One of the first questions you'll encounter when entering the cryptocurrency world is: "How can the value of these digital assets change so quickly?" In this world where Bitcoin can fluctuate by thousands of dollars a day and Ethereum fluctuates based on market news, stablecoins, especially those based on the US dollar, offer a haven of peace amidst the storm. This is where USDC (USD Coin) comes in. As its name suggests, this cryptocurrency functions as a "digital dollar." A stablecoin whose value is pegged at a one-to-one ratio to the US dollar, USDC is designed for both those who want to benefit from the speed and technology of the crypto world and those who need to trade with a stable digital asset.

So, what distinguishes USDC from other cryptocurrencies? Perhaps the most significant difference is that each USDC is backed one-to-one by one US dollar or equivalent high-quality liquid assets in the real world. In other words, we're talking about a structure designed to ensure that "1 USDC = 1 USD" in practice, not just in theory. This allows users to trade with peace of mind, knowing that the digital assets they hold have tangible value. Its low volatility makes it a particularly attractive alternative, particularly for use cases such as trading, savings, and instant payments. In this guide, we will thoroughly examine what USDC is, how it works, who developed it, which blockchains it resides on, and why it holds such a significant place in the digital economy. If you're ready, let's explore the story of the digital dollar together, focusing on questions like "What is USDC?", "What is USDC coin?", and "How does USDC work?"

USDC Definition and Origins

USDC, or USD Coin, is a stablecoin that, as its name suggests, sets out to be the "dollar" of the digital world. While it may sound quite simple, this simplicity actually stems from a robust structure and detailed planning. Let's take a closer look at what USDC is and how it came to be.

First, let's clarify this fundamental feature: 1 USDC is always worth approximately 1 US dollar. This means the price of this coin doesn't rise one day and fall the next, like Bitcoin or Ethereum. USDC's mission is to remain stable. As Coinbase's initial announcement emphasized, this coin was designed as "an exact representation of a US dollar." This has made it a particularly attractive tool for investors seeking stability in payment transactions, money transfers, or the crypto world.

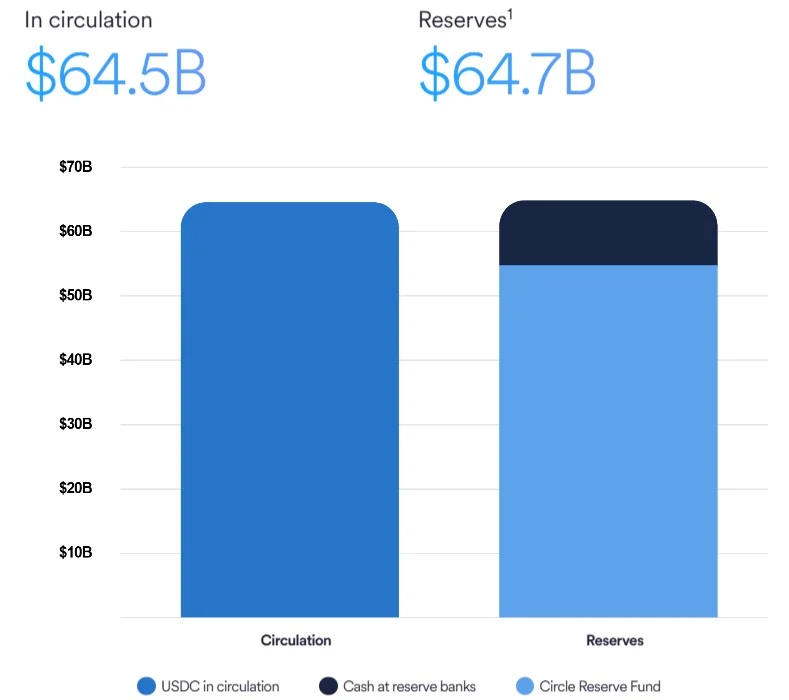

But if you're wondering, "How can a digital asset remain stable?", that's where the reserve system comes into play. Think about it this way: For every USDC printed, a dollar's worth of real-world value is held somewhere. These assets are held either directly as cash or as short-term, secure financial instruments (e.g., US Treasury bonds). Circle explicitly states that these reserves are held by large, reliable financial institutions and are audited monthly by independent auditing firms. This means users can make transactions without having to wonder, "Is there really anything behind this coin?"

