What everyone is looking for in crypto derivatives markets is clear: low costs, high speed, and no price slippage during transactions. MYX Finance (MYX) is a project that emerged with a focus on precisely these needs. Thanks to a special system called the Matching Pool Mechanism (MPM), users can execute their transactions with virtually no slippage. Furthermore, the platform supports multiple blockchains, making it convenient for investors from different networks. Let's take a look at the reasons why it's so popular in the DeFi world.

MYX Definition and Origins

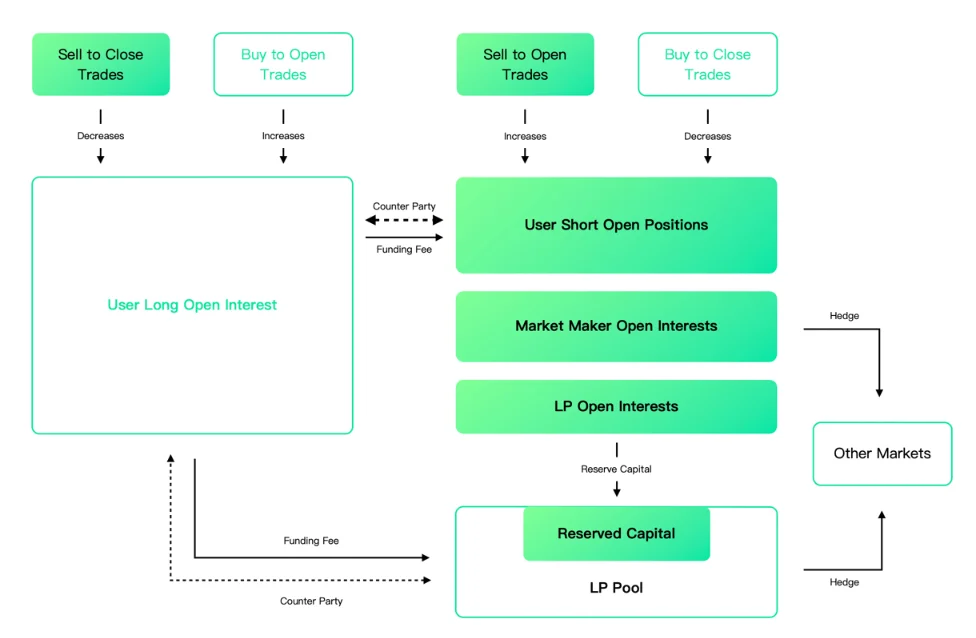

MYX Finance is a decentralized exchange where users can trade perpetual futures contracts with up to 50x leverage. However, what sets it apart is that it operates with a brand new method, rather than using traditional order books or automated market makers (AMMs). This system is called the Matching Pool Mechanism (MPM). By matching buyers and sellers in a common pool, it allows for virtually no price slippage, even in large transactions. In other words, the worry of "will there be a price slippage or a price change?" while trading is greatly reduced.

MYX Finance has a non-custodial structure, meaning users retain control of their funds. All transactions are carried out through smart contracts; no one can directly access user funds.

The project's foundations were laid in 2023. Social media accounts were first launched in June. Then, on November 28, 2023, the team received a $5 million seed round led by Sequoia China (now HongShan). This round also included prominent blockchain funds such as ConsenSys and Hack VC. The first testnet phase launched on the Linea Goerli testnet the following day. The second testnet was completed on December 26.

The project progressed quickly, and the mainnet went live on the Arbitrum network on February 18, 2024. Following the launch, various campaigns were organized to further strengthen the community. For example, a joint event held in April 2024 with the OKX Web3 wallet introduced many users to the platform. MYX's main goal is to take the trading experience of centralized exchanges and combine it with the advantages of DeFi, such as transparency and user control. By offering an always-on global derivatives market, "trading isn't limited to a New York morning," he says. Users can connect to MYX and open trades from anywhere in the world, 24/7.

One of the platform's most striking features is its multi-network support. Users can deposit assets as collateral on more than 20 different blockchains from a single account, without having to manually use a bridge. This allows capital held on different chains to be used more efficiently in a single location.

Another practical advantage is that transactions are free of gas fees. MYX pays transaction fees on behalf of the user through a system called "relay." The user can then repay this fee with the asset of their choice. This means they don't need to hold network tokens like ETH or BNB in their wallet just to trade. This provides significant convenience, especially for new users. MYX Finance initially began operating on Arbitrum but issued its token on the BNB Smart Chain (BSC) using the BEP-20 standard. Today, it also operates on various networks, including Linea and BNB Chain.

Thanks to its chain abstraction technology, users can bring their assets, even from non-EVM-compatible networks like Solana, and use them as collateral. MYX is quite flexible in this regard.

Price data comes from the Pyth Network, a reliable oracle. Interchain asset transfers are also facilitated by the Across Bridge infrastructure.

Smart contracts are written in Solidity, and security is not compromised. Audit reports have been obtained from industry-renowned firms such as SlowMist and PeckShield. Additionally, the platform utilizes a multi-signature system to protect critical transactions, along with various security and risk management modules such as Time Traveler, Live Surveillance, Auto-Deleveraging, and Risk Reserve.

