Flare (FLR) is an EVM-compatible Layer-1 network that aims to facilitate data flow and interaction between blockchains. In short, it aims to bring this feature to networks lacking smart contract support (e.g., the XRP Ledger). It achieves this with two key building blocks: State Connector ensures reliable data transfer from different blockchains and Web2 sources, while Flare Time Series Oracle (FTSO) brings time series data, such as prices, onto the chain in a decentralized manner. The network is based on Proof-of-Stake consensus and, because it works with tools compatible with the Ethereum ecosystem, is highly accessible to developers. Its native token, FLR, undertakes many critical tasks, from payment of transaction fees and network security to providing data to the oracle system and governance.

In this guide, we will examine, step by step, the answers to questions such as "What is Flare?", "What is FLR coin and what does it do?", "How does its technical architecture work?", "What use cases does it offer?", and "What might it offer in the future?"

Flare's Definition and Origins

The Flare Network's foundations were laid in 2019. The project was launched by three founders, all graduates of University College London (UCL): Hugo Philion (CEO), Sean Rowan (CTO), and Dr. Nairi Usher (Chief Scientist). The team stands out with their strong academic backgrounds in finance and computer science. Flare's starting point was to mobilize idle value in large blockchain networks lacking smart contract support. The first whitepaper, published in August 2020, outlined the project's goals, and the network's native token, Spark, was introduced at the time. This document specifically outlined the goal of adding smart contract capabilities to Ripple's XRP Ledger network and expanding the use cases of the XRP token.

Flare quickly attracted the attention of major investors during its development phase. In 2019, Ripple's investment arm, Xpring, provided initial support for the project with seed funding for bitstamp.net. Then, in 2021, Flare secured an $11.3 million investment from investment funds including Digital Currency Group. This round also saw individual participation from well-known cryptocurrency figures like Do Kwon (founder of Terra) and Charlie Lee (creator of Litecoin).

Flare's History: Key Developments

Flare has achieved many significant milestones since 2019. Let's take a look at the key developments in the history of this cryptocurrency project:

- 2019: The foundations of the Flare Network were laid. Hugo Philion, Sean Rowan, and Dr. Nairi Usher launched the project, while Ripple's investment arm, Xpring, supported the project with an early-stage seed investment. This initial funding was a significant milestone in Flare's journey.

- August 2020: Flare's first technical document was published. This document introduced the "Spark" token and shared a plan to bring this feature to blockchain networks like XRP that lack smart contract support. Thus, Flare officially announced its technological vision.

- December 2020: The Flare team began preparing for a major airdrop for XRP holders. On December 12, 2020, wallet balances on the XRP Ledger were recorded, determining the amount of Spark tokens (later renamed FLR) to be distributed in the future. This snapshot marked the community's first step into the Flare ecosystem.

- July 2021: Flare introduced the "canary network" concept, dubbed Songbird. Songbird went live in September 2021, providing a testbed for Flare's mainnet. New features were first tested here, bugs were fixed, and the network's resilience was measured. Songbird had an independent governance and economic model powered by its own token, SGB.

- July 2022: The genesis block of the Flare mainnet was created on July 14, 2022. From that date on, the network became available to developers. Later that year, the team renamed the Spark token FLR and shared an updated whitepaper containing technological innovations. January 9, 2023: Flare's long-awaited Token Distribution Event (TDE) took place. The first 15% of the total 28.5 billion public FLR supply (approximately 4.28 billion FLR) was distributed via airdrop to XRP holders who participated in the 2020 snapshot. This distribution officially marked the launch of the Flare mainnet. Token transfers, smart contracts, and other transactions were now active for all users.

- February 2023: The Flare community voted on FIP.01, the network's first major vote. With the acceptance of this proposal, the distribution method for the remainder of the airdrop was changed. Instead of passive XRP holders, rewards were now given to users who hold Wrapped FLR (WFLR) on the network and actively contribute to the ecosystem. The remaining token pool of approximately 24.2 billion FLR began to be distributed at an average monthly rate of 700 million FLR for three years. This transition marked the transition of Flare to a fully community-centric model.

2023: The Flare ecosystem began to grow significantly. The first DeFi protocols and NFT projects launched on the network. For example, the Flare-based NFT marketplace Sparkles enabled the trading of digital collectibles. Around the same time, some DeFi projects began building a new DeFi ecosystem known as "XRPFi" by establishing liquidity pools and token bridges on Flare.