Another advantage of USDC is that it's not limited to Ethereum. Initially, it was issued on Ethereum using the ERC-20 standard. However, over time, it has grown and evolved, and has become a part of many more blockchain networks. It's now possible to use USDC on many different chains, including Solana, Algorand, Avalanche, Flow, TRON, Stellar, Hedera, and Arbitrum. This gives users the freedom to choose their transfer chain, enabling faster and lower-cost transactions.

So, who created USDC? Who's behind it? The answer is: Centre Consortium. It's a joint venture between two major names, Circle and Coinbase. Circle is a Boston-based financial technology company operating in compliance with US regulations. Its CEO is Jeremy Allaire, while Coinbase is a major cryptocurrency exchange led by Brian Armstrong. USDC, the combination of these two experienced companies, has earned trust not only for its technological infrastructure but also for its regulatory compliance and transparent structure.

In short, USDC is a highly robust stablecoin, both technologically robust and backed by a substantial reserve system, bridging traditional finance and the crypto world. Moreover, it continues to expand its reach by appearing on more chains every year.

USDC's History: Key Milestones

USDC's story is filled with developments that could be considered a turning point for those seeking stability in the crypto world. Founded in 2018, this digital dollar quickly rose to prominence not only with its stable price but also with its strong support structure. Now, let's take a look at how USDC gradually evolved to its current position.

2018: Launch and First Steps

USDC's birth was announced on October 23, 2018, by the Centre consortium, a joint venture between Circle and Coinbase. At that time, stablecoins were not yet widespread in the crypto ecosystem, and USDC's vision was quite clear: 1 USDC would be a one-to-one digital representation of the US dollar on the Ethereum blockchain. With the launch, Coinbase and Circle users began buying and selling USDC through mobile or web apps. The point emphasized in the introductions was that each USDC was truly backed by one dollar and that this was transparently verified. This approach created a new standard of trust in the stablecoin world at the time.

2020: Rise with the DeFi Wind

2020 was recorded as the year that DeFi (Decentralized Finance) exploded. DeFi protocols like Uniswap, Compound, and Aave achieved record transaction volumes, and USDC became a darling of this new era. USDC became one of the most preferred stablecoins for transactions such as providing liquidity, providing collateral, and borrowing. As of September 2020, the amount of USDC in circulation surpassed $2 billion, making it one of the world's 15 largest cryptocurrencies by market capitalization. According to Circle data, approximately 40% of the funds held on platforms like Compound and dYdX at the time were traded in USDC. In other words, investors were seeking returns while also opting for stability with USDC.

2022: Multi-chain deployment

By 2022, USDC was no longer an asset running solely on Ethereum. Circle launched a multi-chain expansion strategy to reach more users and reduce transaction costs. USDC launched on the Flow network in January and later that year also appeared on blockchains like Solana, Avalanche, Algorand, Stellar, and Hedera. DeFi transactions and NFT purchases using USDC have become quite common, especially on networks like Solana, which offer fast and inexpensive transactions.

During this period, Circle also implemented solutions like the Cross-Chain Transfer Protocol (CCTP), which facilitates cross-chain mobility. This allows users to transfer USDC between different blockchains more quickly and securely.

2023: A New Era in Transparency

The most important trust factor behind USDC is undoubtedly transparency. Throughout 2023, Circle took this issue even more seriously and began updating its reserve information weekly. Furthermore, one of the four major auditing firms, known as the Big Four, regularly audited and reported on reserves every month. This made it possible for anyone to verify the authenticity of all USDC in the market.

Furthermore, Circle began to take a more proactive approach to regulatory compliance by increasing its communication with the U.S. Securities and Exchange Commission (SEC), the Office of the Comptroller of the Currency (OCC), and other regulatory authorities. This effort made USDC a more reliable option not only in the crypto space but also in the traditional financial world. Thus, we provide an answer to those asking, "Is USDC a reliable coin?"

2024, 2025: Regulatory and Institutionalization Steps

2024 and 2025 were milestones for USDC. Circle conducted extensive efforts to comply with new stablecoin legislation in the US (such as the Senate GENIUS Act). During that same year, USDC's daily trading volume surpassed even Tether (USDT) on many days, indicating a significant shift in market confidence towards USDC.

