Raydium, a name we've been hearing a lot about lately, is a popular decentralized exchange (DEX) and automated market maker (AMM) protocol within the Solana ecosystem. In this guide, we'll answer questions like what Raydium is, how it works, what Ray coin is, and what the RAY token is used for, as well as examine the platform's history, features, and use cases in detail. Leveraging Solana's high-speed blockchain infrastructure, Raydium DEX aims to offer users low transaction fees and fast transaction confirmations in cryptocurrency exchanges. Furthermore, Raydium integrates with the order book of the decentralized exchange Serum, providing deeper liquidity and a unique trading experience.

Raydium's Definition and Origin

Raydium is a DEX and AMM protocol launched on the Solana blockchain in 2021. Standing out among Solana DEXs, Raydium enables token swaps using automated market maker pools and accesses centralized order book liquidity through its integrated Serum integration. This approach makes Raydium a platform that isn't limited to its own pools but can share liquidity throughout the ecosystem. As a result, Raydium users can experience super-fast and low-cost trading by leveraging the Solana network's high performance, which can process thousands of transactions per second.

Development for the project began in late 2020, and the Raydium mainnet officially launched in February 2021. Raydium stood out as the first AMM platform to integrate directly with Serum DEX. This allows cryptocurrencies in Raydium pools to be reflected as orders on the centralized limit order book on Serum (the current community version, OpenBook). Raydium's vision was to leverage Solana's high transaction capacity to provide efficient returns for liquidity providers and to create an environment where traders could execute fast, low-slippage transactions. In short, what is Raydium Solana? It's an innovative and high-performance DEX protocol that combines both the AMM model and the order book mechanism for DeFi applications on the Solana network.

Raydium's History: Key Milestones

Since its launch, the Raydium project has made many significant strides and progress within the ecosystem. Below, we've summarized the key milestones in Raydium's history chronologically:

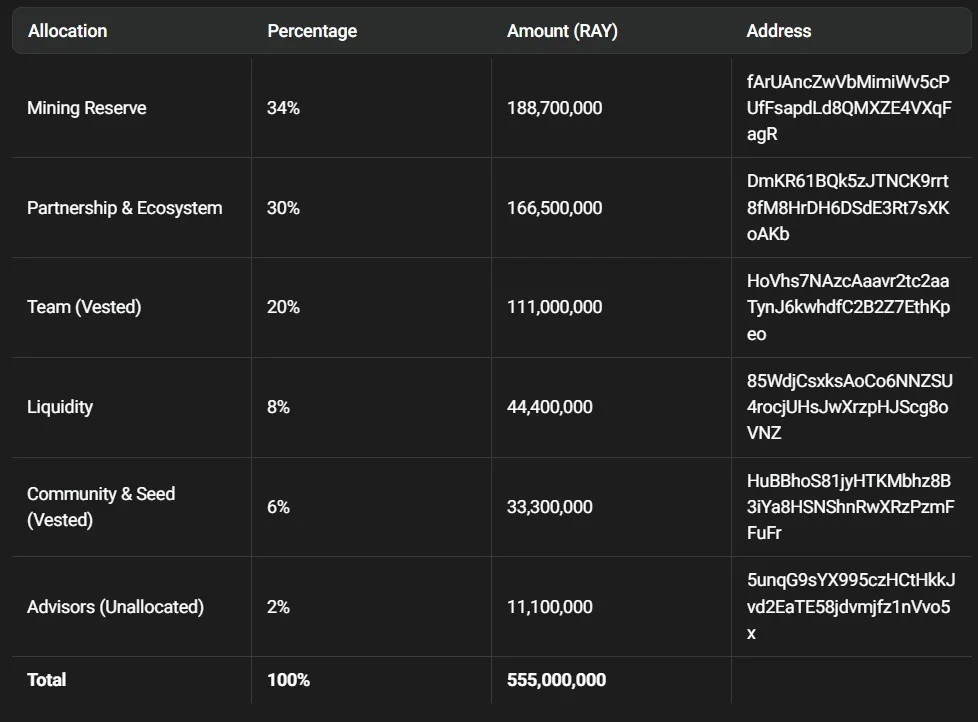

- February 2021: The Raydium mainnet launch took place. The RAY token was released (Ray coin's release date is this month). RAY, the platform's native token, began playing a role in liquidity mining rewards and ecosystem usage from day one.