2024: The Flare network also made significant strides in the enterprise arena. In January 2024, Google Cloud became the official validator and data provider for Flare. This development significantly increased the network's institutional credibility. Around the same time, the Flare team accelerated work to complete and integrate protocols like FAssets and LayerCake into the mainnet.

2025: As Flare completes its third year, it continues with new partnerships and major updates. The team aims to make 2025 "the most transformative year" for the ecosystem. In this context, efforts are underway for the launch of new protocols, integrations with various blockchains, and institutional collaborations.

Why is Flare Important?

There are several key elements that distinguish Flare and place it in a unique position in the industry:

Bridge between blockchains

Flare connects multiple blockchains, providing interoperability—that is, harmonious interaction—between them. In short, it creates an environment where different networks can "talk to each other." Blockchain ecosystems, which have traditionally operated in isolation, are now able to transfer data and value between them thanks to Flare. This enables fast and secure bridge transactions between chains without the need for a central intermediary. This allows developers to develop next-generation application scenarios where different networks work together.

Integrating assets without smart contract support into the DeFi ecosystem

One of Flare's most important missions is to bring major crypto assets, such as Bitcoin, XRP, Dogecoin, and Litecoin, which cannot run smart contracts on their own, into the world of programmable finance. Thanks to Flare's F-Asset system, users can lock their Bitcoin or XRP and create 1:1 wrapped versions of them (such as FBTC and FXRP) on the Flare network. These assets are considered secure because they are fully collateralized and issued in a decentralized structure; moreover, users can withdraw their original assets at any time.

This model reactivates trillions of dollars of value that have been sitting idle in wallets for years. Assets like Bitcoin and XRP can now be traded on Flare and used as collateral, liquidity, or yield-generating tools in DeFi protocols. Thus, Flare both increases market liquidity and introduces new yield opportunities to the crypto economy.

Integrated and Incentive Oracle Infrastructure

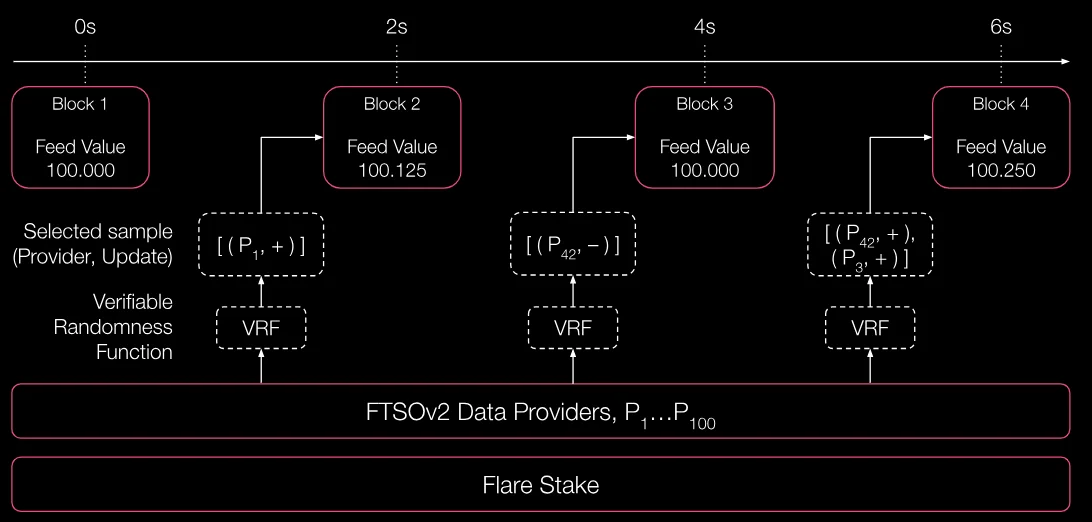

One of Flare's core components, the Flare Time Series Oracle (FTSO), is a decentralized oracle system that provides reliable external data for blockchain applications. FTSO periodically collects price, rate, and similar information from exchanges or other data providers and provides it to smart contracts on Flare. The system's fully decentralized nature distinguishes it from other oracle solutions. Independent data providers, such as BTC/USD or XRP/USD, share prices with the network. FLR holders participate in the process by delegating their tokens to these providers. Providers receive FLR rewards based on the accuracy of the information they provide, and delegators earn a share of these rewards. This model both encourages accurate data flow and enables users to generate passive income.

