Plasma (XPL) is a high-performance Layer 1 blockchain network specifically developed for stablecoin transactions. In other words, Plasma aims to make stable cryptocurrencies (such as USDT) as fast, low-cost, and accessible as digital cash. Launched in 2025, this project has recently been making headlines in the crypto world. In this guide, we will answer questions such as what is Plasma coin, how did it come about, what technologies is it based on, what are its use cases, how does the token economy work, and what advantages does it offer to individual users, in simple language.

Definition and Origins of Plasma

What is the Plasma network? Plasma is an independent blockchain designed from scratch to facilitate stablecoin transfers. That is, it is not a sidechain or scaling solution of an existing chain like Ethereum; it is a completely separate blockchain network with its own infrastructure. This network aims to be the fundamental infrastructure for stablecoin circulation on a global scale, while prioritizing low transaction fees, high speed, and a user-friendly experience. What were the purposes behind the development of Plasma? The motivation behind the project's emergence is closely related to the growing role of stablecoins in the crypto ecosystem. In recent years, the supply of stablecoins has reached hundreds of billions of dollars, while monthly transaction volumes have begun to exceed trillions of dollars. However, existing blockchains, designed before the widespread use of stablecoins, suffer from problems such as high transaction fees, slow confirmation times, and a lack of specialized features for digital dollar transfers. Plasma emerged to address these inefficiencies; it aims to provide an infrastructure that will eliminate the friction experienced in stablecoin payments, acting as a dedicated highway.

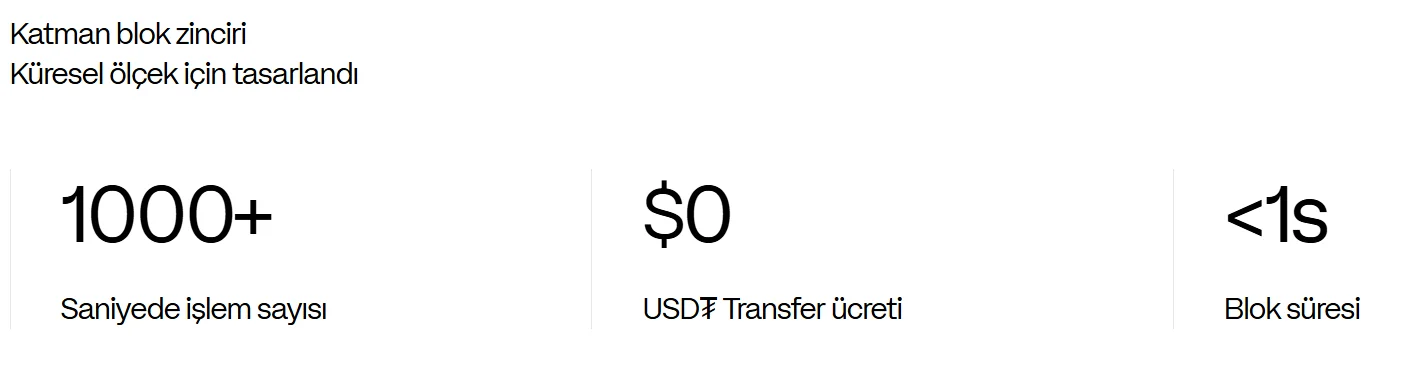

What is its technological infrastructure? Technically, Plasma is based on a modern and innovative architecture. It uses an improved variation of the HotStuff protocol called PlasmaBFT as its consensus mechanism. This ensures transaction finality in a very short time (less than 1 second) on the blockchain and can reach a capacity of over 1,000 transactions per second. In other words, the network has the speed and scalability required for real-time payment transactions. At the execution (smart contract) layer, Reth, a high-performance Ethereum client written in Rust, is used. This makes Plasma fully EVM compatible; developers can deploy Solidity smart contracts to the Plasma network without any modifications, and users can connect popular wallets like MetaMask to Plasma without using extra tools. In short, Plasma offers an infrastructure compatible with Ethereum while creating much faster and cheaper transaction capabilities in the background through its own consensus and optimization processes. Another innovative aspect of Plasma is its solution to gas fees. On most blockchains, even sending a token requires acquiring the main currency of that chain (e.g., ETH on Ethereum) to cover the gas fee. Plasma eliminates this barrier by using a system called Paymaster (Fee Sponsor). Through this mechanism, the protocol itself or decentralized applications allow users to pay transaction fees with stablecoins like USDT, or even subsidize the fee entirely. This means you don't need to hold XPL tokens in your wallet to make a basic USDT transfer on Plasma; the network will fund it from its own XPL budget if needed, or you can pay directly with USDT. This approach makes stablecoin usage extremely practical and seamless, even for users new to crypto or with little technical knowledge.

