Meteora (MET) is the native token of a dynamic liquidity protocol running on the Solana blockchain. It is part of a platform designed to make liquidity smarter, more efficient, and more sustainable in the DeFi ecosystem. In this guide, we will examine the Meteora protocol and the MET token in detail, covering all the important points from its definition and history to its use cases and token economics.

Definition and Origins of MET

Meteora was developed as a decentralized exchange (DEX) and liquidity protocol built on the Solana network. The main goal of the project was to provide an efficient, combinable, and long-term sustainable liquidity infrastructure for decentralized finance (DeFi) applications. In fact, this story began in 2021 under the name Mercurial Finance. By 2023, the team repositioned the project and switched to the Meteora brand. With this transformation, Meteora became a core liquidity layer for many platforms, most notably Jupiter, one of the most important DEX aggregators in the Solana ecosystem. The Meteora protocol aimed to directly address some of the structural problems frequently encountered in classic DeFi models. These included the dispersion of liquidity into different pools, a large portion of capital remaining idle, increased slippage rates in volatile markets, and unfair token launches where bots played a prominent role. To overcome these problems, the team implemented a dynamic market maker model called DLMM, automated vault structures, and a fairer launchpad approach. The goal was to create a deeper, more balanced, and lower-cost liquidity environment for both liquidity providers and traders.

The MET token was designed as a governance and utility token placed at the heart of this ecosystem.

Operating on the Solana network with the SPL token standard, MET played an active role in the distribution of incentives and governance processes within the Meteora protocol. Following the collapse of the FTX exchange, the project team made a clear decision due to structural problems experienced on Mercurial Finance's former token, MER, and started with a clean slate. During this process, the Mercurial platform was shut down, and the Meteora protocol, built around the MET token, was implemented. In short, Meteora continued its journey as a new structure that drew upon Mercurial's experiences but learned from its mistakes, aiming to advance the dynamic liquidity layer vision on Solana with the MET token.

MET's History: Key Milestones

Meteora's journey began with the idea of rethinking liquidity within the Solana ecosystem and quickly took shape through significant milestones. Instead of remaining merely a DEX, the project aimed to become one of Solana's core liquidity layers over time. During this process, critical steps were taken, including rebranding, technical architecture changes, new partnerships, and ultimately the launch of the MET token. Below, you can find the main milestones that the Meteora protocol has reached to date in chronological order:

- February 2023, protocol launch: The Meteora protocol, as the successor to Mercurial Finance, went live on the Solana mainnet in February 2023. This launch was carried out by the team behind Jupiter, Solana's largest DEX aggregator. While the Mercurial platform and MER token were officially discontinued, Meteora was launched from scratch with new features.

- Mid-2023, initial integrations: After its launch, Meteora quickly gained integrations within the Solana ecosystem. In particular, the Jupiter DEX aggregator began supporting Meteora's liquidity pools, and users were directed to Meteora pools via the Jupiter interface. In this way, Meteora became an important part of the ecosystem in its early stages. (Note: During this period, while platform usage increased, the user base remaining from the Mercurial era was also transferred to Meteora.)

- December 2023, Introduction of V2 and DLMM: At the end of 2023, the Meteora team announced the V2 version of the protocol and introduced the Dynamic Liquidity Market Maker (DLMM) concept. Launched in December 2023, the DLMM beta pools generated approximately $1 billion in transaction volume with only about $12 million in TVL, proving the system's high capital efficiency. The DLMM model attracted great interest thanks to its zero-slip price ranges (thousands) that concentrate liquidity and dynamic fee mechanisms adjusted according to market volatility.

- 2024, Platform Development and Launchpad Partnerships: Throughout 2024, the Meteora protocol continuously developed. Significant steps were taken, especially in the Launchpad area: In August 2024, a partnership was established with the Moonshot launchpad, enabling new token projects to be launched fairly and liquidly through Meteora DLMM pools. Over time, launchpads like Believe, BAGS, and Jup Studio have also joined the Meteora ecosystem, generating hundreds of thousands of dollars in additional weekly volume and revenue. These integrations have made Meteora one of the preferred platforms on Solana for providing liquidity for new projects.

