Solana has become a shining star in the crypto world with its fast transactions, low costs, and vibrant developer community. One of the prominent projects in this vibrant ecosystem is Jito (JTO). Going beyond simply being a liquid staking protocol, Jito focuses on the MEV (Maximum Extractable Value) issue within Solana and aims to provide a more equitable structure. This way, it becomes a crucial infrastructure layer that benefits not only individual investors but also the entire Solana network.

In this guide, we will cover a wide range of topics, from what Jito does and how it works to concepts like liquid staking and MEV, the protocol's evolution and future potential. If you're interested in earning passive income through Solana or participating in the ecosystem's governance processes, this article is for you.

Jito's Definition and Origin

Jito is an innovative protocol running on the Solana network, offering both liquid staking and MEV infrastructure. In the blockchain world, Maximum Extractable Value (MEV) presents both an opportunity and a controversial topic. Validators can manipulate the order of transactions when adding them to blocks. This allows them to generate additional revenue through techniques such as arbitrage opportunities, liquidations, and even "sandwich attacks." However, this could lead to increased spam and network congestion, especially on networks with high transaction volumes like Solana.

Jito developed a custom MEV infrastructure to address this issue. At the heart of this system is the Jito-Solana validator client, an enhanced version of Solana Labs' client. This client offers additional functionality to process MEV revenues efficiently and transparently.