Plasma's History: Key Developments

We can examine the milestones Plasma has reached since its launch as follows:

- Launch process: The Plasma project rapidly developed throughout 2025 and reached its mainnet in the third quarter of the year. The foundations of the project were laid with strong funding and support. In February 2025, a seed and Series A funding round of approximately $24 million was completed, led by industry giants such as Framework Ventures and Bitfinex (the operator of Tether). This funding round also included significant market players such as DRW/Cumberland, Bybit, Flow Traders, 6th Man Ventures, and Nomura; and well-known names such as Tether CTO Paolo Ardoino and Peter Thiel provided support as individual angel investors. This strong start ensured that Plasma gained significant trust both in the crypto sector and in traditional finance circles.

- Testnet and Mainnet: Following an intensive development process, the Plasma testnet went live in July 2025. The anticipated mainnet launch then took place on September 25, 2025. With the mainnet launch, Plasma's own cryptocurrency, the XPL token, began listing on major exchanges. On launch day, the amount of stablecoins entering the ecosystem reached a striking level of $2 billion; the market capitalization of the XPL token exceeded $2.4 billion on the first day, and its price rose to $1.54. By the end of the first week, the total value locked (TVL) on the Plasma network surpassed $5.5 billion, demonstrating the market demand for a purpose-built stablecoin infrastructure. Thanks to this impressive start, XPL emerged as one of the most valuable new crypto assets in 2025.

- Network improvements: The deployment of the Plasma mainnet brought with it significant technical features. For example, the Plasma team announced a unique integration called the Bitcoin bridge (BTC bridge). This allows users to securely and decussively transfer their BTC to the Plasma network, converting it into 1:1 collateralized wrapped BTC tokens called pBTC, which they can then use in smart contracts on Plasma and convert back to real BTC. This trust-minimized BTC bridge expands Plasma's capabilities by providing direct Bitcoin liquidity to decentralized finance (DeFi) applications. The team also announced they are working on a Confidential Payments module for privacy-focused transactions. When this feature is implemented, data such as transaction amount and recipient information can be hidden without compromising existing wallets and compatibility, providing a certain level of privacy in stablecoin transfers. The Confidential Payments feature is still under research and development and is planned to be added to the network in a future update.

- Ecosystem Growth and Adoption: Plasma experienced rapid adoption in the period following its mainnet launch. Many decentralized applications and protocols have sought to integrate with Plasma to speed up and reduce the cost of stablecoin transactions. For example, Aave, a leading global DeFi lending protocol, launched its own money market on Plasma. Within 48 hours of its launch, $5.9 billion worth of deposits flowed into Aave pools on Plasma, peaking at $6.6 billion in TVL in mid-October. This made Plasma the second-largest market for Aave after the Ethereum mainnet, quickly establishing it as a significant player in the global lending market. Similarly, the Binance exchange began supporting the Plasma network, offering its users on-chain USDT yield products. Listings on major exchanges (such as Binance, OKX, and Bybit) and community-focused airdrops have rapidly increased the adoption rate of the XPL token. As of December 2025, XPL coin price is estimated to be around $0.13.

Why is Plasma Important?

The Plasma project stands out in the crypto world for focusing on a specific problem and offering innovative solutions. While traditional blockchains have various obstacles in the use of stablecoins as a daily payment method, Plasma removes these obstacles, providing benefits across a wide range of applications, from Web3 integration to real-world financial applications. Below, we detail Plasma's importance under the headings of use cases and token economics to better understand it.

Use Cases

- Web3 Integration: Plasma is a network that can easily integrate into the Web3 ecosystem thanks to its compatibility with the Ethereum Virtual Machine (EVM). Developers can migrate existing Ethereum smart contracts or decentralized applications (DApps) to Plasma with minor changes, thus offering their users faster and cheaper transactions. Especially when stablecoin-based applications (e.g., decentralized exchanges, lending protocols, payment dApps) run on Plasma, scalability and fee issues encountered on general-purpose chains like Ethereum are minimized. This also gives Web3 projects the opportunity to reach wider audiences and get closer to real-world use. Indeed, the adoption of Plasma by large DeFi protocols like Aave proves how attractive the network is as an infrastructure for Web3 applications.