- September 2024, Phoenix Rising plan (MET announcement): After operating without a token for a long time, Meteora announced the MET token in the second half of 2024. With the plan called "Phoenix Rising," the details of MET's token economy (tokenomics) were shared with the community. The announcements stated that 20% of the total MET supply would be allocated to former Mercurial supporters, 15% would be given to Meteora users, and approximately 48% of the total supply would be in circulation at launch. This exceptionally high initial circulation rate demonstrated a goal of achieving a wider community distribution, unlike previous token launches in the Solana ecosystem (e.g., Jupiter's JUP token at 13.5%).

- October 23, 2025, MET token launch (TGE): After a long preparation period, Meteora's Token Generation Event (TGE) took place on October 23, 2025. On this date, the MET token was created on the Solana blockchain and distributed as an airdrop to pre-eligible users. Eligible users withdrew their MET tokens to their wallets using the claim interface on Meteora's official website. Simultaneously, up to 10% of the total supply of MET tokens was locked in a one-sided liquidity pool, creating an initial liquidity pool where users could purchase MET in exchange for USDC. This innovative distribution model enabled early price discovery and liquidity. In November 2025, following the TGE, the MET token began listing on major exchanges. For example, the Binance exchange opened MET trading to users on November 13, 2025, by listing the MET/USDT, MET/USDC, and MET/TRY trading pairs.

- December 2025: As of December 2025, the MET token price is hovering around $0.21.

Why is MET Important?

The MET token is central to the Meteora protocol and is significant both for its functionality within the ecosystem and its value model. Below, we will examine step-by-step why the MET token is so critical, under the headings of use cases and token economics.

Use Cases

- Use in DLMM pools: The MET token plays a role in various ways within the dynamic liquidity pools offered by Meteora. In particular, the Meteora protocol has offered the possibility of creating a one-sided liquidity pool in new token launches. As seen in the launch of the MET token itself, users who won airdrops could, if they wished, place their METs in Meteora's initial pool and receive Liquidity Distributor NFT positions in return, earning a share of the pool transaction fees. In this way, MET has gone beyond being just a governance token and has become an asset that can be used in liquidity provision processes. In the future, it will be possible to evaluate MET in different token pairs within Meteora DLMM pools to provide liquidity or share in fee revenues.

- Staking and Voting (Governance): One of the most important use cases of the MET token is its governance mechanism. MET holders can participate in decision-making processes regarding the future of the Meteora protocol by staking their tokens. Staking users gain voting rights in Meteora DAO votes and can participate in proposals for changes to the protocol. For example, MET holders can vote on issues such as updating protocol parameters (fee rates, new pool approvals, etc.). In addition, there is the possibility of receiving a share of the protocol's revenues in exchange for staked METs. The Meteora team plans to share a portion of the transaction fees on the platform with MET stakers. This fee-sharing model aims to both create long-term demand for the MET token and incentivize liquidity providers and token holders in the same direction. In short, staking MET empowers users with governance while also offering the opportunity to generate passive income.

- In-protocol incentives and rewards: Within the Meteora ecosystem, the MET token is a tool used for various ecosystem incentives. MET rewards and programs have been implemented to encourage Meteora's growth and user participation. For example, the Meteora protocol ran a points program throughout 2024, distributing points to its active users; during TGE, users received a MET airdrop in exchange for these points (15% of the total supply was allocated to this program).

- MET has also been used in strategic partnerships: granting MET airdrop rights to those staking JUP tokens on the Jupiter platform is one example (3% of the total MET supply was allocated to Jupiter stakers). Going forward, it is planned to support ecosystem growth through MET token distributions within liquidity mining programs or other collaborations. In this way, MET acts as a central incentive element in rewarding protocol users and attracting new participants.

Token Economics

- Supply Structure: The total supply of MET tokens is fixed at 1 billion. This means that a non-inflationary model is adopted by keeping the maximum amount of the token predetermined. The circulating supply will not be increased through new MET issuances, so if demand increases over time, the fixed supply can positively impact the token value. A certain portion of the total supply is initially put into circulation (through airdrops and liquidity pools), while the remainder is locked for future use.

