At a time when digital payments are gaining momentum and users are seeking speed, low costs, and security, PayPal USD (PYUSD) was developed to address these needs. Launched in collaboration with PayPal and Paxos, PYUSD is a stablecoin pegged to the US dollar. Backed 100% by cash and short-term Treasury bonds, this digital asset aims to build a robust and reliable bridge between traditional finance and the Web3 world. Running on Ethereum (ERC-20) and Solana (SPL), PYUSD allows PayPal and Venmo users to transfer value in seconds with low fees. Token issuance and redemption occur through Paxos Trust, and all reserves are transparently audited. The NYDFS license and PayPal's BitLicense provide the project with a strong regulatory foundation.

Let's take a detailed look at what PYUSD offers, how it works, and why it is rapidly gaining importance in both the individual and corporate worlds.

PYUSD Definition and Origin

PayPal USD, or PYUSD for short, is a stablecoin developed by digital payments giant PayPal in collaboration with Paxos Trust, a regulatory-compliant blockchain company. PYUSD's key feature is that each token is pegged to $1. It is 100% backed by cash and short-term Treasury bonds. This means that when a user holds 10 PYUSD, they are actually holding $10 worth of cash or government bonds in Paxos's controlled reserves. This provides both security and a stable digital store of value.

PYUSD was created to offer a fast, low-cost, and secure payment solution in the digital economy. PayPal wants both individuals and businesses to be able to conduct their daily transactions via its blockchain infrastructure. Specifically, it aims to build a secure bridge between fiat money (i.e., traditional USD) and the crypto world. In other words, with PYUSD, users can easily convert their PayPal balance into digital form and convert it back to traditional USD when needed. This two-way bridge structure makes PYUSD a highly practical solution.

As a technological infrastructure, PYUSD was initially implemented as an ERC-20 token on the Ethereum network. However, over time, it will be ported to the Solana network, which stands out for its scalability and low transaction costs. With the launch of Solana support in May 2024, PYUSD will be much faster and cheaper to transfer. This is a significant step for a user-friendly brand like PayPal to offer stable value across different networks. This structure, which combines Ethereum's secure and widespread ecosystem with Solana's speed advantage, provides flexibility for both developers and ordinary users. Paxos manages this entire process transparently and in compliance with regulations. It reports its PYUSD reserves monthly through independent auditors. These reports are made publicly available for everyone to access. Furthermore, Paxos, the issuer of PYUSD, is licensed by the New York Department of Financial Services (NYDFS). Similarly, PayPal obtained a BitLicense in 2022, ensuring PYUSD's fully regulated market presence. Users can instantly convert their balances from their US PayPal or Venmo accounts into PYUSD and back to USD with equal ease. Furthermore, PYUSD can be sent to other wallets, used for online purchases, or traded on supporting exchanges. This flexibility makes it a functional tool in both the traditional finance and cryptocurrency worlds.

PYUSD History: Key Milestones

PYUSD has experienced rapid growth since its launch. PYUSD quickly expanded into a broad ecosystem, both in terms of technical infrastructure and user access, and is solidifying its place in the stablecoin space with significant partnerships and strategic integrations. Here are the milestones in this process:

- August 2023 – Launch: PayPal officially announced PYUSD on August 7, 2023. Led by CEO Dan Schulman, this announcement symbolized PayPal's entry into the digital currency world. It was emphasized that PYUSD would be launched in partnership with Paxos Trust and fully licensed.

- September 2023 – Venmo integration: On September 20, 2023, PYUSD was integrated into the Venmo app. Users could now buy and sell PYUSD and make fast and free transfers between their PayPal and Venmo accounts. With this development, the NYDFS also added PYUSD to its "green list," solidifying its regulatory acceptance. Fall 2023 – Exchange and wallet support: PYUSD was listed on leading crypto exchanges such as Crypto.com, Coinbase, Kraken, and Bitstamp towards the end of the year. It was also integrated with popular wallets such as MetaMask, Ledger, and Phantom, as well as institutional custody platforms such as Fireblocks and Copper. Support for payment services such as BitPay increased its potential for daily use.

- March 2024 – Free transfers with Xoom: PayPal integrated PYUSD into its cross-border transfer platform Xoom. This initiative allowed users to send money with PYUSD to many locations around the world without any exchange rate differences or transaction fees.