- On-chain payment systems: Plasma's most obvious use case is on-chain payment and remittance systems. Although stablecoins are considered suitable for daily payment methods due to their stable value, using them on most blockchains involves high transaction fees and technical complexity. Plasma solves this problem by allowing USDT transfers with near-zero fees. For example, a user can send USDT to the other party in seconds and almost for free on the Plasma network – without needing to hold XPL in their wallet, paying the transaction fee directly with USDT. In this way, the Plasma network provides an extremely suitable platform for scenarios such as remittance (international money transfer), receiving stablecoin payments in e-commerce, in-game payments, or micro-payments. The fact that transactions are instantaneous (sub-second finality) and costs are negligible makes stablecoin payments truly as easy as "sending a message".

- Real-world applications: The Plasma team has a vision to integrate blockchain technology with real-world financial systems. They not only offer a technical infrastructure but also develop user-friendly solutions. For example, they announced Plasma One, a stablecoin-focused neobank and card product. This application allows users to directly use their USDT balances on the Plasma network for daily expenses, essentially experiencing a bank account and debit card. Furthermore, the Plasma foundation is collaborating with traditional payment providers and financial institutions to license its payment technology. This means that in the future, Plasma's infrastructure could operate in the background, unknowingly powering the financial transactions of millions of people using stablecoins. In short, Plasma's potential real-world applications include a wide range of services such as international money transfers, commercial payments, savings and lending (via DeFi), and even providing infrastructure for government-backed digital currency projects. The project's founders believe that mainstream adoption of stablecoins is only possible with such a robust and user-friendly infrastructure.