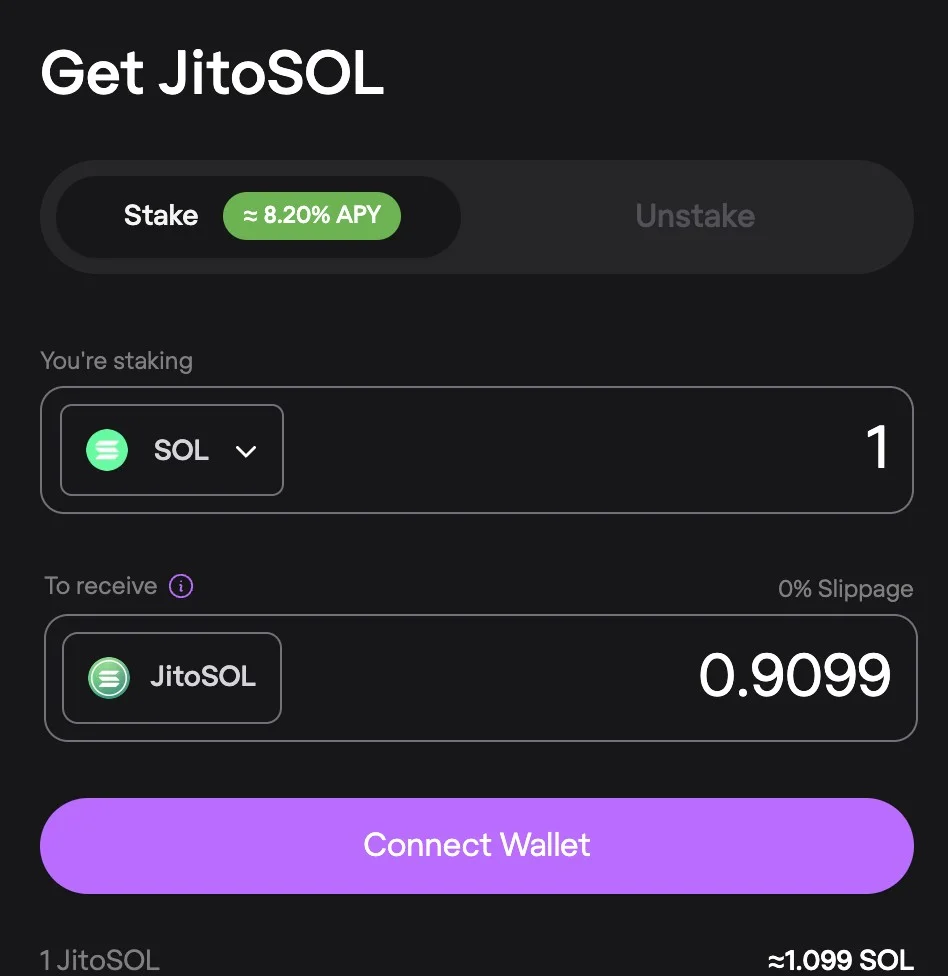

This system allows users to stake their SOL tokens while maintaining their liquidity. In traditional staking systems, tokens are locked for a specific period and become unusable during this period. Jito eliminates this limitation, allowing staked assets to be used as collateral in the DeFi ecosystem or used for additional earning opportunities. Jito's liquid staking token, jitoSOL, is at the core of this structure. When users stake their SOL through Jito, they receive jitoSOL in return. This token automatically accumulates not only traditional staking rewards but also MEV income. This allows jitoSOL's value to continuously increase against SOL over time. This means that while the amount of jitoSOL in your wallet remains constant, the amount of SOL represented by each jitoSOL grows over time. This mechanism stands out as one of the key differences between Jito and other liquid staking solutions and provides a clear answer to the question, "What is jitoSOL?"

Jito was developed by Jito Labs in 2021 and has since undergone a robust technological infrastructure and product development process. As is well known, many crypto projects prefer to quickly issue tokens and enter the market, but this is not the case for Jito. Jito was founded in 2021 and only launched the JTO token at the end of 2023. This means the project has taken time to mature. The governance model was launched with the introduction of the JTO token at the end of 2023.

Jito's distribution of MEV rewards to stakers offers a value proposition beyond traditional staking. This increases both user engagement and liquidity. This system is highly attractive not only to those seeking passive income but also to users seeking a more active presence in the DeFi ecosystem. Jito's "double-tiered yield" model distinguishes it from its competitors. This directly impacts Jito's Total Value Locked (TVL) and market share.

Jito's History: Key Milestones

Jito Labs was founded in 2021 by Lucas Bruder and Zanyar Sherwani. The project was supported by strong financial support from the outset. In December 2021, it received a $2.1 million seed investment, and in August 2022, it raised a $10 million Series A investment from leading cryptocurrency companies such as Multicoin Capital, Framework Ventures, and Alameda Research. Jito's liquid staking solution, Solana, saw rapid adoption thanks to its popularity. By September of that year, the Jito network reached 200 validators, accounting for over 15% of staked SOL.

By February 2023, Jito's MEV infrastructure was actively used by major validators like Figment. The launch of both the technical infrastructure (MEV) and the governance model (JTO token) during the same period also attracted attention. This approach allows users to not only gain technical advantages but also have a say in the protocol's future by participating in governance processes.

The JTO token was officially launched on December 7, 2023. This launch was preceded by a comprehensive "Jito Airdrop" campaign that ended on November 25th. 10% of the total supply, or 100 million JTO, was distributed to the community. Beneficiaries of the airdrop included jitoSOL holders, those using jitoSOL in DeFi protocols, and those operating Jito's MEV client.

By 2025, the use of jitoSOL as collateral in DeFi protocols had become increasingly widespread. In 2024, the Solana DeFi ecosystem recovered, reaching a TVL of $3.8 billion, and jitoSOL contributed significantly to this growth. On July 1, 2025, the Jito Foundation formed a significant strategic partnership with Anchorage Digital. Anchorage, the first federally authorized crypto bank in the US, began supporting the storage, printing, and redemption of jitoSOL. This marked a significant step forward in institutional adoption for jitoSOL.

Why Is Jito Valuable?

Jito's value is clearly evident in its innovative features and contributions to the Solana ecosystem. Below, we've summarized the key elements that make Jito valuable:

Double-Tiered Yields and Liquidity

Jito offers a dual-tiered earnings model, providing users with MEV returns in addition to traditional staking rewards. This significantly increases the passive income potential of staked SOL. Furthermore, through jitoSOL, it maintains the liquidity of staked SOL. This is a critical advantage for users seeking a "staking + liquidity solution," as they can use their assets as collateral in DeFi protocols or invest them for additional returns, rather than locking them up. This flexibility makes Jito a central player in the Solana DeFi ecosystem and provides one of the key answers to the question, "What is the use of JTO coin?"

