The blockchain world has grown at an incredible pace in the last few years. We're not just talking about giants like Bitcoin or Ethereum, but hundreds of different networks. Each operates with its own rules, language, and technology. So, how will so many blockchains communicate with each other, just as different countries speak different languages? That's where Quant comes in.

Starting with the vision of bridging different networks, Quant aims to transform blockchain technology from its "fragmented island" perspective into a single, harmonious ecosystem. In this article, we'll explore everything from Quant to Overledger technology, the QNT token's use cases, and the project's corporate partnerships. If you're ready, let's start our Quant guide.

Quant (QNT) is a blockchain technology project focused on ensuring interoperability between different blockchain networks. Launched in 2018 by Gilbert Verdian, Quant Network has developed an operating system (DLT gateway) called Overledger, which allows blockchains to easily communicate with each other and with existing corporate networks. This allows us to answer the questions of what QNT coin is and what Quant is. Quant is an innovative infrastructure that connects multiple blockchains under a single roof, enabling the seamless flow of data and value between them. QNT coin is the token of this ecosystem. Quant Network facilitates the adoption of blockchain technology by real-world institutions, particularly by targeting the integration of diverse systems in areas such as finance, healthcare, and supply chain. The project's native cryptocurrency, QNT coin (Quant token), is at the core of this ecosystem, serving as a license token used for access to the Overledger platform, an application development license, and network transactions. In other words, the QNT token's purpose is to answer the question: it's a digital asset required for paying fees, providing authorization, and enabling applications on the Quant network.