FTSO facilitates blockchain applications' reliable access to price indices, precious metal rates, and other market data. Thus, Flare offers a powerful solution to the "oracle problem," a long-standing problem in the blockchain world.

Integration of real-world data and events into Web3

Another key component of Flare, the State Connector, is a system that can retrieve data not only from other blockchains but also from external sources such as Web2 APIs. This structure makes Flare's real-world events verifiable on-chain. For example, smart contracts on Flare can securely detect when a transaction on the Bitcoin network is completed, when an interbank interest rate reaches a certain level, or when the temperature in a city exceeds a certain value. This paves the way for a new generation of smart contracts that respond to real-world data.

This mechanism enables the development of fully on-chain systems, such as weather-based insurance payments, royalties to artists based on stream count, or derivatives tied to stock market indices. In short, Flare bridges the data gap between the blockchain and the physical world, connecting Web3 applications to the real world.

Community-driven ecosystem and governance

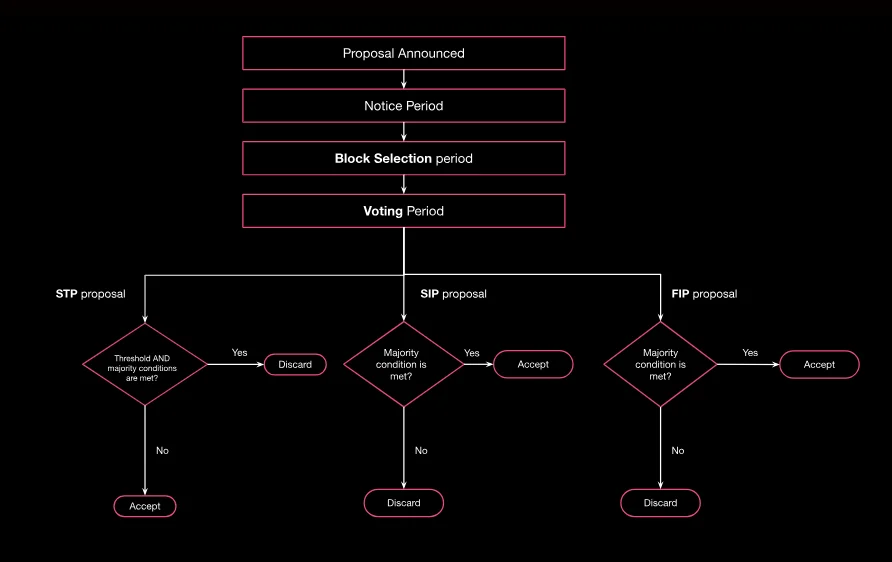

Since its inception, Flare has pursued a model that prioritizes community participation. The distribution of approximately 58% of the total FLR supply directly to the community through airdrops and similar means has broadened network control across a broad user base. One of the most compelling examples of this approach was the FIP.01 vote in 2023. With this vote, FLR holders completely overhauled the token distribution mechanism and demonstrated their active voice in how the network operates. Flare's governance system relies on FLR holders directly voting on critical decisions, such as new protocol updates or economic parameter changes.

The Flare Network's economic structure and FLR token model were designed with the security and sustainability of the network in mind. This system can be examined under three main headings: token economics and distribution, inflation and issuance processes, and the reserve/collateral mechanism.