Decentralized and Transparent MEV Management

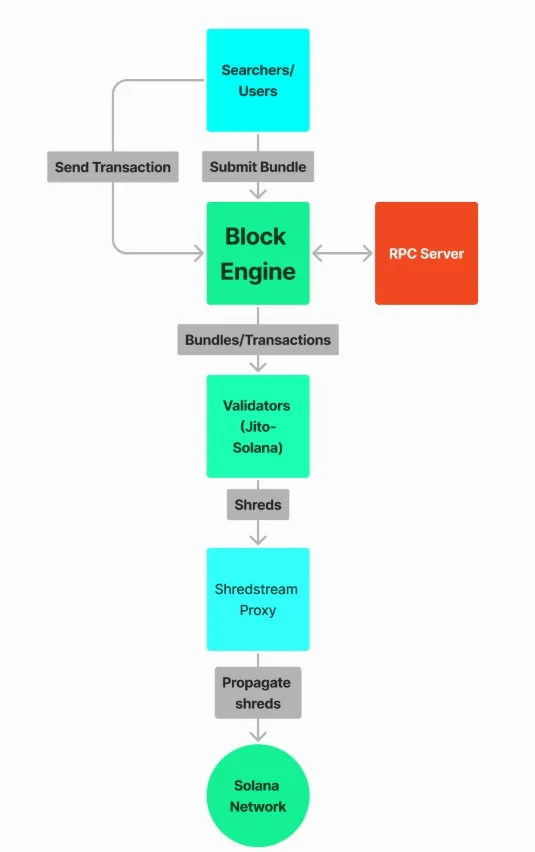

Jito is taking a leading role in transforming MEV management within Solana to a more decentralized, transparent, and participatory model. Thanks to the Block Engine and Bundle systems it developed, MEV opportunities are captured through auctions, and these revenues are distributed fairly to stakers. It also reduces spam and congestion on the network. This mechanism is a key innovation that distinguishes Jito from the "Solana MEV protocol." Let's examine the three main components of Jito's MEV system as follows:

- Bundles: MEV searchers send transactions to Jito in packets, which must be executed on an all-or-nothing basis. By adding a tip to the packets, they can prioritize their transactions. This method increases transaction efficiency on the network and reduces congestion.

- Block Engine: This system creates an off-chain auction space between MEV searchers and validators. Each packet combination is simulated, and the highest-valued ones are selected and included in the next block. This allows for more efficient use of Solana's block space and prevents malicious MEV methods.

- Relayer: This component reduces the burden on validators by verifying and filtering transactions on an independent server. It then forwards the verified transactions to Block Engine and the validators.

One of the most important aspects of this system is validator reward sharing. Jito shares the revenue generated from MEV equitably not only with validators but also with users who stake them. This incentivizes validators for performance, and stakers receive a higher return on their investments.

Furthermore, Jito Labs recently temporarily suspended its mempool services to prevent sandwich attacks. While this decision resulted in some short-term revenue loss, it was offset by a focus on the network's long-term health.

JTO token features and governance

JTO token is the primary tool that provides governance in the Jito protocol. Holders of the “JTO governance token” can participate in decision-making processes on important issues such as protocol parameters, fee structure, treasury usage, and validator selection. JTO token is the native governance token of Jito Network and plays an important role in shaping the future of the platform. The answer to questions such as “What is Jito token?” and “What is JTO coin used for?” is hidden in the decision-making powers that this token offers to the community. JTO holders can have a say in critical decisions on the protocol through the Jito DAO (Decentralized Autonomous Organization). These decisions include:

- Protocol updates: Voting on changes and improvements to Jito’s infrastructure.

- Fee structure adjustments: Determining the fee rates on the JitoSOL staking pool and (re)staking network.

- Treasury management: Providing guidance on how the JTO treasury held by the DAO and the fees obtained from JitoSOL will be used.

- Delegation strategies: Making decisions about how StakeNet programs will operate and which validators will be prioritized.

- Protocol parameters: Optimizing other technical settings that affect the overall performance of the network.