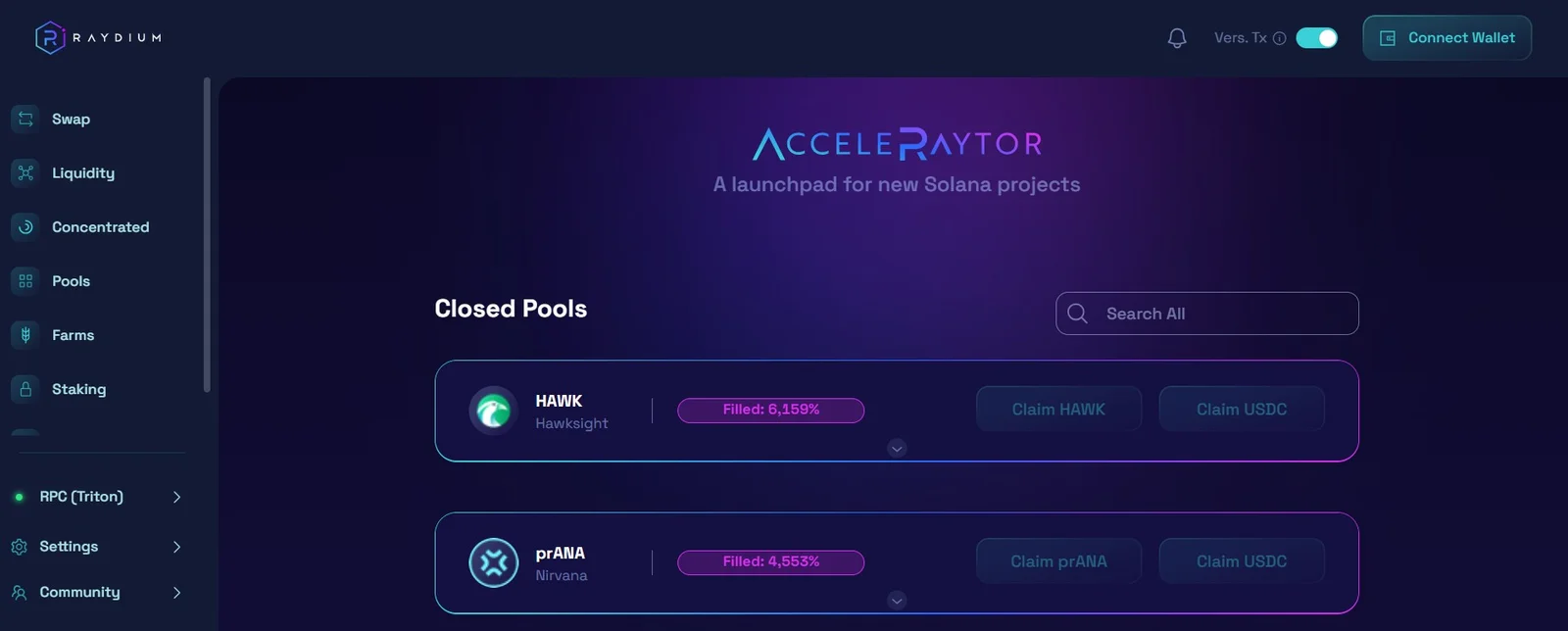

- 2021: Many new features were added to the platform within the first year. The Fusion Pool concept was introduced in March 2021. So, what is a Fusion Pool? In short, they are joint reward farming pools that allow different projects to incentivize liquidity pools on Raydium with their own tokens. Also in early 2021, Raydium launched its launchpad platform, AcceleRaytor (April 2021). With AcceleRaytor, token sales (IDOs) for new Solana-based projects began on Raydium. At the same time, yield farming opportunities were introduced on Raydium; users began earning RAY tokens by funding liquidity pools and staking their LP tokens. This made Raydium a significant attraction in the rapidly growing Solana DeFi ecosystem.

- 2022: In its second year, Raydium continued to strengthen its technical infrastructure and ecosystem integrations. In March 2022, the Raydium V2 platform update was released, improving the user interface and improving performance. Serum integration was strengthened, and Raydium's liquidity pools continued to contribute more effectively to the Serum (OpenBook) order book. This enabled Raydium to offer liquidity not only to its own users but also to users trading through other DEX interfaces on Solana. Throughout 2022, many new projects were pre-sold through Raydium's AcceleRaytor launchpad, making the platform one of the first-choice IDO platforms for projects on Solana. Towards the end of the year, Raydium launched beta testing of its concentrated liquidity (CLMM) model, testing its ability to concentrate liquidity within specific price ranges (a feature considered important because it provides lower slippage and more efficient capitalization).