Quant's Definition and Origins

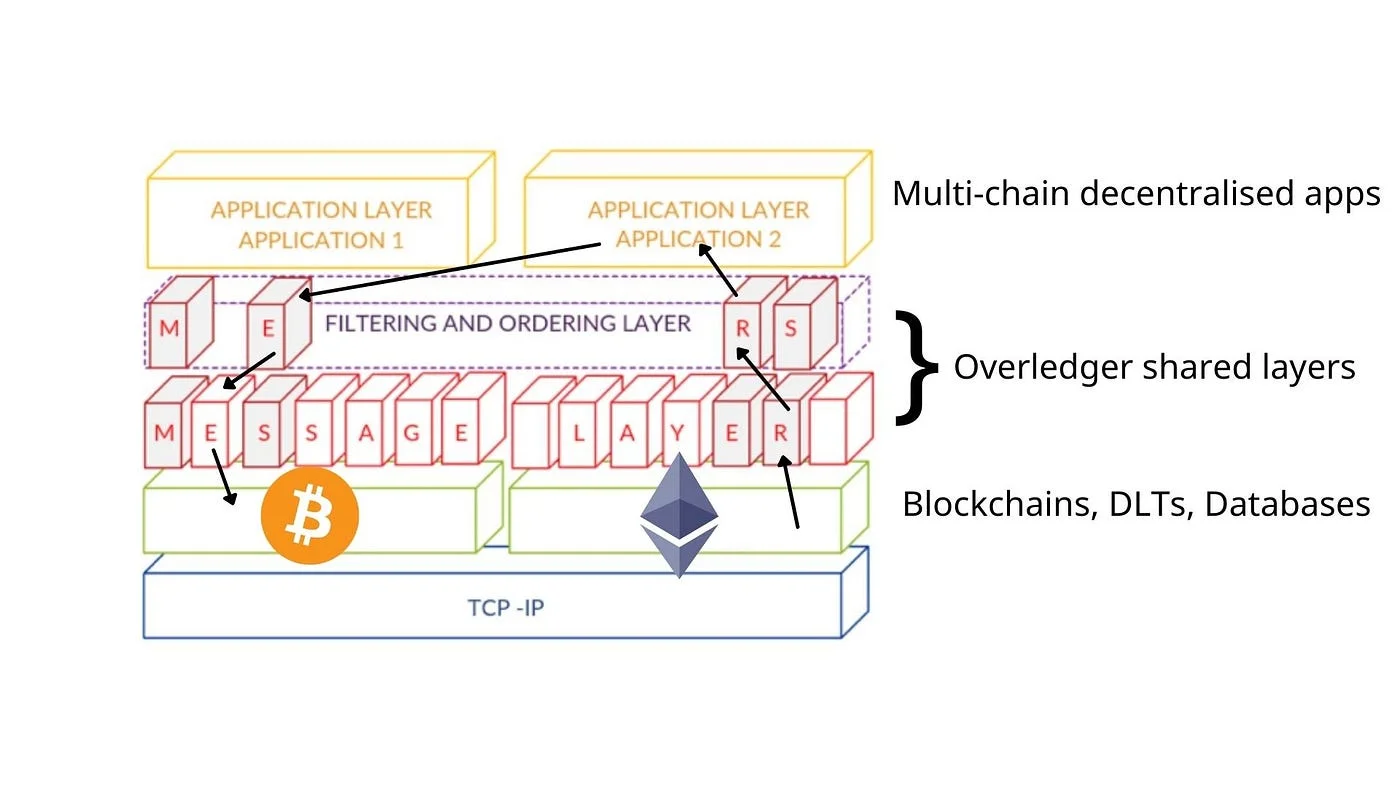

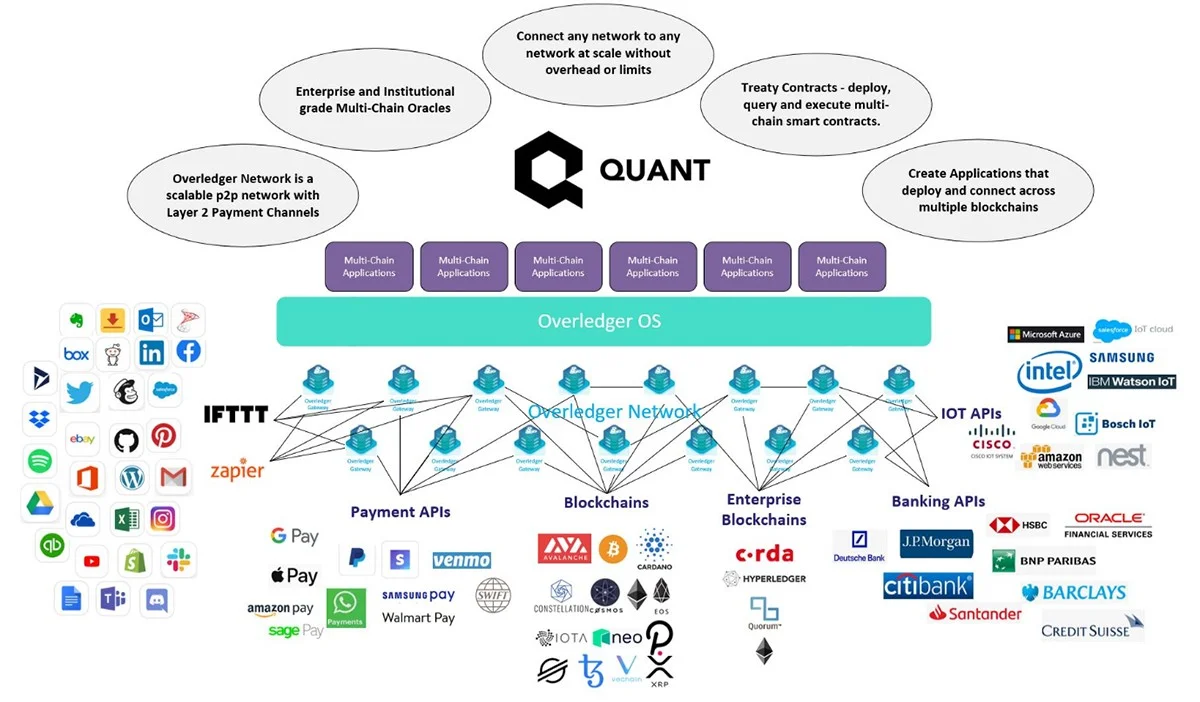

The Quant Network's primary goal is to ensure the interoperability of blockchain technologies with existing internet and institutional systems (inter-blockchain compatibility). Its founder, Gilbert Verdian, observed communication gaps between different databases and systems while working for both the UK and Australian governments, and to address this, he spearheaded blockchain standardization initiatives in 2015. In line with this vision, the Overledger infrastructure, which emerged as the answer to the question of what Quant Network is, is defined as a "network of networks" technology that will address the lack of communication between networks on the internet. What is Overledger? Simply put, Overledger is a universal API gateway that connects multiple blockchains and distributed ledger systems under a single roof. This platform bridges blockchains and traditional networks, enabling interoperability between different protocols. This allows institutions, banks, or government systems to communicate with them from a single point, regardless of the underlying blockchain, through Overledger.

The project's core product, Overledger, acts as an intermediary layer between blockchains and traditional networks. For example, a bank can use both its private ledger and public blockchains like Ethereum, Ripple, and Bitcoin simultaneously with Overledger. Overledger provides an API layer that standardizes data exchange between different networks, allowing developers to write chain-agnostic applications. This allows a single application (mDApp) to run simultaneously on multiple blockchains and securely transfer transactions from one chain to another. This interoperability layer, developed with the Quant Network, unites today's disconnected blockchain ecosystems and contributes to the vision of open and connected networks that the internet initially promised.

The Quant Network's inception began with an ICO (Initial Coin Offering) in 2018. Gilbert Verdian and his team raised over $11 million in a token sale in April 2018, launching the QNT token. With this success, the company was officially established as a private software startup based in London and quickly gained attention. The first version of the Overledger platform was introduced in late 2018 and made available to developers in December 2018. Throughout 2019, the team tested and refined the platform's core features, demonstrating the technology's practical utility by running the first multi-chain applications (mApps) across different blockchain networks. A live demo, particularly across popular networks like Bitcoin, Ethereum, and Ripple, demonstrated Overledger's ability to read transactions across these networks and combine them into a single application. Ultimately, Quant's birth stemmed from the motivation to provide a concrete solution to interoperability, one of the blockchain world's most pressing needs at the time.

The Quant Network's vision of interoperability isn't merely a technical curiosity; it's an approach aimed at solving major real-world problems. For example, it's quite difficult for a bank to effectively use its own private database and a public blockchain simultaneously. Quant's Overledger, on the other hand, allows banks to integrate blockchain into their existing systems with minimal changes. Furthermore, this eliminates the need to build separate infrastructure for each new blockchain; interaction with different networks is facilitated through a single API. As a result, Quant has become one of the leading platforms when it comes to blockchain interoperability.