Circle also accelerated its institutionalization efforts. It prepared for an initial public offering on the US Stock Exchange and filed with the OCC in 2025 to become the first national bank in the digital currency space.

Furthermore, Circle stood out as the first stablecoin company to adopt regulatory approvals such as BitLicense and state-by-state money transmitter licenses. This made USDC one of the most comprehensively regulated and compliant projects in technology, legal, and financial terms.

Why is USDC Valuable?

Why does USDC stand out among hundreds, even thousands, of coins in the crypto world? What are the advantages of USDC? Why do investors, traders, developers, and even ordinary users prefer it? The answer to these questions lies in the clear and powerful advantages offered by USDC. Let's take a look at why this digital dollar is so valuable.

Price stability: A safe haven in the crypto storm

The sudden price fluctuations in cryptocurrencies are well known. Bitcoin can drop 10% in a day, and Ethereum can jump sharply in a few hours. But USDC is always stable. Because its value is pegged 1:1 to the US dollar, one USDC is always equivalent to approximately one dollar. This is seen as a significant advantage, especially for those who want to use crypto as a payment tool.

Broad ecosystem: USDC is everywhere

USDC is at the heart of the crypto world today. It is used as collateral on platforms like Compound, Aave, and Uniswap, playing a key role in liquidity pools, and even appearing as a payment method in NFT markets.

Furthermore, Circle USDC is almost universal on centralized exchanges. Major exchanges like Coinbase, Binance, and OKX support USDC, and wallet apps allow for sending and receiving USDC. According to Circle, 23 blockchains currently support USDC. These networks are as follows:

- 1. Algorand

- 2. Aptos

- 3. Arbitrum

- 4. Avalanche

- 5. Base

- 6. Celo

- 7. Codex

- 8. Hedera

- 9. Ethereum

- 10. Linea

- 11. NEAR

- 12. Noble

- 13. Optimism

- 14. Polkadot

- 15. Polygon PoS

- 16. Solana

- 17. Sonic

- 18. Stellar

- 19. Sui

- 20. Unichain

- 21. World Chain

- 22. XRPL

- 23. zkSync

Data confirms this: According to analytics firms like Messari, USDC is the second most traded stablecoin after Tether in terms of DeFi transactions and on-chain volume. Thanks to its fixed value, users can create arbitrage opportunities and develop strategies to achieve returns with low risk.

Financial Access: A Digital Dollar Without a Bank Account

One of the most significant aspects of USDC's value is that it offers an accessible alternative to the dollar for everyone. While opening a bank account may be easy in developed countries, billions of people worldwide still lack access to basic financial services.

However, if you have an internet connection and a crypto wallet, you can instantly own dollars with USDC. You can send, store, and make payments. Especially in countries experiencing economic crises, people are turning to stablecoins to protect their national currencies from losing value. Research like Galaxy Digital shows that USDC and similar assets are used as a kind of digital safety net in these regions.

Transparency and Audit

USDC holds a large reserve, and independent auditing firms review these reserves monthly and publicly report the results. Circle's reserves are kept separate from the company's balance sheet and are managed under strict regulations. Furthermore, the legal basis for this process is strengthened by official documents such as BitLicense and state-based money transfer licenses. Circle is one of the first companies to successfully get USDC approved by regulators as a “stored value instrument.”

Who is the Founder of USDC?

The team behind USDC isn't just any startup; it's a strong partnership between two giants who have made waves in the crypto world and proven themselves in both finance and technology. So, who is part of this powerful partnership?

The technical and legal framework for USDC was created under the umbrella of a consortium called Centre. This consortium consists of two major players: Circle and Coinbase, both leading players in the crypto ecosystem. However, Centre's primary goal wasn't simply to develop a product; it was to build a transparent, regulatory-compliant, and user-friendly digital dollar on blockchain infrastructure.

Circle is a fintech company founded in Boston, USA. Behind it are two highly experienced individuals: Jeremy Allaire (CEO) and Sean Neville (former CTO). Jeremy Allaire has long been well-known in the tech world; he previously founded software companies like Allaire Corporation. An early adopter of the blockchain and digital currency vision, Allaire has become a pioneer in this field with Circle. Circle stands out not only for its technical infrastructure but also for its regulatory compliance. For example, the company was one of the first crypto companies to receive a "BitLicense" from the New York Department of Financial Services. It also holds money transmission licenses in many US states. Thanks to this structure, USDC began to be viewed as a reliable asset by regulatory authorities from day one.