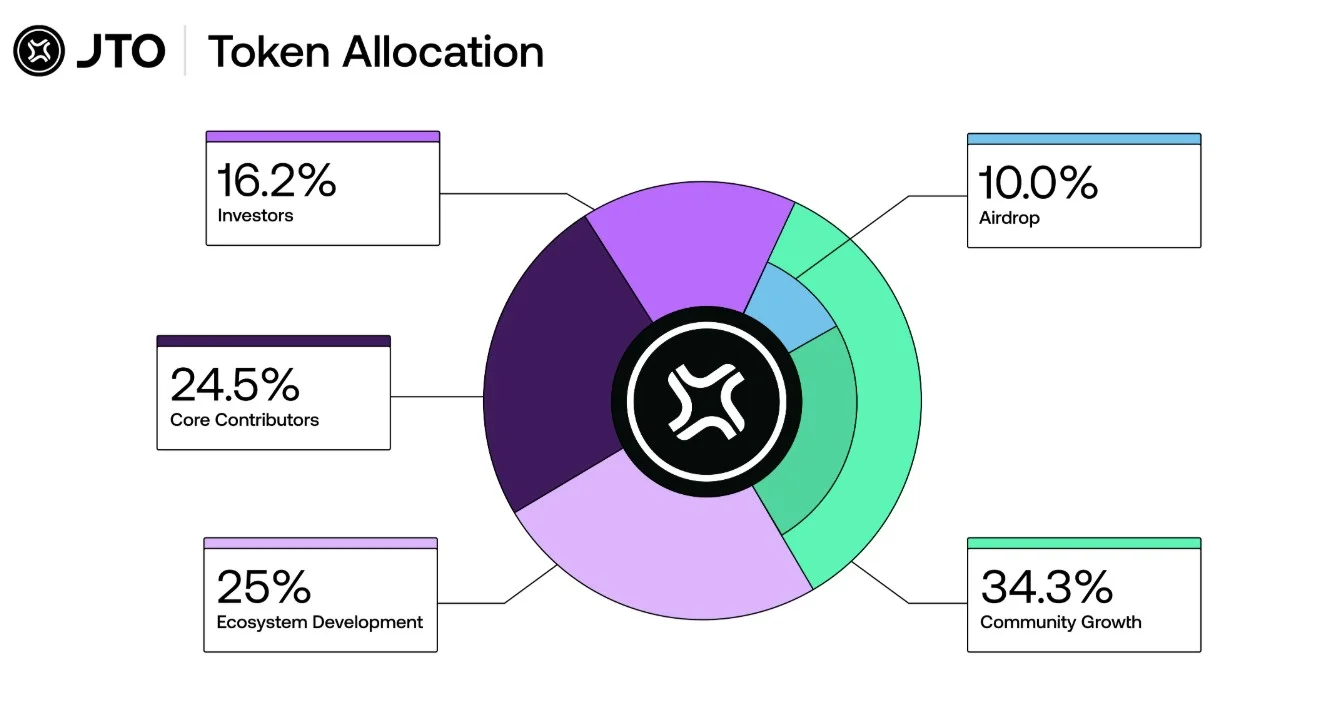

The total supply of JTO is set at 1 billion tokens. This supply is distributed evenly among different stakeholders:

- Community Growth: 34.3%

- Ecosystem Development: 25%

- Core Contributors: 24.5%

- Investors: 16.2%

- Airdrop: 10% (100 million JTO)

Project | Pool Split |

Raydium | JTO/SOL |

Raydium | JTO/SOL |

Orca | JTO/USDC |

Orca | JTO/USDC |

Kamino | JitoSOL/JTO |

Kamino | JitoSOL/JTO |

Kamino | JitoSOL/SOL |

Kamino | JitoSOL/JUP |

Meteora | JitoSOL/JUP |

Leading position in the Solana ecosystem with MEV

Jito stands out as one of the largest liquid staking protocols on Solana. Together with Marinade Finance, it holds a significant share of the market. In particular, jitoSOL has become one of the most liquid LSTs in the Solana ecosystem. As of February 2025, it has become the largest LST on Solana, reaching approximately $3.2 billion in TVL (Total Locked Value), an increase of 129% on an annual basis. In other words, Jito has a strong position in the “Solana liquid staking” market.

Jito staking system and jitoSOL

Jito’s staking system offers SOL holders in the Solana ecosystem both the opportunity to earn passive income and to evaluate their assets without losing liquidity. Thus, it is one of the developments that provide Jito’s value. The system is very user-friendly: You deposit your SOL tokens into Jito’s staking pool, and in return, you receive a liquid staking token called jitoSOL. The most important feature of jitoSOL is that its value is fed by two different reward sources:

- Solana staking rewards: Classic staking income distributed to validators.

- MEV returns: Earnings from arbitrage, liquidation or “sandwich attacks” that occur during block production.

