As the DeFi world grows rapidly, new protocols are also showing their own style. SushiSwap is one of the most remarkable projects in this field. Although it started as a clone (fork) of Uniswap, it has managed to stand on its own feet over time and has been equipped with brand new features. It is no longer just an exchange platform; staking, farming, borrowing-lending, and even cross-chain transfers are possible. In this article, we will examine step by step what SushiSwap does, how it works, and why it stands out in the DeFi world.

Definition and Emergence of SushiSwap

In its simplest form, we can think of SushiSwap as a cryptocurrency exchange that works without an order book. In other words, users make their buy-sell transactions through liquidity pools without a central structure. This model is called “automatic market maker” or AMM for short. Users who deposit tokens into the system also receive a share of the transaction fees as “liquidity providers”. SushiSwap was launched in 2020 by anonymous developer “Chef Nomi.” This means that the identity of the developer, who uses a pseudonym of sorts, is initially unknown. Chef Nomi’s name comes from the Hearthstone card named ‘Chef Nomi’, which is featured in the photo he uses on his Twitter profile. Very little is known about the developer, and their account was created around the same time as SushiSwap’s launch.

SushiSwap History: Major Milestones

SushiSwap’s history is one of the most interesting and turbulent stories in DeFi history. It all started in the summer of 2020. Built on Uniswap’s open source code, SushiSwap entered the industry with an aggressive strategy called “vampire mining.” This strategy was as follows: users who provided liquidity to Uniswap would earn additional SUSHI tokens when they moved their LP tokens to SushiSwap. This led to billions of dollars of liquidity flowing into SushiSwap. While the Uniswap community was confused, SushiSwap attracted all the attention in its early days.

2020 - Launch and Uniswap liquidity was drawn by “vampire mining”

SushiSwap launched in August 2020 by forking Uniswap’s protocol. It quickly attracted attention at the beginning. This was mainly due to the attractive incentive system that rewarded liquidity providers with the SUSHI governance token. SushiSwap implemented a unique strategy against Uniswap called “vampire attack” or “vampire mining”. In this strategy, users who provided liquidity to Uniswap were incentivized to earn additional SUSHI tokens by depositing their LP tokens into SushiSwap. Chef Nomi forked Uniswap’s open-source protocol and added “community-driven” features, drawing billions of dollars of liquidity from Uniswap to his own platform. This became a case study in changing the nature of competition in the DeFi space. While the Uniswap community was confused, SushiSwap attracted all the attention in its early days.

But then a crisis erupted. When founder Chef Nomi suddenly withdrew $27 million worth of SUSHI funds to his wallet, panic broke out over an “exit scam”. The community was up in arms.

Chef Nomi incident

Immediately after the launch, it was revealed that Chef Nomi had withdrawn approximately $27 million worth of SUSHI token development funds. This caused great concern in the DeFi community and allegations of an “exit scam”. This controversy caused the SUSHI price to drop. However, following a strong backlash from the community, Chef Nomi returned the funds. On September 11, 2020, he returned $14 million worth of ETH (in terms of funds) to the treasury. He apologized and said that his decision was not as expected. This incident has been referred to as SushiSwap’s “controversial past.”

2021–2023 and beyond: SushiXSwap, Kashi lending, Furo, NFT marketplace and on-chain solutions