- May 2024 – Release on the Solana network: At Consensus 2024, it was announced that PYUSD now runs on the Solana network. Solana's high transaction capacity and low cost made PYUSD transfers much more efficient. Around the same time, Paxos began publishing monthly audit reports on reserves.

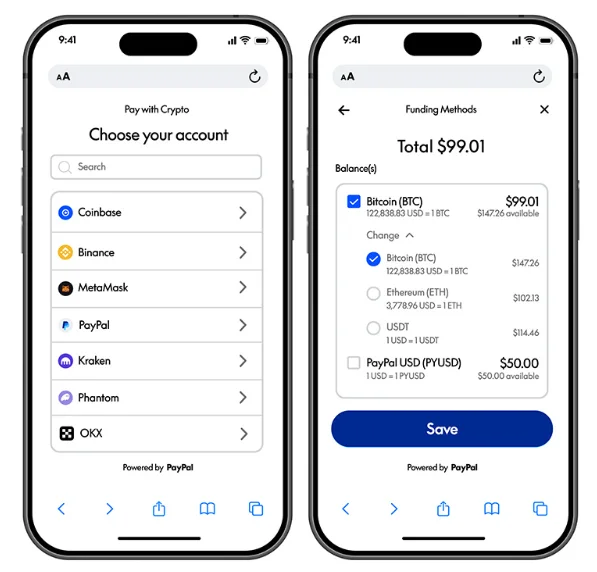

- 2025 - 2025 saw significant developments in regulation, technology, and adoption for PYUSD. In February, the US Securities and Exchange Commission (SEC) closed its 15-month investigation into PYUSD without imposing any sanctions. Around the same time, PYUSD was temporarily removed from some European exchanges (e.g., Kraken) due to the European Union's MiCA regulation coming into effect. PayPal announced that PYUSD had exited the experimental phase and aimed to roll it out to 20 million businesses by the end of 2025. It also planned to support freelancers with bulk payments through Hyperwallet. In June, plans were announced to integrate PYUSD into the Stellar network, making it more widely available in microfinance and remittance platforms with faster and lower-cost transactions. The "Pay with Crypto" platform, launched in July, allows businesses to receive crypto payments from over 100 wallets, store these payments as PYUSD, and earn returns of up to 4%. In August, PYUSD entered the top 10 stablecoins list by forming a $1 billion liquidity partnership with Spark in the DeFi space. As a result of these developments, PYUSD's market capitalization surpassed $2.8 billion in October, with an average daily trading volume of $100 million.

Why is PYUSD Important?

PYUSD offers a unique user experience by combining the speed and security advantages of blockchain with the familiar structure of traditional finance. With its 24/7 infrastructure, transfers occur in seconds, making global money transfers much more convenient for both individuals and institutions. Furthermore, these transactions are secured by reserves backed by 100% cash and short-term US Treasury bonds. Thanks to independent audit reports regularly published by Paxos, the exact value of PYUSD is transparently verified.

PYUSD largely eliminates the high transaction fees and long waiting times associated with traditional cross-border transactions. PYUSD transfers between PayPal and Venmo are completely free, while transactions made through other networks are also quite low-cost. Being able to trade with a stable asset, especially for large transactions, protects users against exchange rate fluctuations and increases operational efficiency.

One of PYUSD's biggest distinguishing features is its strict regulatory compliance. Paxos's New York Department of Financial Services (NYDFS) license and PayPal's BitLicense demonstrate that this stablecoin operates in full compliance with regulations. This provides a significant level of trust, particularly for institutional investors and large businesses.