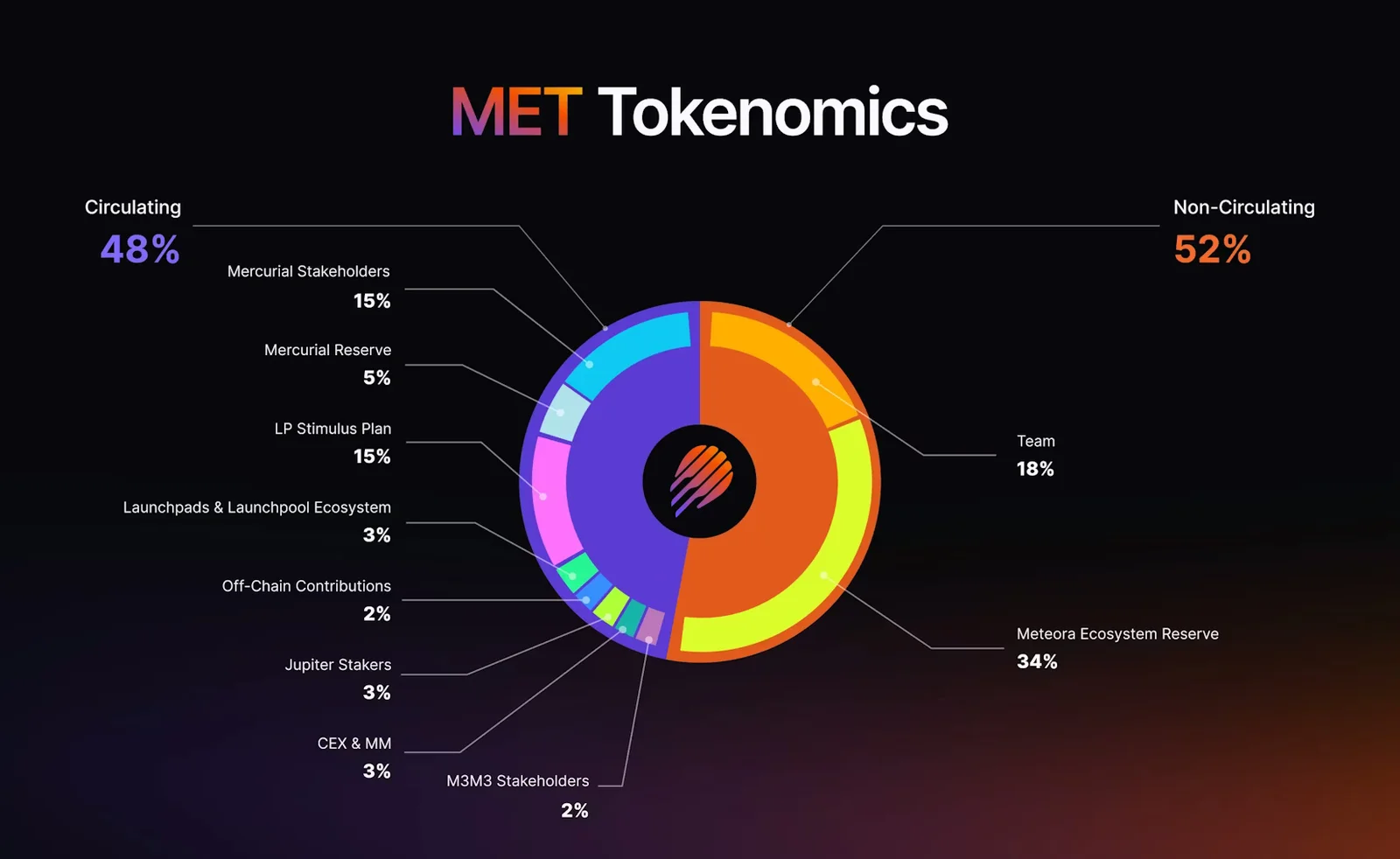

- Distribution and Circulation: Meteora has designed the distribution of MET tokens to be as community-focused and fair as possible. Approximately 48% of the total supply was put into circulation at launch (TGE). This high initial circulation aimed to enable users and early supporters to participate in the project. When examining the breakdown of distributed tokens, 20% was allocated to former Mercurial token holders and stakers, and 15% to community members using the Meteora platform. Additionally, 3% is allocated to the Launchpad Partnerships ecosystem, 3% as an incentive for those staking JUP on the Jupiter platform, 2% to various off-chain contributors, 3% to operational liquidity needs, and 2% to a special staking participant group called M3M3. Through this distribution plan, Meteora has created a decentralized ownership structure by instantly giving almost half of the MET tokens into the hands of real users. The remaining approximately 52% of the supply is locked and will be used in long-term plans.