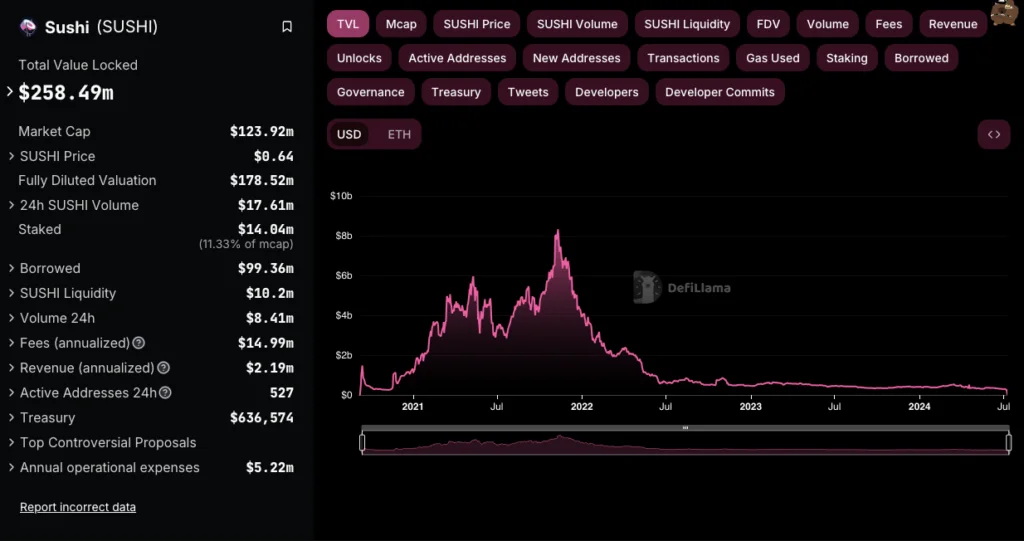

Despite its controversial beginnings, SushiSwap has grown and evolved significantly. It reached nearly $30 billion in trading volume in May 2021. In November 2021, the total value locked (TVL) on the platform exceeded $8 billion. SushiSwap has expanded its product line through continuous innovation. This expansion includes cross-chain integrations, award-winning farming tools, and various DeFi modules. SushiXSwap is a cross-chain swap tool that allows users to seamlessly transfer assets between different blockchains. The v2 release has increased the number of supported networks and made cross-chain transactions even easier with the integration of USDC’s Cross-Chain Transfer Protocol (CCTP). In addition, DeFi modules such as BentoBox, a vault for smart contracts, Kashi, a lending protocol running on BentoBox (users can borrow and lend collateral), and Furo, which is used for scheduled payments and token vesting, have added depth to the ecosystem. Furo works by tokenizing each member's position as a non-fungible token (NFT). It is worth noting that Kashi is discontinued in early 2023.

On the other hand, SushiSwap has developed an NFT platform called Shoyu by bringing its innovative approach in the field of decentralized finance (DeFi) to the NFT market. Shoyu is an NFT marketplace that aims to provide a user-friendly experience for artists and content creators. The platform aims to overcome the limitations of existing NFT markets by working on features such as support for wider file formats, advanced visual presentation options, and reducing high transaction fees on Ethereum.

Why is SushiSwap Valuable?

SushiSwap has gone far beyond being “just a DEX” and has become a large DeFi protocol. With its wide range of products, governance model, cross-chain support and passive income opportunities, it seriously differentiates itself from other AMM projects in the sector. So, what makes SushiSwap so special? How does SushiSwap work? Let's take a look together...

A strong infrastructure built on the Automated Market Maker (AMM) model

SushiSwap is based on the AMM model, which eliminates the traditional order book structure. Thanks to this structure, users can buy and sell tokens without the need for any intermediaries.

The liquidity in the system is provided by the users and they receive a direct share from each swap transaction. This creates a real win-win environment for liquidity providers. In addition, thanks to this AMM-based structure, SushiSwap can offer continuous liquidity and a low rate of price slippage.

Governance power, staking and revenue sharing with SUSHI token

What is SUSHI coin? SUSHI is the native governance token of the SushiSwap platform and is at the heart of the ecosystem. This token is not just a cryptocurrency; it is also a multifunctional tool that allows you to have a say in the operation of the platform and earn money.

So, what does SUSHI token do? First of all, it gives you the right to participate in community votes that shape the future of SushiSwap. Users can vote on new feature proposals, decide how to distribute development funds, or contribute to other protocol updates related to governance through SUSHI tokens.

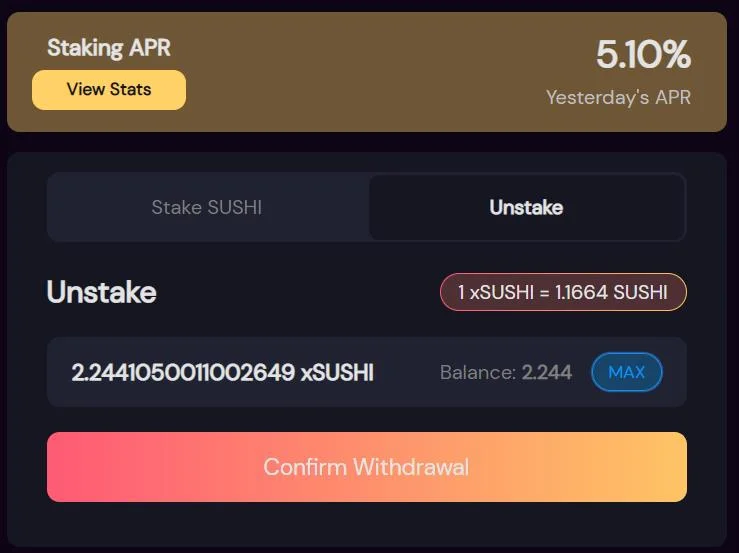

At this point, an important detail comes into play: Governance rights do not belong directly to SUSHI holders, but to users who stake these tokens. Users stake their SUSHI tokens through SushiBar and receive xSUSHI in return. This xSUSHI not only provides governance power; it also offers the opportunity to share some of the protocol revenues that SushiSwap generates from its trading volume.