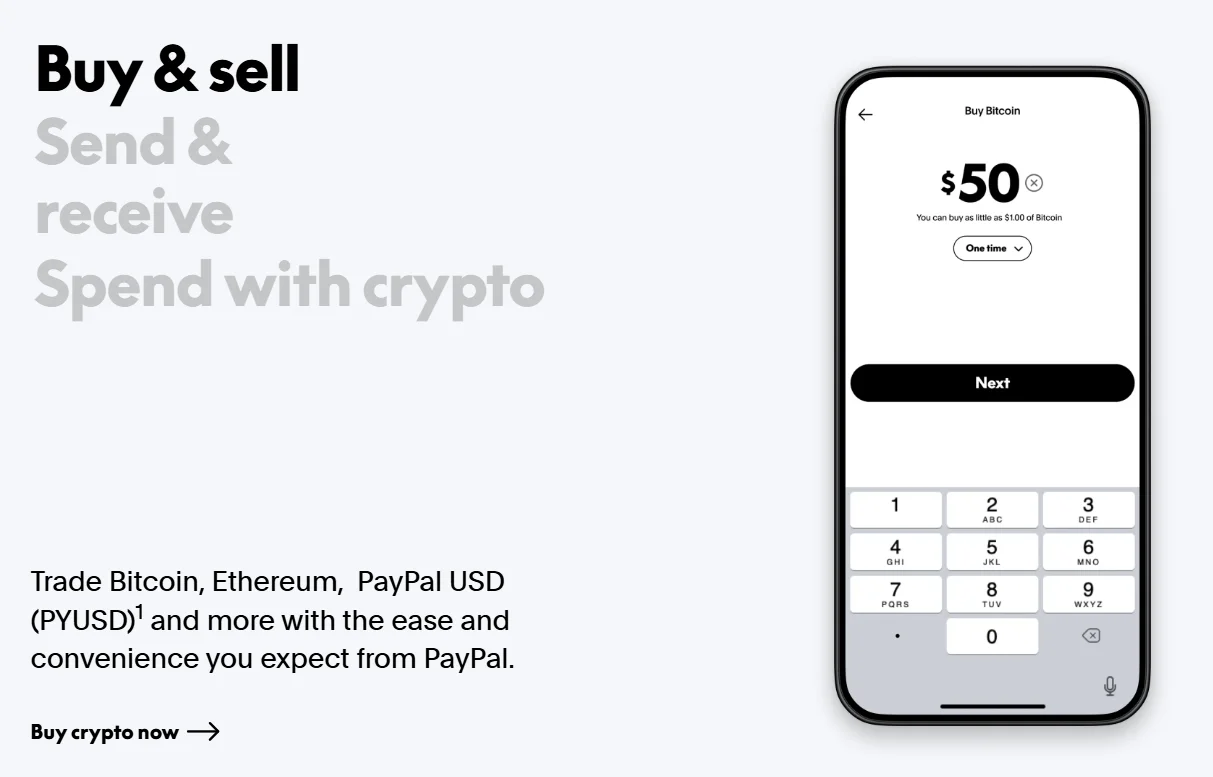

PYUSD also boasts significant user access. Its integration with PayPal and Venmo allows millions of users to access this digital dollar with a single click. Furthermore, because PYUSD is traded on major exchanges like Coinbase and Crypto.com, it appeals to a broad audience of investors and developers. The use of PYUSD, particularly in DeFi protocols and liquidity pools, is becoming increasingly widespread, making it an important tool in both traditional and decentralized finance.

Finally, one of the most striking aspects of PYUSD is its ability to serve as a functional bridge between fiat and the crypto ecosystem. Users can easily convert their dollar balances into PYUSD, use them in the blockchain environment, and convert them back to fiat dollars when needed. This two-way ease of use holds great potential for the future of financial systems. PYUSD thus builds a seamless and secure bridge between the digital and traditional worlds.

PYUSD Model: Economics, Reserves, and Issuance Mechanism

PYUSD's token economics model also adds value to the coin. PYUSD is designed as a stablecoin that aims to maintain the peg of 1 PYUSD = 1 US dollar. To maintain this value, its reserves consist of 100% cash and short-term Treasury bonds. Paxos holds these reserves in dedicated accounts under the supervision of the NYDFS and publishes independent audit reports monthly, ensuring both regulatory compliance and user trust.

The token issuance and redemption process is highly transparent: Users can acquire PYUSD by depositing USD through their PayPal or Venmo accounts; Similarly, they can convert PYUSD back to USD at any time. PYUSD initially launched as an ERC-20 token on Ethereum and expanded to the Solana network by 2024. Integration with other networks such as Stellar and Polygon is planned for the near future. This multi-network strategy increases PYUSD's accessibility and transaction efficiency.

PYUSD Uses

Furthermore, PYUSD offers many practical uses for everyday users and businesses. It enables low-fee transfers, particularly for cross-border payments. Transactions between PayPal and Venmo are free, while international money transfers with services like Xoom are also becoming faster.

With the on/off-ramp feature, users can directly switch between USD and PYUSD without using a bank or exchange. This feature simplifies crypto access. Furthermore, merchants accepting PYUSD receive payments instantly at a fixed dollar value, reducing exchange rate risk and transaction time. On the institutional side, PYUSD is used in both treasury management and DeFi applications (liquidity pool, lending, collateral). Integration with PayPal wallets provides a seamless experience within the digital ecosystem, while also being tradeable on external wallets and major crypto exchanges.