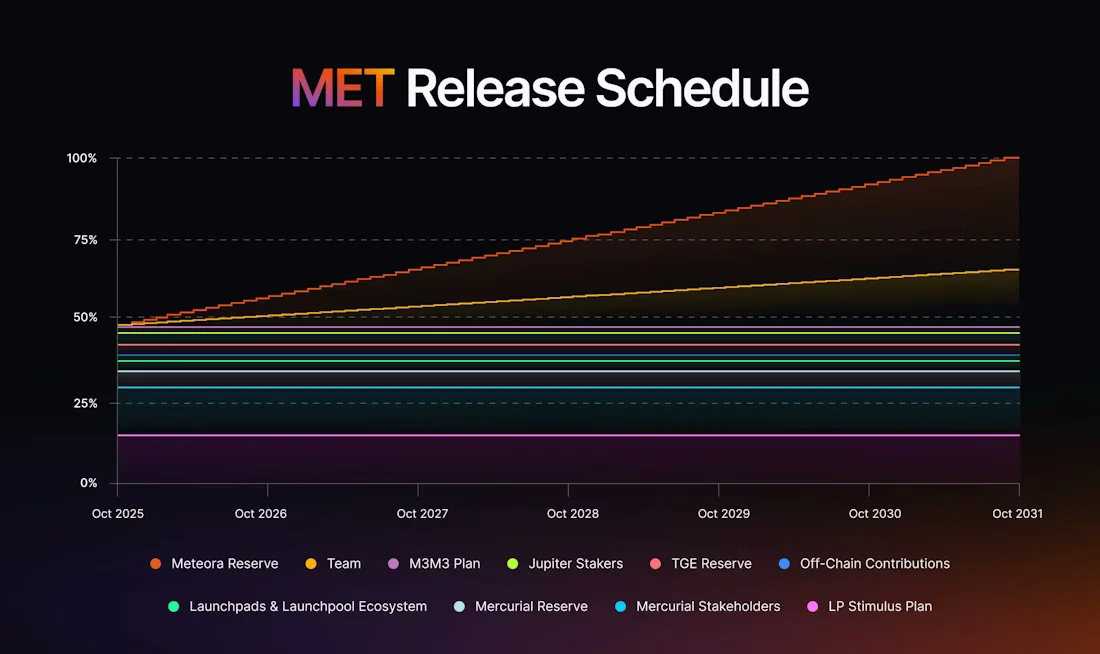

- Team and Reserve Allocations: 52% of the total MET supply, excluding the distributed portion, is allocated to team and protocol reserves. According to official statements, 18% is for the core team and 34% is designated as the Meteora protocol reserve. However, these tokens are not immediately released into circulation but are subject to a long-term vesting schedule. Team and reserve tokens will be released gradually over 6 years in a linear fashion, meaning a certain percentage will be released each year. This prevents the mass sale of team tokens, which would create a burden on the market, and encourages the project team to focus on long-term success. The 6-year vesting process is designed to ensure the sustainable development of Meteora and protect the MET token value from sudden supply shocks.

- Staking and Reward Mechanisms: Meteora's token economy relies on reward distribution through protocol revenue sharing and incentive reserves, rather than continuous inflation. This means that instead of constantly minting new tokens to reward MET token holders, pre-allocated community reserves and protocol-generated revenues are used. For example, it is planned that future MET stakers will receive a percentage of the protocol's DEX transaction fees. This approach creates long-term incentive models for MET: Token holders earn as the protocol grows, and since the total supply remains constant, motivation to hold (HODL) increases. As highlighted in Meteora's Phoenix Rising plan, all allocations except team and reserve allocations are available at launch, and no inflationary token release is planned afterward. This means that in the long term, there will be no selling pressure from sudden supply increases in the MET market, and incentives will be provided primarily through protocol revenues and collaborations. In short, the MET token economy is built on a balanced model that rewards users while maintaining token value.