In addition, the platform offers its users earning opportunities not only through staking, but also through liquidity provision. By depositing certain token pairs into pools, users can both receive a share of transaction fees and earn SUSHI rewards in special pools called “Onsen”. This two-way incentive model is an important factor that attracts both investors and DeFi enthusiasts to SushiSwap.

An open-source platform constantly updated by the developer community

Although SushiSwap was initially a fork of Uniswap’s open source code, it has developed its own unique features over time. The platform is governed by the Sushi DAO, a decentralized autonomous organization (DAO). This is a SushiSwap governance model where SUSHI token holders have the authority to decide on the future of the platform. The community-based DeFi structure behind the project allows for continuous innovation and the addition of new features. The transfer of control to the community after Chef Nomi returned the funds also strengthened this community structure.

Cross-chain support, rewarded farming models, and different DeFi modules

Although SushiSwap may seem like just a DEX at first glance, it promises much more in the DeFi space with its range of products. The platform is not limited to just token swaps, but has become a multi-faceted DeFi ecosystem that offers its users cross-chain transaction opportunities, liquidity incentives, and borrowing-lending solutions. One of its most striking features, SushiXSwap, allows SushiSwap to become a true cross-chain DEX. With this module, users can directly swap tokens between Ethereum, Arbitrum, Optimism, Polygon, Binance Smart Chain and many other blockchains without the need for bridging or token wrapping operations. Especially with SushiXSwap v2, the number of supported networks has increased, transfer times have shortened and the user experience has become even simpler.

This cross-chain structure makes SushiSwap a prominent player in the multi-chain DeFi world by facilitating capital mobility between different blockchain ecosystems. In addition, the platform makes cross-chain usage of stablecoins, especially USDC, even more seamless with integrations such as Circle's Cross-Chain Transfer Protocol (CCTP). Innovative components such as Payload Executors, which allow users to directly cover transaction fees on the source chain, make cross-chain transactions more intuitive and accessible.

On the other hand, SushiSwap not only offers a user-friendly swap experience; it also offers profit-oriented mechanisms. The SushiSwap farming models offered by the platform allow users to earn passive income by providing liquidity. In this system, users become liquidity providers (LPs) by depositing various token pairs into SushiSwap pools. In return for these investments, they both receive a share of transaction fees and can earn additional SUSHI token rewards in special pools called "Onsen".

One of the most important details that distinguishes the SushiSwap farming system from others is the double-reward incentive mechanism called 2x Rewards Farms. In these models, users can earn not only SUSHI, but also the native token of the blockchain where that pool is located. For example, a user who contributes to a pool on the Arbitrum network is rewarded with both SUSHI and ARB tokens. This system not only increases earnings, but also further democratizes DeFi participation by encouraging chain diversity.

SushiSwap's DeFi solutions are not limited to this. SushiSwap lending modules, built on the infrastructure case called BentoBox, further deepen the financial services side of the platform. The most prominent module in this context was Kashi. Kashi, which ceased operations in 2023, was a system that offered isolated risky lending pools where users could borrow and lend by presenting various crypto assets as collateral. Since each pool had different risk profiles, users could take positions according to their own preferences and strategies.

In addition, Furo, which was developed for scheduled token payments and entitlement systems, is a highly functional tool especially for DAOs, investment funds or projects that make regular payments. Payments made through Furo are represented as NFTs, which ensures that transactions are transparent and traceable.

Wide token support

SushiSwap supports many different cryptocurrencies, primarily Ethereum-based ERC-20 tokens. This has enabled it to process over 11,000 trading pairs. This diversity offers users a wide range of transactions.

Security measures

It aims to protect user assets with various security measures such as multi-sig wallets, bug bounties, and the FailSafe system. Regular security audits are also conducted. The multi-sig system makes it difficult for unauthorized access by requiring approval from multiple authorities for transaction approval.

Who is the Founder of SushiSwap?

As we mentioned earlier, SushiSwap was started by an anonymous developer nicknamed Chef Nomi. Although there is no exact answer to the question of who Chef Nomi is, we do know that this nickname comes from the Hearthstone card. We also know that their accounts were created at the same time as the project’s launch. Chef Nomi created SushiSwap by forking the Uniswap protocol. However, after a controversy arose when Chef Nomi withdrew development funds, he returned the funds and transferred control of the project to the community. Although control was initially temporarily transferred to Sam Bankman-Fried, the platform later became completely under community management.