PYUSD's Future and Roadmap

Finally, PYUSD's future also adds value to the coin. PYUSD's future plans are focused on multi-chain expansion, global regulatory compliance, and institutional integration. Following Ethereum and Solana, it is expected to become active on networks such as Stellar, Arbitrum, and Polygon. Furthermore, bridge protocols like LayerZero will increase PYUSD's portability across blockchains.

PayPal is also keen to expand PYUSD beyond the US. Once compliance with international regulations like MiCA is achieved, its use in Europe and other regions could expand. A focus is being placed on bank and fintech partnerships to increase institutional adoption.

Transparency will become even more important in the future: Paxos's monthly audit reports may increase in frequency, and real-time verification systems may be implemented. Additionally, reward programs such as interest or cashback are also on the agenda to incentivize users. Finally, the use of PYUSD in next-generation financial products (e.g., token-based derivatives or digital insurance) could become widespread.

Who are the Founders of PYUSD?

PYUSD is backed by two powerful names: PayPal, a pioneer in digital payments, and Paxos Trust, which provides a fully compliant stablecoin infrastructure. PayPal CEO Dan Schulman emphasizes the need for reliable tools that can integrate with both the fiat and blockchain worlds for the widespread adoption of digital assets. He believes PYUSD directly addresses this need. Paxos CEO Charles Cascarilla describes PYUSD as "the first stablecoin issued by a leading financial institution" and sees this move as a significant advancement in the digital asset world. Jose Fernandez da Ponte, Head of PayPal's Blockchain and Crypto Group, stated that the primary goal in PYUSD's design was to provide "a fast, simple, and low-cost payment solution for commerce." This visionary leadership approach makes PYUSD a strategically strong product.

From the ecosystem perspective, PYUSD is also progressing with significant support. Global crypto exchanges like Crypto.com, Coinbase, and Kraken currently list PYUSD; popular wallets like MetaMask, Ledger, and Phantom support this digital dollar. On the institutional side, secure custody services like Fireblocks and Copper continue their PYUSD integrations. In terms of payment systems, shopping with PYUSD is now possible thanks to service providers like BitPay. Moreover, PayPal's services, such as Venmo and Xoom, make individual-to-individual and country-to-country transfers of PYUSD more accessible. This broad partnership structure provides easy access to PYUSD for both individual users and corporate actors.

Frequently Asked Questions (FAQ)

Below are some answers to your questions about PayPal's PYUSD:

- What is the difference between PYUSD and PayPal Balance? A PayPal balance is a digital fiat account used only within the PayPal/Venmo ecosystem. PYUSD, on the other hand, can be converted from this balance, but it is a crypto asset that can travel on the Ethereum/Solana networks. This means you can send PYUSD to wallets other than PayPal or use it on supporting services. Every 1 PYUSD is worth exactly 1 USD, guaranteed by Paxos.

- How are PYUSD reserves verified? Paxos publishes independent audit reports every month. These reports document the total value of cash and bonds held against PYUSD. Furthermore, the records are checked by certified independent auditors, allowing users to confirm that the reserves are 100% mutual.

- Which blockchains is PYUSD valid on? PYUSD was initially released on Ethereum (ERC-20 token). Support for Solana (SPL) was added in May 2024. PayPal and Venmo wallets display their balances as a single account on both networks. Network connections to Arbitrum, Polygon, and others are also planned for the future.

- Why do corporates use PYUSD? PYUSD offers low costs and fast settlements for cross-border payments. Its transparent reserve structure and auditability make it compliant with financial regulations. Large companies can mitigate risk by holding excess cash in Treasury bonds and access digital payment infrastructures with PYUSD. In short, it provides operational efficiency and compliance advantages.

- Can individuals use PYUSD? Yes. PYUSD is available to individuals in the US with eligible PayPal or Venmo accounts. These users can buy and sell PYUSD directly within PayPal/Venmo. It can also be accessed by purchasing PYUSD from exchanges like Coinbase and Crypto.com or from supporting wallets. This means that individuals can also access PYUSD, albeit with limited access.

You can find the most up-to-date analyses, tools, and guides on PYUSD and the stablecoin ecosystem in the JR Kripto Guide series.