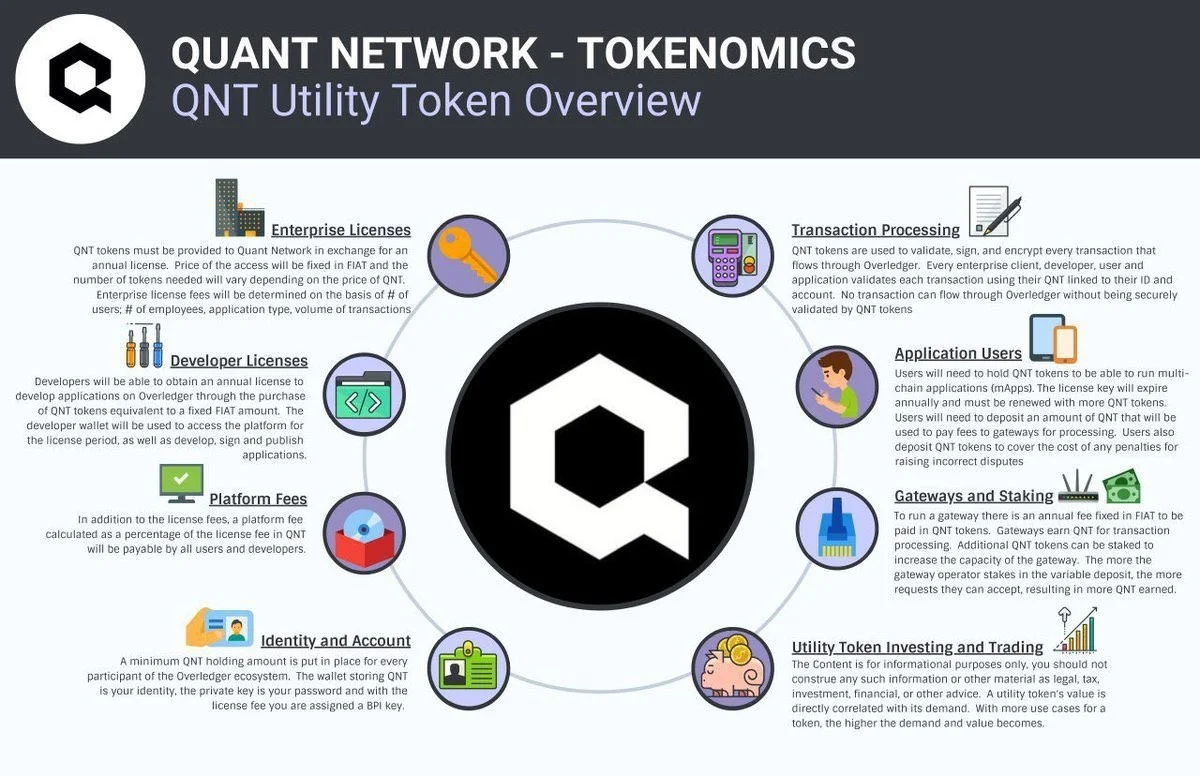

QNT, the native token of the Quant network, is an essential part of the ecosystem. While QNT is an Ethereum-based ERC-20 token, it is designed with the flexibility to migrate to other networks independently of the platform. Those wishing to work as developers on the Quant Network must acquire QNT tokens, as accessing Overledger services and API calls requires payment in QNT. Developers actually purchase platform licenses with fiat (fiat currency), but Quant's Treasury automatically converts this payment into QNT in the background and locks it in smart contracts on the blockchain. This allows institutional customers to pay for the service fee compliantly via credit card or bank transfer without the hassle of purchasing tokens from exchanges—the system handles the rest and converts the relevant amount into QNT. Similarly, end users who want to read/write on Overledger or use an mDApp must indirectly spend QNT. For example, when an institution pays a subscription fee for an Overledger access key, which is renewed annually, this fee is collected in QNT and locked in a smart contract for the duration of the subscription. This entire model allows the QNT token to function as a kind of fuel and permission key within the Quant ecosystem. QNT, which has a maximum supply of approximately 14.6 million units, is likely to increase in value over time as more institutions adopt Overledger (a dynamic of limited supply and high demand). In summary, QNT is a critical tool for Quant to maintain and secure its network effect.

Quant's History: Key Milestones

Quant's story began with a search for a solution to one of the blockchain world's biggest challenges: interoperability. Founder Gilbert Verdian's years of institutional and public sector experience laid the foundations for this vision. Officially launched with an ICO in 2018, Quant Network has gradually expanded both its technology and its corporate partnerships since then:

2018: Quant Network Establishment and QNT Token Launch

The project's foundations were laid under the leadership of Gilbert Verdian. At the ICO held in April 2018, $11 million in funding was raised, and QNT tokens, with a total supply of 14.6 million, were launched. That same year, London-based Quant Network Ltd. was founded, and the Overledger operating system concept was first introduced (Quant X event). Starting in December 2018, developers began testing their first multi-chain applications using Overledger.