Coinbase also played a major role in USDC's emergence. Founders Brian Armstrong and Fred Ehrsam undertook a pioneering mission in bringing cryptocurrencies to a wider audience. Coinbase's existing millions of users allowed USDC to quickly become widely available. The first USDC transactions were made directly through Coinbase users. This launched the stablecoin concept into active use within a broad ecosystem.

Frequently Asked Questions (FAQ)

We've covered a comprehensive journey about USDC so far. We've covered many details, including what a stablecoin is, how USDC emerged, why it's important, and how it's used. However, you may still have some questions that need clear answers. We've prepared this section to provide a quick overview of frequently asked questions. Here are the most frequently asked questions about USDC and their answers…

- What is USDC and how does it work? USDC is a stablecoin pegged to the US dollar. Users can transfer USDC to their wallets through their Circle or Coinbase accounts, or from supporting crypto platforms. They can convert USDC transferred on the blockchain to dollars at any time at a 1:1 ratio. Thanks to Circle's centralized infrastructure, every USDC is guaranteed by backed reserves.

- Is USDC trustworthy, and does it have reserves? Yes, USDC is a trustworthy stablecoin. Each USDC is held in reserves backed by US dollars or similar monetary instruments. Circle has these reserves audited and reported monthly by independent auditors. Furthermore, the company publishes transparent reports in accordance with the standards set by US regulators. All of this is concrete evidence of the value proposition behind USDC.

- What is the difference between USDC and USDT? USDC and USDT are both stablecoins pegged to the dollar, but there are some differences. USDC offers greater regulatory compliance and transparency, while its reserves are entirely backed by lower-risk assets like cash and Treasury bonds. USDT, on the other hand, has a larger reserve structure and generally offers higher market liquidity. USDC is preferred for institutional use, while USDT is preferred for fast and widespread transactions. The differences between the two can be summarized as follows:

| Feature | USDC (USD Coin) | USDT (Tether) |

Issuer | Circle (via Centre Consortium, in partnership with Coinbase) | Tether Limited |

Blockchain Support | Ethereum, Solana, Avalanche, Arbitrum, Flow, Algorand, Stellar, Hedera, etc. | Ethereum, TRON, Solana, Algorand, OMG Network, Avalanche, etc. |

Use Case | DeFi protocols, payments, digital dollar accessibility | Liquidity provision, exchange trading |

Market Perception | Considered more suitable for institutional investors, seen as reliable | Broader user base, but subject to regulatory concerns |

Stablecoin Market Share | Second largest (after USDT) | Largest stablecoin |

- Which networks can USDC be used on? USDC is available on many blockchains. Initially launched as an ERC-20 token on the Ethereum network. Today, USDC is available on 23 networks. It is natively available on multiple chains, including the most popular ones, Solana, Flow, Algorand, Stellar, Avalanche, Arbitrum, and Hedera. This means users can choose one of their favorite blockchains and trade with USDC. There are also infrastructures suitable for cross-chain transfers.

- How to obtain and where to buy USDC? The easiest way is through cryptocurrency exchanges and platforms. USDC can be bought and sold on many major exchanges, including Coinbase. In addition to Coinbase, you can acquire USDC through exchanges such as Binance, OKEx, Huobi, Bitstamp, or decentralized exchanges such as Poloniex and Uniswap. You can also purchase USDC by depositing fiat directly through Circle's website and app. In short, crypto exchanges or Circle/Center platforms are the preferred channels for acquiring USDC.

- Is USDC an investment instrument or simply a payment instrument? USDC is primarily designed as a payment and liquidity tool; because its value is stable, it is generally used as a secure medium of exchange rather than for price speculation. However, some users use USDC in DeFi applications to generate interest or rewards. For example, USDC can be deposited into various protocols and earn annual returns of 2–8%. However, even in this case, the investor is locking in the return on a stable asset rather than the volatility of the crypto asset. In short, while USDC is primarily a digital payment and store of value, it can also be used by some users within the ecosystem to generate returns.

If you're looking for stability among crypto assets, don't miss the JR Kripto guides, where we examine USDC and other stablecoins in detail.