- 2023: The Raydium team began taking steps toward decentralized governance. Community-driven governance principles were announced in 2023, and governance proposals were opened for discussion on the platform, allowing RAY token holders to vote. As part of this effort, Raydium adopted the goal of gradually transferring project management to the community. Furthermore, the RAY token staking program was expanded, encouraging more users to stake their RAY. RAY stakers began earning passive income by sharing protocol fees and gaining a voice in governance. All these developments strengthened Raydium's position within the ecosystem.

- 2024: As the Solana DeFi ecosystem matured, Raydium became one of the largest AMM DEXs. By 2024, the platform single-handedly accounted for a significant portion of the total DEX trading volume on the Solana network. Raydium emerged as one of the leading protocols on Solana in terms of daily trading volume and total value locked (TVL). The deep liquidity and fast trading experience offered by Raydium, in particular, made the platform a popular choice for both institutional and individual traders. The Raydium V3 interface update, released in 2024, introduced mobile compatibility, advanced analytics tools, and new liquidity pool types (e.g., constant product market maker pools). All these innovations strengthened Raydium's competitiveness and established a strong presence in the Solana-centric DeFi world.

Why Is Raydium Valuable?

Raydium has a number of features and advantages that distinguish it from similar DeFi protocols and make it valuable. Let's examine the key value propositions of the Raydium DEX platform below:

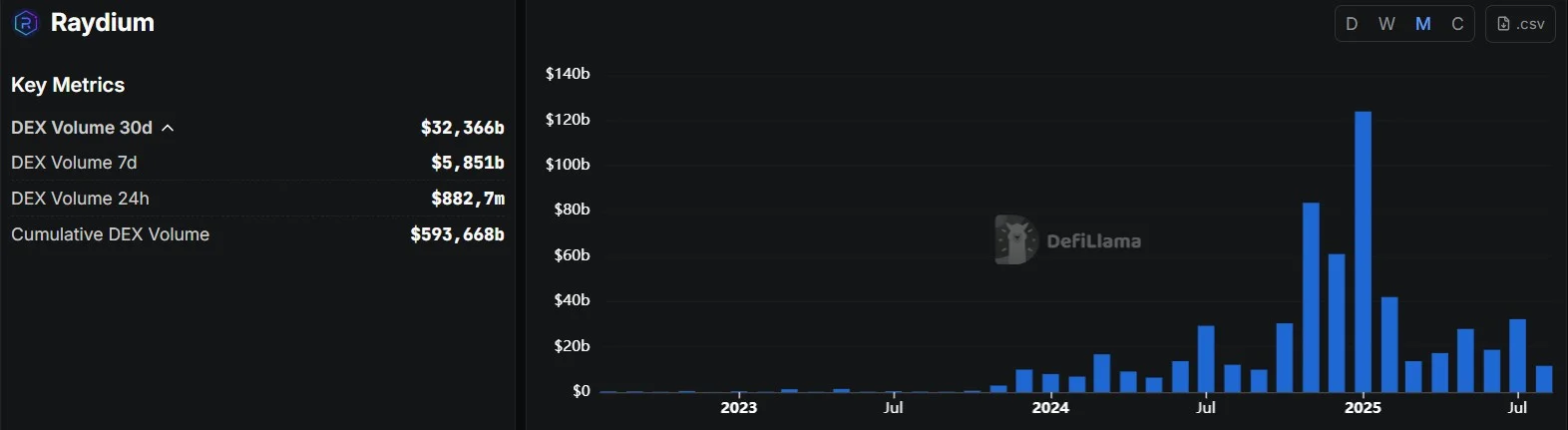

High Speed and Low Cost

Raydium is extremely fast and inexpensive because it processes its transactions on the Solana blockchain. The Solana network's capacity of over 50,000 transactions per second and negligible transaction fees of 0.0001 SOL on average allow Raydium users to trade without the high gas fees and network congestion seen on networks like Ethereum. This allows traders to experience instant execution of their orders and minimize slippage. Due to these features, Raydium has hosted volumes exceeding $120 billion, as will be seen below.

AMM and Order Book Integration

Unlike many AMM protocols, Raydium offers a hybrid model that combines liquidity pools with a central order book. The platform's smart contracts automatically place orders on the Serum/OpenBook central limit order book using assets from the liquidity pools. This means that liquidity on Raydium can also be used by other Serum interfaces within the Solana ecosystem. As a result, Raydium contributes to a broad ecosystem-wide liquidity network, rather than being a siloed AMM. This integration offers users the best of both worlds: it combines the continuous liquidity of AMMs with the depth and price stability of order books. For example, a user who swaps on Raydium gains access not only to the liquidity available in Raydium pools but also to the liquidity available on OpenBook.