Token Economy

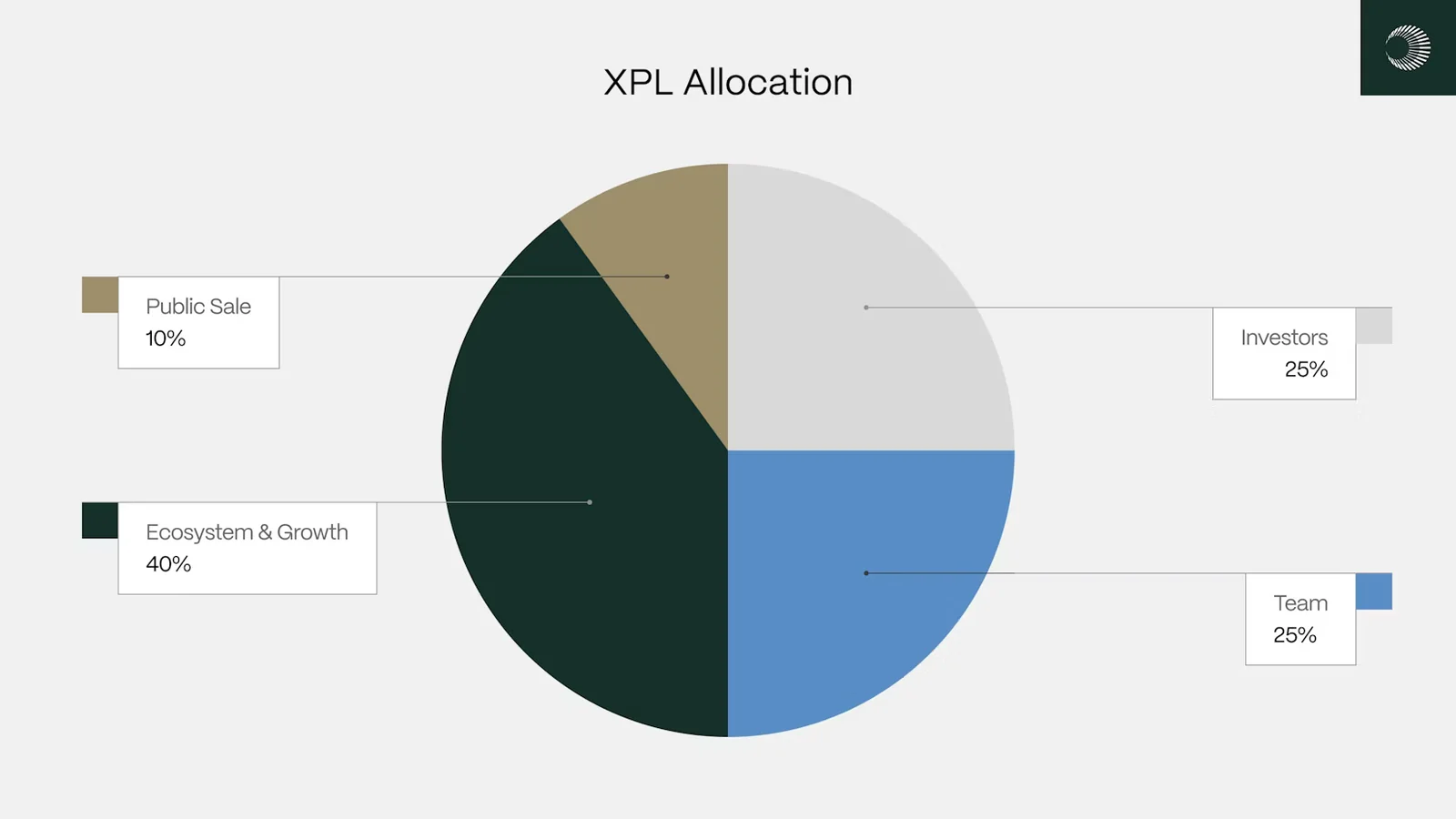

- XPL, the native cryptocurrency of the Plasma network, forms the backbone of the network's economy. The total supply is set at 10 billion XPL. This supply is distributed across various categories to create a fair and sustainable ecosystem: 10% is allocated to the public token sale, 40% to ecosystem and growth funds, 25% to the founding team and employees, and 25% to investors and strategic partners. Specific lock-up periods and a staggered vesting schedule are applied to team and investor shares to prevent sudden, heavy selling pressure on the market. Similarly, a 12-month lock-up period is foreseen for tokens acquired from the public sale, particularly for US users.

- Staking and Reward Structure: Plasma is based on Proof of Stake consensus, so the network's security and continuity are ensured by staking XPL tokens. Participants who want to become validators lock a certain amount of XPL on the network to verify blocks and earn rewards for this service. One of the notable aspects of Plasma's staking system is its reward inflation model. Initially, the XPL inflation rate is 5% annually, but it is reduced by 0.5% each year, eventually reaching 3%. This inflation is distributed to validators as new block rewards, thus maintaining strong early security incentives while preventing the total supply from becoming excessively inflated over time. Plasma also implements a unique penalty (slashing) method for validators who make mistakes. In this model, called "soft slashing," validators who make mistakes only lose their rewards for that period as a penalty, but their staked principal remains untouched. This system secures the network while also offering a more forgiving approach for validators. Furthermore, it provides delegation opportunities for small investors or users without technical expertise: XPL holders can delegate their tokens to a validator, participate in the staking process through them, and receive a proportional share of the rewards. Thus, contributing to network security and generating passive income has become a process accessible not only to large players but also to ordinary users.

- In-use incentive mechanisms: The Plasma ecosystem doesn't position the XPL token solely as a "gas fee payment tool." XPL also plays a role in governance and ecosystem incentives within the network. XPL holders will be able to participate in future network governance voting, submit suggestions, and have a say in shaping the project's direction. Ecosystem funds (40%) reserved for developers and contributors can be distributed as rewards and grants to parties developing applications and contributing to growth on the network. For example, to accelerate Plasma adoption, programs such as transaction fee campaigns, liquidity mining incentives, or hackathon rewards can be funded from the XPL budget at certain periods. Indeed, during the Aave integration, the Plasma Foundation allocated $10 million worth of XPL as an incentive to attract liquidity to the Plasma version of Aave, significantly accelerating deposit flow. Finally, the ability to pay gas fees with stablecoins on the Plasma network is also an indirect incentive mechanism; since users do not have to spend XPL on basic transactions, the barrier to entry to the network is low, which increases usage rates. In short, the XPL token economy has a multifaceted structure that both secures the technical operation of the network and incentivizes usage and growth.