Token Distribution and Economics

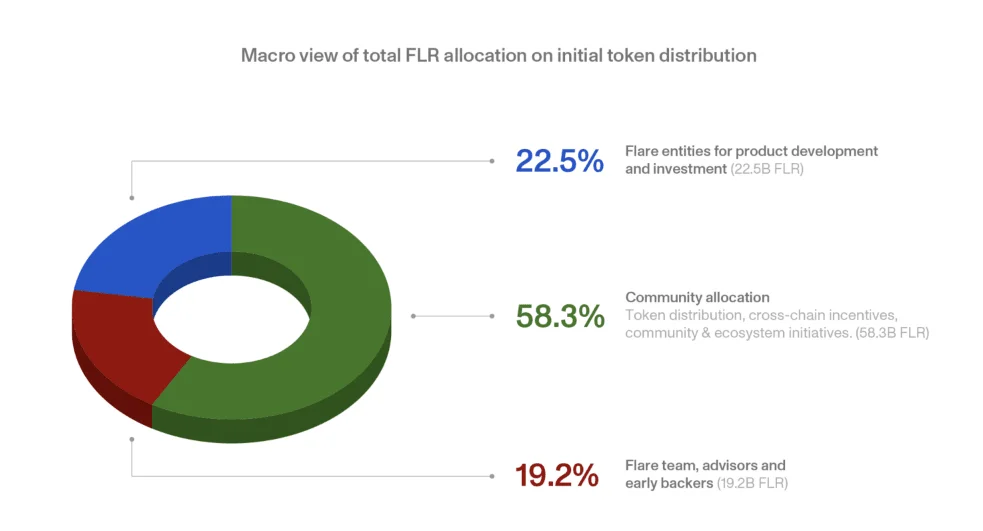

FLR's total supply was set at 100 billion units. 58% of this was allocated to the community and ecosystem; the majority was shared with users through an airdrop. 19% was allocated to the team, early supporters, and advisors, and 22.5% to strategic partners and investment funds. This structure both strengthens decentralization and supports Flare's long-term development.

Airdrop and Distribution Process

The first portion of the 58 billion FLR allocated to the community reached XRP holders through an airdrop on January 9, 2023. Approximately 4.28 billion FLR was distributed in this distribution. The remaining 85% (24.2 billion) will be distributed to users who hold Wrapped FLR (WFLR) at a rate of approximately 700 million FLR per month for three years. This model creates a system that rewards the community that actively uses the network, rather than passive investors.

Inflation and New Token Issuance Mechanism

Flare uses a controlled inflation model to maintain the network's incentive balance. The rate is fixed at 10% in the first year, 7% in the second year, and 5% starting in the third year. There is also a maximum annual issuance limit of 5 billion FLR. Newly minted tokens are distributed to participants who support the network:

- 70% goes to FTSO data providers,

- 20% to network validators,

- 10% to those involved in the State Connector system.

This distribution provides economic incentives for the actors who ensure network security.

Reserve and Collateral System (F-Asset Model)

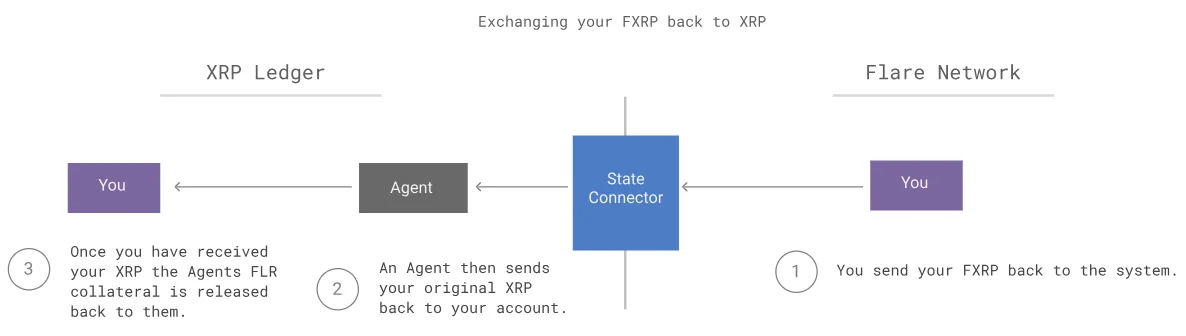

One of Flare's unique features is its wrapped asset system, called FAssets. This model allows assets from different blockchains to be used on Flare. For example, a user can mint their XRP or BTC at a 1:1 exchange rate for FXRP or FBTC through an agent on Flare. Agents deposit a certain amount of FLR and stablecoin collateral for this transaction.

This system is based on the principle of over-collateralization; that is, the value of the FAssets created is secured by a higher percentage of collateral than the underlying asset. This protects users' assets against both default and market fluctuations. FLR serves both as collateral and as a reserve currency.

FLR Token Use Cases

FLR is the native token used in all network functions. Transaction fees (gas) are paid with FLR, and stakes are used to run validators or conduct delegation. Users can earn rewards by delegating their FLR to data providers in the FTSO system or to vote on governance proposals.

Many DeFi applications also use FLR as collateral or utility tokens. For example, FLR can be staked to take out loans, conduct staking, or access certain services. This versatile use case makes FLR the cornerstone of the Flare ecosystem. Overall, the Flare network, with its technical infrastructure, offers a wide range of use cases, from DeFi protocols to cross-chain dApps, oracles and data services to NFT platforms, staking and governance processes, and community incentives, becoming a versatile platform that connects the blockchain ecosystem in both financial and technological terms.