MYX's History: Key Milestones

Behind every crypto project lies a journey. For MYX Finance, this journey has been fast, exciting, and full of ups and downs. From the initial idea to the mainnet launch, from airdrops to record prices, many steps have brought MYX to its current position. Below, let's take a look at the key moments of this journey.

Late 2023: The First Foundations and the Launch Process

In June 2023, MYX's social media accounts were launched, and the project gradually began to gain traction. A $5 million seed investment in November accelerated the process. This investment included major names such as Sequoia China (now HongShan), ConsenSys, and Hack VC. Immediately after announcing the investment, the team launched the first testnet on the Linea testnet. The second testnet was completed by the end of December.

February 2024: Mainnet goes live

On February 18, 2024, MYX officially launched on the Arbitrum network. As users began making their first transactions, events were held to increase community interest. This quickly led to a surge in user numbers.

May 2025: Token distribution and airdrop momentum

On May 6, 2025, MYX's token was officially launched. As part of the TGE (Token Generation Event), early adopters and liquidity providers were rewarded. A significant portion of the total supply, 14.7%, was shared with these users. The distribution was phased over five months.

That same month, MYX reached a wider audience thanks to the Airdrop+ campaign with the MEXC exchange and the "triple airdrop" event organized in partnership with zkPass. The airdrops increased both liquidity and user interest.

August 2025: Volume exploded, listings followed.

MYX truly stepped up its game during the summer months. Weekly trading volume reached $2.2 billion. The total assets locked in the protocol (TVL) exceeded $30 million. At that time, more than 170,000 users were actively trading on MYX.

As interest in the project grew towards September, some centralized exchanges joined in. On September 9, 2025, Gate.io began listing the MYX token, followed shortly thereafter by Bitget. This development significantly increased volume.

September 2025: WLFI announcement and skyrocketing price

A bombshell announcement on September 5 catapulted MYX's star. The project announced that it would list the token World Liberty Financial (WLFI), associated with Donald J. Trump, as a perpetual contract. This news caused a stir in the market. The MYX price followed a trend as follows:

A significant short squeeze occurred between September 6th and 10th. Users with short positions liquidated $89.5 million, while long positions held only $23.5 million. The difference disrupted the market, and the MYX token surged by over 1,400% in a week, reaching its all-time high of $18.42 on September 10th. At that time, open interest exceeded $400 million.

September 2025: Volatility, criticism, and a decline

Things changed somewhat after this surge. Daily perpetual trading volume rose between $6 billion and $9 billion. Such large figures naturally attracted attention. During the same period, 3.9% of the total supply (39 million tokens) was unlocked.

Some observers considered this timing to be no coincidence. There were rumors that early investors might have sold when the price had risen so high. There were also comments on social media describing this surge as a "scam pump." According to technical analysis, the RSI indicator rose to the 89–97 range, signaling an overbought signal. Many analysts predicted that these levels would not be sustained and that the price could experience a 70–85% correction. Indeed, towards the end of September, the MYX price declined significantly, settling at a more stable level.

Fourth Quarter 2025: Version 2 Update

Following all these developments, the MYX team did not sit idle. It was announced that the Version 2 update would arrive in the last quarter of the year. This new version will add Solana support and further enhance the MPM system. The goal is to provide a more stable, user-friendly trading environment with near-zero slippage.

The roadmap also includes other plans: integrations with new networks, campaigns to promote liquidity, and user interface enhancements. MYX's goal is to offer a perpetual trading experience that is as fast as centralized exchanges but completely on-chain.

Why Is MYX Important?

The elements that make MYX Finance unique and stand out in the DeFi ecosystem are evident in its use cases and token economy. We've outlined why these aspects are critical below:

Perpetual Transactions with Zero Slippage

One of MYX's most striking features is its Matching Pool Mechanism (MPM), which reduces price slippage to almost zero even in large-volume transactions. This means that even when someone opens a $100,000 position, the price doesn't jump. This is a significant advantage, especially for those making large trades or using high leverage. It feels like trading on a centralized exchange.

Cross-chain trading in one place

MYX is remarkably successful at bringing assets from different blockchains together on a single platform. For example, you can bring ETH from the Ethereum network or SOL from Solana and deposit them as collateral on MYX. This eliminates the hassle of bridging and transferring assets. This allows you to trade without wasting time on which network you're on. This feature both saves time and increases transaction efficiency.

A gas-free and convenient trading experience

MYX doesn't require users to hold network tokens (such as ETH or BNB) to trade. Transaction fees are covered by a relay system. Users can then pay this fee with another asset if they wish. This system offers significant convenience, especially for beginners. Furthermore, thanks to the platform's 24/7 availability, trading is possible at any time, day or night.

Earning Income by Providing Liquidity

On MYX, you don't just have to buy and sell. You can also earn passive income by depositing your assets into liquidity pools for specific trading pairs. Those who perform these transactions are awarded MLP tokens. In other words, you become a shareholder of the pool. In return, you receive 40% of the fees collected from trades and a portion of the funding fees as income. You also receive a share of the pool's profit and loss distribution. In a balanced market environment, the risk of being an LP (liquidity provider) is quite low.