2019: First version of Overledger and early integrations

The first production version of the Overledger Network was launched. This significantly reduced blockchain development time and costs. It demonstrated that enterprise blockchain projects, which typically require eight months and millions of pounds, can be implemented with Overledger in "eight minutes and three lines of code." A partnership was established with the Italian financial services network SIA, and Overledger was tested in European interbank payment systems (June 2019). Quant was also accepted into the Amazon Web Services (AWS) Partner Network and began offering solutions on AWS, paving the way for Overledger to be available to millions of AWS enterprise customers.

2021: A breakthrough in enterprise partnerships (Oracle, AWS, etc.)

Quant's vision of interoperability caught the attention of major technology companies. In 2021, a significant partnership was announced with Oracle; Overledger was certified by Oracle to integrate with the Oracle Blockchain Platform and began being offered to Oracle's enterprise customers. This enabled financial institutions in the Oracle ecosystem to connect their existing systems to different blockchains through Overledger gateways. At the same time, Quant strengthened its presence on AWS and brought blockchain integration to cloud platforms by releasing enterprise products such as "Overledger Authorize" on the AWS Marketplace.

2022: Overledger 2.0 and broad network support

In 2022, the platform received significant improvements with the release of Overledger 2.x. The "Overledger 2.0.5" update enabled bridging of DeFi, stablecoins, NFTs, and ERC-20/721 tokens across different ecosystems (September 2021). The subsequent "Overledger 2.2.12" update (August 2022) introduced the Tokenize feature, allowing for easy cross-institutional token creation and management. A total of 22 Overledger updates were released throughout the year, bringing support for popular networks such as Polygon, Polkadot, XDC, and Hyperledger Fabric. This added a much broader range of blockchains to existing integrations such as Ethereum, Ripple, and Bitcoin. At the end of 2022, Quant announced its integration with Latin America's LACChain network, expanding into regional blockchain projects.

2023–2024: DID, CBDC, and Financial API Breakthroughs

In recent years, Quant Network has taken steps to adapt its technology to new use cases. Projects have begun to develop, particularly for decentralized identity (DID) solutions and digital identity management. Work is underway on infrastructures that allow users to securely verify their identities across different platforms. Quant has also emerged in the Central Bank Digital Currency (CBDC) field. In 2023, Quant participated as a technology provider in Project Rosalind, a joint retail CBDC experiment between the Bank of England (BoE) and the Bank for International Settlements. Transactions between central bank money and commercial banks were successfully integrated using Overledger APIs. Shortly thereafter, Quant launched the Overledger Platform (June 2023), making its enterprise blockchain infrastructure available to everyone. This low-code platform, offered as a SaaS model, enables large enterprises and SMEs to easily integrate blockchain technology via API. For example, it becomes possible to issue its own digital currency and transfer it between different blockchain networks in just a few steps, or to add blockchain functions to existing systems with simple API commands.

By 2024, Quant participated in initiatives such as the Regulated Liability Network (RLN), which aims to facilitate the issuance and exchange of digital assets in a regulated environment. In the RLN trial conducted with banks and fintech companies in the UK, tokenizing and reconciling commercial bank money and central bank money on a single shared ledger was successfully tested. Quant provided the interoperability infrastructure for this project in collaboration with R3. These steps demonstrate Quant's active role not only in the crypto ecosystem but also in the transformation of the traditional financial system. This presents a positive outlook for the future of Quant coin in the long term; a blockchain project that works with large institutions such as governments and banks has a high probability of staying in the industry.

Why is Quant Valuable?

There are several key elements that have enabled the Quant project to stand out and the QNT coin to gain so much traction:

- Inter-blockchain data and transaction compatibility: Quant solves one of the biggest problems in the industry by enabling independent blockchain networks to communicate with each other. By providing a common communication layer between distributed ledgers written in different languages and protocols, it makes data transfer from chain to chain secure and seamless. For example, with Overledger, the result of an Ethereum smart contract can be transferred directly to the Hyperledger network or the Ripple ledger. This normally impossible interaction is made possible by Quant technology. This compatibility breaks down siloed walls between blockchains, opening up much more comprehensive use cases.