Flare's Future and Roadmap

After largely completing its infrastructure in 2023, Flare Network has shifted its focus to ecosystem growth, technological advancements, and multi-chain integrations. One of its key short-term goals is to fully integrate the FAssets protocol into the mainnet. This system empowers the "XRPFi" vision by allowing users to mint assets such as BTC, XRP, or DOGE directly on Flare. The team is also working on the LayerCake protocol, which will enable fast and secure token transfers between different blockchains. This solution will enable cross-chain asset migration without the need for centralized bridges.

In the medium term, Validium-based Layer-2 solutions are being explored to increase scalability and reduce network load. Flare also plans to take steps toward the tokenization of real-world assets (RWA), enabling traditional financial assets like bonds, commodities, or real estate to be traded on the blockchain. At the enterprise level, the network is increasing its reliability and reach through partnerships with giants like Google Cloud, Kraken, and BitGo.

In 2025 and beyond, Flare will continue to organize developer grants, hackathons, and community campaigns to accelerate ecosystem growth. With the completion of the token distribution process in early 2026, the network will be fully managed by the community. Locking inflation at 5% and making new issuances tied to network usage will ensure the long-term sustainability of the Flare economy.

Who is the Founder of Flare?

Behind Flare Network is an expert, innovative, and visionary team. The project's co-founders and leaders are Hugo Philion (CEO), Sean Rowan (CTO), and Dr. Nairi Usher (Chief Scientist).

Hugo Philion studied investment and risk management at Cass Business School in London and then completed a master's degree in machine learning at UCL. Sean Rowan also completed his master's degree in computer science and machine learning at UCL, while Dr. Nairi Usher earned a PhD in quantum computing from the same university.

The three co-founders combined their academic knowledge with the innovative potential of blockchain technology to create Flare.

The Flare team isn't limited to just these three; it includes a diverse team of developers, researchers, and business development specialists working to grow and sustain the network. Even in its early stages, the project has gained strong industry credibility. Early support, particularly from Ripple's investment arm, Xpring, has made Flare a highly regarded project. The team's advisors and partners also include experienced blockchain experts.

Frequently Asked Questions (FAQ)

Below are some frequently asked questions and answers about Flare:

- What is Flare?: Flare is an EVM-compatible Layer-1 smart contract network that enables data and value transfer between different blockchains. Its goal is to integrate chains without smart contract support into the Web3 ecosystem.

- What is FLR coin?: FLR is the native token of the Flare network and is used for transaction fees, staking, governance, and the oracle system. It is also the primary incentive for validators and data providers who secure the network.

- What is the difference between Flare and the Songbird network?: Songbird is Flare's "canary network," or testnet. Think of it like Polkadot's Kusama. New features and updates are first tested on Songbird and then integrated into the Flare mainnet. Powered by the SGB token, Songbird offers a live yet experimental environment with independent governance. In short, if Songbird is the testing ground, Flare is the final product.

- How to get FLR tokens: FLR was initially distributed only to XRP holders via an airdrop. However, it can now be easily purchased on major exchanges like Binance, Kraken, and KuCoin. It's also possible to participate in Flare's FTSO system by voting (delegating) to data providers and earning FLR in the form of accuracy rewards.

- What consensus mechanism does Flare use?: Flare is based on Proof-of-Stake (PoS). Validators stake a certain amount of FLR to generate blocks and ensure network security. The system uses a hybrid consensus system inspired by the Avalanche protocol, combining high speed, low energy consumption, and strong decentralization.

- How do staking and delegation work in Flare?: There are two methods. The first is validator staking: By staking FLR, you can run a validator node and receive a share of transaction fees and inflation rewards. Second, FTSO delegation: You wrap your tokens (WFLR) and transfer them to a trusted data provider, earning FLR rewards as accurate data is provided. Delegation doesn't lock your tokens; you can cancel them at any time.

- What is Flare's relationship with XRP?: Flare was designed to bring smart contract capabilities to XRP. Therefore, a snapshot was made in 2020, and an FLR airdrop was made to XRP holders. This not only ensured early adoption of the network but also gave XRP holders access to DeFi opportunities on Flare through FXRP. Today, XRP remains one of the most important F-Asset assets on Flare.

You can closely follow the development of Flare and similar innovative and versatile projects with the JR Kripto Guide.