Leveraged hedging and arbitrage opportunities

Thanks to perpetual trading, investors can bet not only on the rise but also on the fall. For example, if you hold BTC in your wallet but anticipate a decline, you can protect yourself by shorting MYX. Or, you can exploit price differences across different exchanges to engage in arbitrage. MYX's low transaction costs and fast structure make implementing these strategies quite easy.

MYX token economics: Distribution, usage, and potential

Supply and distribution

The total supply of the MYX token is limited to 1 billion units. This means no new tokens are minted. This means the supply will remain constant over the long term. The distribution plan is as follows:

DAO System

The MYX token doesn't just offer a discount on transaction fees. It also serves as a governance tool. This means that if you hold MYX tokens, you can vote on important platform-related decisions. For example, decisions such as removing a trading pair, changing fee rates, or adding new features can be submitted to the community. MYX aims to evolve into a DAO (decentralized autonomous organization) over time, placing decisions in the hands of the community.

Staking and Revenue Sharing

Another strength of the MYX token is its staking feature. Users who stake their tokens receive a portion of the revenue generated by transactions on the platform as rewards. In other words, as transaction volume increases, stakers' earnings also increase. Additionally, thanks to the VIP user system, those who hold a certain amount of MYX in their wallets can receive significant discounts on trading fees. Discounts of up to 70% are possible with just 10 MYX.

Value Preservation and Reserve Fund

MYX has also made sure to protect itself against potential market volatility. A Risk Reserve Fund has been set aside to offset potential losses in liquidity pools. As the platform performs, a portion of the earned fees is transferred to this fund, thus protecting user funds in the event of unexpected events. There is currently no active token burn mechanism, but the community may decide to do so in the future. For example, a portion of transaction proceeds could be used to buy back and burn MYX.

Who are the Founders of MYX?

Mark Zhang (aka Yihao Zhang), founder and CEO of MYX Finance, is no stranger to the crypto world. He previously held senior technical roles at one of the three largest crypto exchanges in the world. He has significant expertise, particularly in the architecture of trading systems. He has now brought this experience to the DeFi space and built MYX's "zero slippage" MPM infrastructure.

Of course, the team isn't limited to him. MYX's technical team includes software developers, engineers, and market makers with quant trading backgrounds who have worked on various blockchain projects. This means they have a strong team with both technical and financial backgrounds.

It's also important to consider who invests in a project and who it's collaborating with. MYX is strong in this regard as well. Early-stage funds include leading industry names such as Sequoia China (now HongShan), ConsenSys Mesh, Hack VC, Redpoint, and Cypher Capital. This has enabled MYX to make solid progress not only financially but also in terms of strategic partnerships.

Significant collaborations are also underway on the technology front. Pyth Network provides the oracle infrastructure, and they integrate with Across for cross-chain bridging. They are also compatible with many different applications, including hardware wallets, Web3 wallets, and portfolio tracking tools. The MYX team, led by Mark Zhang, set out with the idea of "making DeFi truly usable and user-friendly." They aim to combine the speed and practicality of centralized exchanges with on-chain security and transparency. This is evident in every decision they make.

The team places particular emphasis on speed, scalability, and security. Therefore, the platform has developed systems to protect users. For example, mechanisms like Auto-Deleveraging (ADL), which automatically activates when market volatility occurs, are readily available.

Frequently Asked Questions (FAQ)

Below are some frequently asked questions and answers about MYX Finance:

- What is MYX Finance?: MYX Finance is a decentralized exchange offering perpetual trading with 50x leverage. Its MPM system keeps slippage near zero and allows users to trade on-chain, at low costs.

- What does MYX do?: MYX brings crypto derivatives trading onto the chain. With its gas-free, multi-network-supported, and cross-collateralized structure, it serves both professional traders and users seeking passive income.

- What is the difference between MYX and GMX or dYdX?: MYX offers near-zero slippage with its MPM system. GMX uses AMM, while dYdX uses an order book. MYX also has the advantage of multi-network support and gas-free trading.

- What is the total supply and distribution of the MYX token?: The total supply is 1 billion. 40% is allocated to the ecosystem, 20% to the team, 17.5% to investors, 14.7% to airdrops, and the remainder to liquidity, community, and reserves. The supply is fixed, with no additional printing.

- What networks does MYX operate on?: It is active on Arbitrum, Linea, and BNB Chain. It accepts assets from Ethereum, Solana, and 20+ networks as collateral. The MYX token is BEP-20 standard and bridgeable.

- Is the platform secure?: Yes. Smart contracts are audited, and security systems such as risk reserves and ADL are in place. However, leveraged trading carries high risk and should be used with caution.

- Is it suitable for beginners?: The platform is user-friendly, but leveraged trading requires experience. Those wishing to begin should experiment with low-risk options first. Reviewing the guides is helpful.

You can find the most up-to-date analyses, tools, and guides about MYX and the decentralized derivatives exchange ecosystem in the JR Kripto Guide series.