RAY token use cases (farming, staking, governance)

Raydium's native cryptocurrency, the RAY token (Ray coin), serves several important functions within the platform. First, users who provide liquidity can earn RAY token rewards through farms. In Raydium's yield farming model, users who add assets to a liquidity pool consisting of two tokens receive LP (Liquidity Provider) tokens and stake these LP tokens in Raydium's farming pools to earn RAY rewards. Second, staking RAY tokens earns additional income and privileges. When users unilaterally lock (stake) their RAY tokens on the platform, they earn passive returns by receiving a share of the platform's transaction fees.

As per Raydium's fee mechanism, 0.22% of the 0.25% fee received for each swap is distributed to liquidity providers, while the remaining 0.03% is used to purchase RAY tokens from the market; this buyback mechanism provides indirect returns for stakers. The third important use case is governance. RAY token holders have the right to participate in platform governance and vote on proposals in the future. Raydium has designed RAY as a governance token to transition to a community-based structure, giving RAY holders a say in important protocol updates, fee changes, or new feature additions. In short, the answer to the question of what the RAY token does is that it's a versatile platform token that offers users farming, staking rewards, and governance rights.

Accessing new projects with AcceleRaytor (launchpad)

Raydium's launchpad feature, called AcceleRaytor, allows users to participate in early-stage sales of new projects on Solana. Raydium users have the opportunity to purchase tokens from promising projects before they even list by participating in IDOs conducted through AcceleRaytor. Furthermore, Raydium offers two types of IDO pools: Community Pool and RAY Pool.

While community pools are open to the public, participation in RAY pools requires a certain amount of RAY tokens to be staked on the platform beforehand. This mechanism aims to reward the Raydium community and create demand for the RAY token. For example, the initial AcceleRaytor projects required a minimum stake of 20 RAY to participate in the RAY pool. Through Launchpad, Raydium provides both capital and liquidity support to new projects in the ecosystem and offers its users early investment opportunities with high potential for profit.

A liquidity hub in the Solana ecosystem

Raydium is a cornerstone of the growing Solana DeFi ecosystem. Through both its technical integrations and its diverse product offerings, it provides liquidity and infrastructure support to other protocols on Solana. For example, many Solana-based wallets and applications utilize Raydium's liquidity pools as the backend for token swaps. Raydium's deep liquidity and high volume contribute to stable price discovery on the Solana network.

By 2024, Raydium became one of the largest DEXs not only on Solana but across all chains in terms of daily trading volume. In fact, during certain periods, Raydium's trading volume surpassed PancakeSwap on the BSC network, ranking second globally behind Uniswap. The difference between various DEXs and Raydium can be illustrated as follows:

Feature / Platform | Raydium | Orca | Jupiter | Lifinity |

Transaction Speed | Very high (Solana infrastructure, ~400ms block time) | High | High | High |

Transaction Fee | ~0.25% (0.22% to LP, 0.03% buyback) | ~0.3% | Variable (depends on routes) | ~0.15% |

Liquidity Model | AMM + Order Book (Serum/OpenBook integration) | AMM (Concentrated + Stable Pools) | Route aggregator (sources liquidity from multiple AMMs) | AMM (Proactive market maker) |

Launchpad Support | Yes (AcceleRaytor) | No | No | No |

Staking Availability | Yes (RAY staking) | Yes (ORCA staking) | No | Yes (LFNTY staking) |

Fusion Pool / Special Farming | Yes | No | No | No |

Liquidity Volume | High (Leader on Solana in 2024) | Medium-High | High (due to aggregator model) | Medium |

User Interface | Advanced, V3 interface + analytics tools | Simple and user-friendly | Simple (swap-focused) | Advanced (charts, automated settings) |

Who is the Founder of Raydium?

Raydium was developed by a decentralized team, and the names of individual founders have not been disclosed to the public. The core team behind the project has chosen to remain anonymous, presenting themselves under pseudonyms such as AlphaRay, XRay, GammaRay, StingRay, and RayZor. This development team consists of experienced individuals from diverse fields, including algorithmic trading, blockchain development, marketing, and mathematics. The Raydium team built the protocol in close collaboration with the Solana and Serum communities. In mid-2020, the team rolled up their sleeves to address the shortcomings they saw in the DeFi space and implemented the idea of an AMM integrated with Serum as a solution. The result is the Raydium platform we know today. Over time, the project's governance has transitioned to a community-driven governance model; RAY token holders have begun to have a say in decisions about the platform's future. In short, there is no clear answer to the question, "Who owns the Ray token?" because Raydium is not owned by a single founder, but rather is collectively owned by the community and the development team.

