. Among the projects operating in the RWA field, Ondo Finance stands out with its regulation-friendly structure, institutional-focused products and strong partnership network. Projects such as Maple Finance, Goldfinch, TrueFi, Clearpool and Centrifuge are also working in the field of institutional debt and asset tokenization. However, Ondo's relationships with traditional giants such as BlackRock, Mastercard and Ripple and the fact that its products are compliant with US securities laws put it at a different and more advanced point than many of its competitors.

Why Is Ondo Finance Valuable?

Ondo Finance stands out with its structure that combines the traditional and decentralized finance worlds. This bridge offers a unique value proposition to both individual investors and institutional players. Here are the key elements that make the Ondo protocol so valuable:

Offers access to tokenized fixed income products

One of Ondo’s strongest features is that it makes high-quality financial products, such as US Treasury bonds, normally only accessible to institutional investors, available to everyone via the blockchain. Products like USDY offer a yield-generating stablecoin alternative collateralized by Treasury bonds and bank deposits. Especially in the current high-interest environment, these products can yield 5% or more.

| Feature | USDY | OUSG |

Target Audience | Retail and institutional investors (outside the U.S.) | Accredited investors only |

Yield Mechanism | Rebasing or yield-accrual | Yield-accrual |

Annual Yield (APY) | Approximately 4.35% | Approximately 4.1% |

Minimum Investment | 500 USDC | 100,000 USDC |

Networks | Ethereum, Solana, Injective | Ethereum, Solana, Polygon |

Use Cases | Stablecoin alternative, yield generation | DeFi collateral, yield generation |

Pioneers of the RWA market

RWA DeFi projects have become one of the most powerful narratives in the crypto world recently. The tokenization of assets and their transfer to the chain provides investors with a new generation of ease of access, while also attracting large financial institutions. It is also emphasized in the market that this market has a potential of trillions of dollars. It is even stated that central banks and sovereign funds are interested in this area.

Ondo is positioned at the center of this narrative with its leadership in the RWA field. Its partnerships with giants such as BlackRock and Mastercard also make the project a reliable financial infrastructure player.

ONDO token is active in governance and incentive mechanisms

ONDO token is an important component that shows that the platform is not just an investment vehicle. This token, which acts as the Ondo governance token, gives its holders the authority to make decisions about the future of the protocol through the Ondo DAO. This increases community participation and strengthens the decentralization of the ecosystem.

In addition, ONDO token has various usage areas within the ecosystem. For example, passive income can be generated through staking mechanisms or used as a means of payment for on-platform services. The fixed supply of the token (10 billion) and its strategic distribution were designed with long-term sustainability in mind. This structure gives a clue to Ondo tokenomics (token economy). In the meantime, we cannot fail to mention the ONDO price. As of May 2025, the Ondo (ONDO) token is trading at $ 0.8. With a market value of approximately $ 2.76 billion, ONDO ranks 34th in this ranking. It also draws attention with its circulating supply of 3.15 billion units. The coin, which reached a peak of $ 2.14 in December 2024, has experienced a correction of over 59% since then. However, the growth potential in areas such as real-world asset tokenization (RWA) and institutional DeFi solutions may be giving positive signals for the future of Ondo.

Facilitating the entry of institutional capital into the DeFi world

Although traditional financial institutions are closely following the opportunities offered by DeFi, they are cautious about this area due to reasons such as security, regulation and lack of infrastructure. Ondo fills this gap. It acts as a bridge in the institutional investment DeFi space with the transparency, regulation-friendly infrastructure and institutional-level technical competence it provides.

Audited and regulation-friendly structure

One of the key elements behind Ondo's success is its transparency and audit-oriented approach. The platform aims to take the best practices of traditional finance and integrate them into DeFi. It offers a structure shaped by KYC (identity verification) / AML (anti-money laundering law compliance) processes, daily independent audits for products such as USDY and legal consultancy. In order to safely use innovative products such as stablecoin yield systems, the Ondo platform works with a permissioned access framework. This meets the requirement that tokenized treasury products in particular be classified as securities. Thus, the platform gains advantages in terms of long-term stability and legal durability.

Infrastructure development

Ondo’s vision is not limited to just issuing tokens. It also aims to build infrastructures where these assets can be transferred and used securely and efficiently. For example:

- Ondo Chain: A purpose-built Layer-1 blockchain

- Ondo Bridge: A cross-chain transfer solution

- Flux Finance: A protocol that enables tokenized assets to be used in DeFi

These infrastructures enable tokenized assets to operate in a manner compatible with institutional finance. With all these components, Nathan Allman and his team have made Ondo not just a product platform, but also an institutional-level infrastructure provider in the DeFi world.

Who is the Founder of Ondo Finance?

Nathan Allman is the founder and CEO of Ondo Finance. Allman began his career in the Digital Assets team at Goldman Sachs, where he worked on cryptocurrency markets. He also gained experience in private credit investments at Prospect Capital Management. Allman, who completed his education at Brown University, combined his traditional finance knowledge with blockchain technology to found Ondo Finance.

The company aims to bring financial markets onto blockchain by offering tokenization of real-world assets (RWA) and institutional-grade DeFi solutions. Under Allman’s leadership, Ondo Finance has strengthened its position in the industry by establishing partnerships with major financial institutions such as BlackRock and Mastercard. However, Ondo is not just the product of one person; the team behind Ondo is as remarkable as its founder. The team includes names from major technology and blockchain companies such as Facebook, Microsoft, Symbiont, and BadgerDAO; private equity funds, and hedge funds.

Frequently Asked Questions (FAQ)

Up to this point in the article, we have covered the structure, history, technology and why Ondo Finance is valuable in detail. Now, here is the frequently asked questions section, where we clearly answer the technical and fundamental issues that readers are most curious about:

- What is ONDO and how does it work?: ONDO is a DeFi protocol that tokenizes traditional financial assets on the blockchain and makes them accessible to everyone.

- What is the ONDO token for?: The ONDO token is used in incentive mechanisms such as participation in the governance process and staking.

- What is real world asset (RWA)?: RWA is the representation of physical or traditional financial assets on the blockchain by converting them into digital tokens.

- What makes Ondo different from other DeFi projects?: Ondo offers fixed returns to both individual and institutional investors by bringing corporate finance products to the blockchain in a regulatory-compliant manner.

- How does ONDO staking and governance work?: Users can earn passive income by staking their ONDO tokens, and have a say in the development of the protocol by voting.

- Is Ondo secure and regulated?: Yes, Ondo is open to independent audits, KYC/AML compliant, and regulatory-friendly; this creates a foundation that supports institutional adoption for the future of Ondo. In other words, Ondo Finance structures its products in accordance with US securities laws and provides access to investors only within the framework of regulation. However, the changing regulatory environment on a global scale may create uncertainties for DeFi and tokenization projects. In particular, the attitude of the SEC and other regulatory authorities may cause changes in access models or product structures in the future. Therefore, it is important for users to carefully review the legal notices and seek independent advice before investing.

Don't forget to follow our JR Kripto Guide series for the most up-to-date content on Ondo Finance and RWA-based Web3 investments!