Plasma's Developers and Leadership

Behind the Plasma project is a team with experience in the crypto and finance world. The founding team consists of a strong and diverse group of experts in technology and finance. Team members include individuals who have worked as software engineers at tech giants like Apple and Microsoft, financiers with high-frequency trading (HFT) experience at institutions like Goldman Sachs, and academics who have conducted research on distributed systems at Imperial College London and Los Alamos National Lab. Furthermore, individuals who have previously played active roles in major stablecoin and blockchain projects and are experts in the sector are involved in Plasma's development. This ensures that Plasma is managed by a team with a solid foundation in terms of technical competence and industry knowledge. The development and growth of the project relies not only on the internal team but also on a broad developer community. As an open-source ecosystem, Plasma is open to developers contributing from around the world. Smart contract developers, wallet and tool providers, node operators, and independent researchers can contribute to the Plasma project through its Github repository and test networks. For example, wallet developers like OneKey quickly integrated Plasma and began offering XPL support in their wallets. This community-focused approach played a critical role in the network's rapid adoption. Furthermore, the Plasma Foundation provides technical documentation, SDKs, and incentive programs to support the developer community. Developer events, testnet bounty programs, and hackathons are organized to keep the ecosystem vibrant. Project Vision and Roadmap: Plasma's vision is to become a significant part of the global financial infrastructure in the stablecoin era. Tether CEO Paolo Ardoino emphasized that a secure, scalable, and decentralized infrastructure is essential for stablecoin adoption to explode into the mainstream, and that Plasma is designed to meet precisely this need. The team aims for Plasma to become the "chain where digital dollars are assumed to move" in the long term. In this context, the roadmap includes both technical improvements and adoption-focused steps. Upcoming goals include implementing privacy features (Confidential Payments), building bridges with more assets and networks (e.g., integrations with different stablecoin issuers, multi-chain support for Ethereum and other L1/L2 networks), and transitioning to community governance to achieve a fully decentralized network. Furthermore, work continues on launching end-user products like Plasma One to increase real-world usage, collaborations with traditional financial institutions, and regulatory compliance. In short, the Plasma team is focused on both pursuing technological innovation and building the necessary bridges for integrating stablecoins into daily life.

Frequently Asked Questions (FAQ)

Below you can find some frequently asked questions and answers about Plasma:

- Which exchanges list Plasma (XPL)? The XPL token has been listed on a number of major cryptocurrency exchanges since its launch. The highest volume trading platform is Binance, where XPL/USDT is one of the most active trading pairs. In addition, XPL can be traded on popular exchanges such as OKX and Bybit. Some regional exchanges and decentralized exchanges have also listed it. In general, XPL has high liquidity and wide accessibility; having various pairs such as USDT, USDC, BNB, and TRY on major exchanges makes it easy for different user segments to access XPL.

- How to stake XPL? The Plasma network operates with a staking mechanism. XPL holders can participate in the staking process in two ways. Users with the necessary technical competence and collateral can become validators by running a node; Users validate transactions, generate blocks, and earn XPL rewards. Those who don't want to run their own node can delegate their XPL to an existing validator and share in the rewards. Staking can be done through Plasma's official dashboard, the Plasma One application, or supporting wallets and exchanges. Rewards are distributed according to an inflation model; approximately 5% annually in the first few years and decreasing over time. Thanks to Plasma's soft slashing model, if an incorrect validator is selected, only the rewards are cut off, the principal is protected.

- Which wallets are compatible with Plasma? Since Plasma is EVM compatible, it can be used with many Ethereum-supported wallets, primarily MetaMask. Users can manage their XPL and on-net assets by adding the Plasma network's RPC information to their wallets. Hardware and multi-chain wallets like OneKey offer Plasma integration, while wallets like Trust Wallet and Coin98 are also expected to provide support. Furthermore, the Plasma team plans to provide an integrated wallet experience with the Plasma One application. This allows users to easily access the Plasma network without learning a new wallet.

- Which networks does it operate on? Plasma operates as an independent mainnet; XPL is the native token of the Plasma blockchain, not on another chain. The goal is not to replace existing networks, but to provide a specialized infrastructure for stablecoin transactions. Plasma also has a multi-chain structure. Thanks to bridges like LayerZero, USDT on Ethereum and Tron can be moved to Plasma. USD₮0 issued by Tether on Plasma facilitates cross-network stablecoin transfers, while the Bitcoin bridge integrates BTC into the Plasma ecosystem. This structure allows stablecoin liquidity to circulate freely between different blockchains.

- What are the advantages for individual users? Plasma (XPL) offers a low-cost and fast blockchain experience for individual users. Transaction fees for basic stablecoin transfers are negligible; there is no requirement to hold XPL when sending USDT, and fees can be paid directly with stablecoins. Thanks to sub-second finality, transactions are almost instantaneous. Ethereum compatibility allows continued use of popular wallets like MetaMask. With the evolving ecosystem, it's becoming possible to earn stablecoin returns through DeFi protocols like Aave, while XPL staking and delegation options offer passive income opportunities. In these respects, Plasma provides a practical, fast, and accessible blockchain infrastructure for individual users.

Don't forget to check out other articles in the JR Crypto Guide series for similar comprehensive guides on important projects in the crypto world.