- Chain-agnostic application development: With Overledger technology, developers can develop applications that can run on multiple blockchains with a single codebase. These applications are called mDApps (multi-chain decentralized applications), and they differ from traditional dApps in that they are not dependent on a single blockchain. Overledger offers a standard REST API interface, enabling developers to write applications without worrying about the underlying blockchain infrastructure. This allows an mDApp to simultaneously use smart contracts on Ethereum, authenticate on Hyperledger, and trigger a transaction on the Bitcoin chain. This future-proof scalability is a key feature that distinguishes Quant from many other projects.

- The QNT token's indispensable functionality: As a utility token at the core of the Quant ecosystem, QNT plays a key role in platform usage. Anyone wishing to use any service on the Overledger network, whether developer or end user, must pay in QNT. Developers pay annual license fees with QNT to connect to Overledger, and if they want to attract users to their applications, they can pay for subscriptions with QNT or other currencies supported by the system (though these are still converted to QNT in the background). Furthermore, to create or use an application on Overledger, a certain amount of QNT must be held in a wallet. This model reduces the circulation of QNT in the network (locking it up), while creating a constant demand demand. This means that as the Quant network grows, the demand for QNT also increases.

- Enterprise focus and integration capabilities: From the outset, Quant Network has focused on working with financial institutions, large corporations, and governments. Founder Gilbert Verdian's background in government institutions such as the UK Treasury and the Ministry of Justice, as well as major corporations like Mastercard and HSBC, strengthens Quant's corporate language. This has positioned Quant as a trusted technology provider for banks and central banks. For example, Quant plays an active role in the Bank of England's digital currency research, interbank payment tests in Europe, and government-backed blockchain projects in Latin America. Being one of the top names that comes to mind when it comes to enterprise blockchain integration in the industry makes Quant appeal to a much broader potential user base than its peers. This is also a significant advantage for the future of Quant coin, as a project that can work with governments and financial institutions is one step ahead in regulatory compliance and real-world adoption.

- Broad blockchain support and flexibility: Quant’s Overledger network currently integrates with many popular blockchain protocols, including Ethereum, Bitcoin, Ripple, Stellar, Polkadot, Hyperledger Fabric, R3 Corda, BNB Chain, and the XDC Network. Once an organization starts using Overledger, connecting to any of these networks requires only a few simple steps. Emerging or custom permissioned networks can also be added to Overledger; for example, Consensys Quorum, Oracle Blockchain, or various central bank digital currency platforms can be integrated into the system. This flexibility ensures the Quant solution’s longevity and easy adaptation to technological advancements. Its lack of dependence on a standard or a single blockchain makes it a neutral interface that embraces all networks. Currently, Quant integrates with the following blockchains: Bitcoin, Ethereum, Ripple, Stellar, EOS, IOTA, R3 Corda, J.P. Morgan Quorum, Avalanche C-Chain, Polygon, and the XDC Network.

Who is Quant's Founder?

So, who owns QNT coin? Quant Network's founder and CEO is Gilbert Verdian. Verdian is a veteran who has held senior positions in cybersecurity and technology for over 20 years. Who is Gilbert Verdian? When we look at the question, highlights of his career include holding critical technology positions in government institutions such as the Prime Minister's Office (Downing Street) and the Treasury in the UK, as well as the NSW Department of Health in Australia. In the private sector, he has held CISO/CTO/CIO positions at global companies such as Mastercard, Vocalink, EY, PwC, BP, and HSBC. Verdian is a visionary who has contributed to the setting of international standards in the blockchain field; he initiated the ISO TC307 Blockchain Standard in 2015 and currently leads ISO's blockchain interoperability working group.