Frequently Asked Questions (FAQ)

Below are some frequently asked questions and answers about Raydium:

- What is Raydium and how does it work?: Raydium is a Solana-based decentralized cryptocurrency exchange (DEX) and automated market maker (AMM) protocol. Users can swap tokens without any intermediaries by connecting their wallets on Raydium. Raydium's operating system integrates the AMM model, which sets prices using assets in liquidity pools, with Serum's central order book. This allows Raydium to execute fast, low-cost, and low-slippage transactions by drawing liquidity from both its own pools and the wider ecosystem.

- What is the RAY token used for?: The RAY token is the native cryptocurrency of the Raydium platform and is used for various purposes. First, yield farming rewards are awarded in RAY tokens; users can earn RAY by adding liquidity to pools and staking LP tokens. Users who stake RAY tokens also earn passive income by sharing the platform's transaction fees and qualify for token sales on the AcceleRaytor launchpad. In the long term, RAY will also serve as Raydium's governance token, meaning RAY holders will be able to vote on the platform's future.

- What is the relationship between Raydium and Serum?: The relationship between Raydium and Serum (OpenBook) is one of Raydium's most distinctive features. Raydium's smart contracts place orders from liquidity pools into Serum's central limit order book (CLOB). This means that the liquidity in Raydium pools is also accessible to other users on Serum. When a user swaps tokens through Raydium, the transaction is reflected in Serum's order book in the background, and the best price is matched on whichever platform is available. Thus, Raydium and Serum share liquidity; Raydium liquidity providers see greater trading volume, while Serum traders benefit from the liquidity of AMM pools. In short, Raydium has integrated with Serum's infrastructure, creating a unique AMM + order book hybrid within the Solana ecosystem.

- How is yield farming done on Raydium?: Earning RAY tokens through yield farming on the Raydium platform is a very user-friendly process. First, you become a liquidity provider by depositing two tokens (such as the RAY-USDC or SOL-RAY pair) in proportional values into one of Raydium's liquidity pools. When you add liquidity, you receive pool share tokens, called LP tokens, in return. Then, you go to Raydium's "Farms" tab and stake your LP tokens in the relevant farming pool. As a result of this staking process, the protocol accumulates your share of RAY rewards over time. You can collect or withdraw your rewards at any time. Some special pools on Raydium are called Fusion Pools, and in these pools, in addition to RAY, you can also earn token rewards from partner projects. In short, yield farming is an important way to generate passive income by providing liquidity on Raydium.

- What is AcceleRaytor and how to participate? AcceleRaytor is a launchpad, or pre-sale, provided by the Raydium platform for new projects. This feature allows promising projects on the Solana network to raise capital by pre-offering their tokens to Raydium users. To participate in AcceleRaytor events, you must connect your wallet to the AcceleRaytor page on Raydium's website during the announced IDO (Initial DEX Offering) dates and contribute, usually in USDC. While participation requirements vary by project, there are typically two pool options: the Community Pool and the RAY Pool. The Community Pool is open to anyone and typically requires fast action (first-come, first-served). The RAY Pool, on the other hand, is only open to users who have staked a set amount of RAY tokens for a specific period. For example, a project may require staking at least 100 RAY for seven days to qualify for the sale. With this structure, Raydium grants privileges to loyal RAY token holders in early sales. As a result, AcceleRaytor provides both a secure IDO environment for projects and provides users with early access to high-potential projects.

- How to stake RAY tokens: Staking RAY tokens on the Raydium platform is quite simple. First, you need to connect a Solana-compatible wallet (e.g., Phantom) to the Raydium app. Then, in the Raydium interface, navigate to the "Staking" or "Pool" section and find the one-sided staking pool designated for RAY (usually listed as "RAY Staking"). Confirm the staking by depositing your RAY tokens into this pool. Once the transaction is confirmed, your RAY tokens are locked, and you can begin staking immediately. During your staking period, RAY rewards from the platform's protocol revenues and buyback mechanism will accumulate in your account. You can withdraw your rewards at any time using the "Harvest" button or choose to accumulate them for a longer period. RAY staking is flexible; you can exit staking and withdraw your invested RAY at any time (although in some cases, there may be a waiting period or a small penalty mechanism on rewards; it's worth checking the current Radillam documentation for details). By staking RAY tokens, you both earn passive income and take the first step toward having a say in the platform's future.

For more content on Raydium and Solana-based DeFi applications, follow our JR Crypto Guide series.