Jito collects these MEV opportunities and distributes the income fairly to jitoSOL holders. In this way, the value of jitoSOL constantly increases over time relative to SOL. In other words, the amount of jitoSOL in your wallet may remain constant; however, each jitoSOL token starts to represent more SOL over time. Users can unwind their jitoSOL at any time and get back more SOL than they initially invested. This allows jitoSOL to work as a compounding investment, making it very attractive for long-term investors.

Who is the Founder of Jito?

Jito was developed by Jito Labs, founded in 2021 by Lucas Bruder and Zanyar Sherwani. These two names are the key figures who created Jito's initial vision and laid the technical foundation of the project. Jito Labs' headquarters is located in Arlington, Virginia, USA. The team consists of developers who are experts in Solana infrastructure and specialize in staking and MEV. Zanyar Sherwani's leadership approach and approach to motivating teams in particular play an important role in Jito Labs' success story.

The success of a blockchain project is often hidden in the team behind it. Jito Labs' founders and technical staff have deep knowledge in complex areas such as Solana, MEV, and staking.

Jito has been developed as an open source project since the beginning. This also allows developers from all over the world to contribute. The Jito-Solana validator client is openly accessible on GitHub. Open source and DAO-based governance make Jito both more resilient and flexible over time. While closed-source projects often rely on the vision of a single team, community-driven projects like Jito can grow much faster by leveraging collective intelligence and global contributions.

Frequently Asked Questions (FAQ)

Here are some frequently asked questions and answers about Jito:

- What is Jito and how does it work?: Jito is a liquid staking and MEV infrastructure protocol running on the Solana network. When users stake their SOL tokens to Jito, they receive jitoSOL in return. jitoSOL accumulates not only the classic staking rewards but also additional revenues from Jito’s MEV system. Jito captures these MEV opportunities through a transparent auction system between validators and seekers, and distributes the resulting profits fairly to the stakers. Thus, users can both stake without losing their liquidity and earn extra income.

- What is jitoSOL, how is it obtained?: jitoSOL is Jito Network's liquid staking token. Users obtain jitoSOL by staking Solana's native token, SOL, on the Jito platform. This token represents the staked SOL and automatically accumulates both staking rewards and MEV income. In this way, the value of jitoSOL increases against SOL over time. Users can not only hold their jitoSOL; they can also use it as collateral in DeFi protocols or add it to liquidity pools to benefit from additional return opportunities.

- What is the JTO token for?: JTO token is Jito Network's native governance token. JTO holders have the right to vote on decisions that will shape the future of the protocol through the Jito DAO. These decisions include determining the staking pool fees, treasury management, delegation strategies, and technical updates to the protocol. JTO is designed to ensure that Jito develops in a community-focused manner. Users can contribute to the ecosystem not only as investors but also as active decision-makers.

- What is the difference between Jito and other staking protocols on Solana?: The main difference that distinguishes Jito from other Solana staking protocols is that it focuses on MEV (Maximum Extractable Value) optimization in addition to liquid staking service. Jito efficiently captures MEV opportunities and distributes these additional incomes fairly to stakers thanks to its specially developed MEV infrastructure, namely the Jito-Solana client, Block Engine, and Bundles. Other major protocols such as Marinade Finance also offer liquid staking services; however, Jito’s MEV-centric structure and approach to sharing this income with the community gives the project a unique competitive advantage. This difference clearly reveals Jito's position, especially in comparisons such as "Jito vs. Marinade".

- What is the feature of Jito's MEV system?: Jito's MEV system was developed to manage MEV transactions on the Solana network in a more transparent, fair and efficient way. The Block Engine at the heart of this system allows MEV seekers to offer transaction bundles to validators via an auction method. Validators choose the most profitable transaction bundles for themselves, and the resulting MEV revenues are shared fairly between validators and users who stake them. This structure not only increases earnings, but also reduces network congestion and protects users from malicious MEV practices.

- How to get JTO, on which network does it work?: JTO token is a cryptocurrency that runs on the Solana blockchain. Users who want to buy JTO can choose popular crypto exchanges such as Binance, Coinbase, Kraken or CEX.IO. These platforms usually support various payment methods such as credit card, bank transfer or e-wallet. Purchased JTO tokens can be held directly in the exchange wallet, or transferred to a Solana-compatible non-custodial wallet (e.g. Trust Wallet) for greater control and security

For those who want to earn passive income and participate in governance in the Solana ecosystem, comprehensive content about Jito awaits you at JR Kripto.