Gilbert Verdian's motivation for founding Quant stems from his personal experience connecting disparate networks. As he explains, while working in the healthcare sector, he observed incompatibilities between hospital data and the systems of different institutions and realized that blockchain technology could be used to solve this problem. Verdian, observing the same problem in the finance and public sectors, launched the Quant Network project with the vision of "an interconnected world that empowers everyone." Thanks to Verdian's reputation and connections, Quant quickly secured significant partnerships and earned institutional trust. The company is headquartered in London, where the team led by Verdian continues its operations. In addition to Verdian, the Quant team includes experts in their fields such as CTO Colin Paterson and strategic advisor Dr. Paolo Tasca. These co-founders, who joined Quant in 2017, bring deep technical and academic expertise to the project.

In short, the answer to the question of who owns QNT coin is clear: Gilbert Verdian is the mastermind behind the Quant project. His experience, spanning from governments to major banks, has ensured that Quant Network is built on a solid foundation in both technology and business development. Under his leadership, Quant continues to serve as a problem-solving and bridge-building player in the blockchain world.

Frequently Asked Questions (FAQ)

Below are some frequently asked questions and answers about Quant:

- What is Quant and what does QNT coin do?: Quant is an interoperability platform that connects different blockchain networks. Thanks to the operating system Overledger, developed by Quant Network, institutions and applications can communicate with multiple blockchains from a single point. In short, Quant enables the transfer of data and value between blockchains, enabling the integration of distributed ledger technologies into the real world.

- Where is the QNT token used?: QNT is used as a license and access token within Quant Network's ecosystem. Developers and users must pay QNT tokens to connect to the Overledger network, make API calls, or run a multi-chain application. For example, developers pay Overledger license fees with QNT, while mDApp users spend QNT to renew their annual access keys; thus, QNT acts as the key to all services on the Quant platform.

- How does the Overledger platform work?: Overledger functions as a gateway layer positioned on top of blockchains. Its four-layer architecture (Transaction, Messaging, Filtering, and Application layers) aggregates transactions from different blockchains, converts them into a standard format, and transmits them across networks. This structure allows each blockchain to accept incoming data via Overledger while maintaining its own consensus. Ultimately, Overledger allows developers to create applications across multiple chains with a single API and perform atomic data transfers between these chains – simplifying complex infrastructures and enabling interoperability.

- Is Quant only suitable for the financial sector?: No, Quant's technology has a wide range of applications beyond the financial sector. Of course, banking, payment systems, and CBDC projects are among Quant's main areas of focus, but it can also be used for data sharing and coordination in sectors such as healthcare, insurance, supply chain, and government services. For example, scenarios such as integrating the registration systems of different hospitals with blockchain in healthcare or tracking data across various networks throughout the supply chain in logistics are all made possible with Quant. Therefore, the Quant Network is suitable not only for finance but also for all sectors requiring data sharing by multiple stakeholders.

- Can QNT be staked?: While the Quant Network is not a traditional proof-of-stake network, there are QNT holding/locking mechanisms within the ecosystem. For example, in the Overledger network, gateway operators are required to stake (lock) a certain amount of QNT to process transactions. This provides an economic security model that deters malicious activity and functions as a kind of staking system within Quant's multi-chain structure. However, there is currently no staking program available to individual investors to earn returns on the network. As the Quant network becomes more decentralized in the future, general staking may become possible, but currently, QNT staking is primarily performed by institutional network participants.

- What distinguishes Quant from other blockchain projects?: The most significant difference between Quant and other blockchain projects is that, rather than creating a standalone blockchain, it provides a layered solution that connects all existing blockchains. For example, while many projects strive to develop a single smart contract platform and integrate it with their ecosystem, Quant aims to make them work together, rather than compete with any single platform. Overledger supports a wide range of networks, from Bitcoin to Ethereum, from Hyperledger to Ripple, acting as a universal translator. This approach means Quant solves a broader problem in the tech world: bridging the gap between networks. Furthermore, the Quant ecosystem's enterprise-focused approach, regulatory compliance, and contributions to standards distinguish it from other crypto projects. Consequently, the Quant Network has carved out a unique position as the unifying cornerstone of the blockchain world.

For more information about the Quant Network and the technologies that enable inter-blockchain communication, check out our JR Kripto Guide series.