MET's Developers and Leadership

Meteora Labs is known as the team/company that developed the Meteora protocol. This team consists of experienced and well-known developers in the Solana DeFi ecosystem. The foundations of the Meteora project were laid with Mercurial Finance, one of Solana's early DeFi applications. The founding team of Mercurial aimed to bring new solutions to liquidity problems in Solana by launching Meteora. In 2021, the team behind the project received $3.5 million in seed funding from significant investors such as DeFiance Capital, Huobi (HTX) Ventures, and Signum Capital. This early support provided funding for Meteora's development and demonstrated confidence in the project's potential.

Meteora's founder and first CEO is Ben Chow, a well-known name in the Solana community. Ben Chow is also known as one of the co-founders of Jupiter, Solana's largest DEX aggregator. As the leader behind Meteora's product architecture and launch strategy, Ben Chow played a significant role in the development of innovations such as DLMM and DAMM. However, in February 2025, following a community controversy (the memecoin incident involving Libra), Ben Chow left his active role at Meteora. Following this departure, project leadership was taken over by other founding members of Meteora. In particular, another core team member, known by the alias "Meow," and a co-founder of Jupiter, has been managing Meteora's operations and strategic direction since 2025. As an anonymous but respected developer within the Solana ecosystem, Meow has taken on the task of guiding the community and growing the protocol. Meteora's core team also includes important developers like M3M3. M3M3 was an early technical contributor to Meteora's automated market maker infrastructure, playing an active role in the development of features such as Alpha Vaults and dynamic fee modules. Continuously contributing to the technical evolution and community governance of the protocol, M3M3 is an active member within the MET DAO. The Meteora project has a strong community-driven governance approach, alongside its development team. A community movement called LP Army, bringing together liquidity providers, has formed around Meteora. Long-term supporters and members of the technical community contribute to the protocol's governance by coming together under the MET DAO (decentralized autonomous organization) structure. This community is active in areas such as discussing ecosystem proposals, planning the distribution of liquidity incentives, and providing feedback on the product roadmap. For example, Meteora's "Rising Incubator" program supports those developing new liquidity tools from within the community, and grants are allocated from the DAO treasury to such initiatives.

Frequently Asked Questions (FAQ)

Below you will find some frequently asked questions and answers about MET:

- Which network does MET run on?: The MET token runs on the Solana blockchain. It has an SPL token standard, meaning it is compatible with wallets and platforms in the Solana ecosystem. In short, you can store MET in Solana wallets such as Phantom and Solflare and use it in applications on the Solana network.

- What is DLMM and what does it do?: DLMM (Dynamic Liquidity Market Maker) is Meteora's advanced pooling model that concentrates liquidity in specific price ranges. This structure aims to balance the return of liquidity providers by applying dynamic transaction fees according to market volatility, while enabling transactions with very low slippage in narrow price ranges.

- What is the supply of MET tokens?: The total supply of MET tokens is 1 billion (1,000,000,000). This maximum supply is fixed, and the Meteora protocol will not create more MET. Initially, approximately 48% of the supply was planned to be in circulation, with the remainder locked for the team and protocol treasury. Since the supply is fixed, a scarcity effect may occur in MET tokens as demand increases over time.

- How to stake MET?: To stake MET, you need a Solana wallet and a small amount of SOL for transaction fees. The wallet is connected to the official Meteora application, MET tokens are locked, and in return, you gain governance rights and the opportunity to share in future protocol revenues.

- Can individual investors buy MET?: Yes, MET tokens are available to individual investors and can be bought and sold on both Solana-based DEXs and centralized exchanges. As of November 2025, many exchanges, primarily Binance, have launched trading pairs such as MET/USDT, MET/USDC, and MET/TRY.

You can follow the latest analyses, guides, and developments about the MET token and the Meteora protocol in the JR Kripto Guide series.