Today, SushiSwap is governed by the Sushi DAO, a decentralized autonomous organization (DAO). With this SushiSwap governance model, SUSHI token holders have the authority to decide on the platform’s future, protocol changes, and development directions. Important decisions, such as fund allocation, are subject to community voting. This makes SushiSwap a truly community-based DeFi-focused protocol. So, while the “founder” of the project is anonymous, the platform’s governance is now in the hands of token holders, in a decentralized structure.

Frequently Asked Questions (FAQ)

SushiSwap is a fairly comprehensive DeFi protocol, so it’s important to answer some basic questions for beginners or returning users. Below, we’ve compiled the most frequently asked questions:

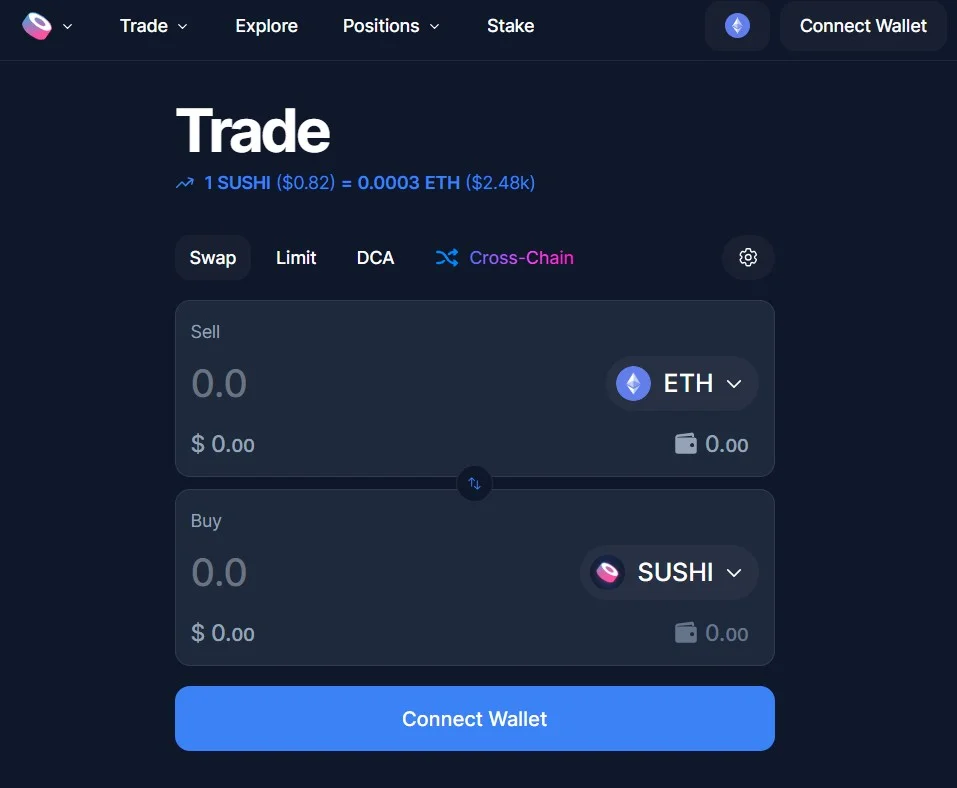

- What is SushiSwap and how does it work?: SushiSwap is a decentralized exchange (DEX) that runs on Ethereum and other networks. It uses an automated market maker (AMM) model instead of an order book; users swap tokens through liquidity pools.

- What does the SUSHI token do?: SUSHI is SushiSwap’s governance token. It offers holders voting rights, passive income through staking, and a share of the platform’s protocol revenues.

- What is the difference between SushiSwap and Uniswap?: SushiSwap started as a fork of Uniswap but later gained its own structure with additional modules such as governance features, farming incentives, staking, and cross-chain swap.

- Who is Chef Nomi and why is he anonymous?: Chef Nomi is the founder of SushiSwap in 2020. His real identity is unknown; his nickname was taken from a character in Hearthstone. He transferred the project to the community shortly after he launched it.

- How to earn passive income on SushiSwap?: Users can earn xSUSHI by staking their SUSHI tokens and earn a share of protocol revenues. They can also provide liquidity and earn additional income from transaction fees and farming rewards.

Check out our JR Kripto Guide series to see the power of community-driven projects in the DeFi world and explore passive income opportunities with SUSHI tokens.