First Digital USD (FDUSD for short) is a 1:1 US dollar-backed stablecoin developed to offer stable value in the cryptocurrency world. Launched in mid-2023 by a subsidiary of Hong Kong-based First Digital Limited, FDUSD is fully backed by cash or cash equivalent reserves. Backed by the Binance exchange, FDUSD quickly reached a market capitalization of billions of dollars and stands out with features such as multi-blockchain support, independent audits, and regulatory compliance. With Binance discontinuing its own stablecoin, BUSD, FDUSD has filled a significant gap on the platform, becoming one of the largest stablecoins. So, what is First Digital USD (FDUSD), how did it come about, and why is it so talked about? In this guide, we will take a close look at all the details, including FDUSD's definition, origin story, history, importance, the team behind it, and answers to frequently asked questions.

Definition and Origin of FDUSD

First Digital USD (FDUSD) is a cryptocurrency pegged 1:1 to the US dollar, issued by First Digital Limited, a Hong Kong-based financial technology company. FDUSD is issued by FD121 Limited, a subsidiary of First Digital Limited, which operates in the stablecoin space. The storage and protection of reserves are handled through First Digital Trust, a licensed custodian and trust company under Hong Kong law. To maintain this 1:1 peg, cash and high-liquid cash equivalents equal to the amount of tokens in circulation are held in reserve. These reserves are regularly reviewed by independent auditors and publicly disclosed through "proof of reserve" reports. This allows users to transparently see that each FDUSD token is backed by a real-world equivalent dollar asset.

The primary motivation behind FDUSD's creation was the need for a reliable digital proxy pegged to the US dollar in the crypto markets. In the first half of 2023, the issuance of the Binance-branded BUSD stablecoin halted under pressure from US regulators, creating a significant gap in the market. Binance, seeking an alternative stablecoin for its trading pairs on the platform, adopted First Digital USD as a solution. Hong Kong-based First Digital already had an infrastructure specializing in digital asset custody and financial services; founded in 2019, the company was listed among Asia Pacific's emerging fintech players by KPMG and HSBC in 2022. FDUSD, announced on this foundation of trust, launched on both Ethereum and Binance Smart Chain (BNB Chain) in June 2023. The goal was to establish a robust bridge between traditional finance and the crypto ecosystem with a regulatory-compliant, fully reserve-backed stablecoin. Initial promotions emphasized that FDUSD is a programmable digital asset designed for direct integration with financial applications such as smart contracts, escrow, and insurance. In this respect, FDUSD is more than just a store of value; It has also positioned itself as a functional infrastructure for Web3-based financial applications.

FDUSD History: Key Milestones

Although FDUSD is only a few years old, it has made remarkable progress in the crypto market in a short time. Since its launch, strong strategic steps, Binance partnerships, and changes in the stablecoin market have shaped FDUSD's current position. Here are the key milestones in FDUSD's story:

2023: Launch and Binance partnership

FDUSD officially launched on June 1, 2023. Initially issued on the Ethereum and BNB Chain networks, the token initially had limited circulation and awareness. However, on July 26, 2023, Binance, one of the world's largest crypto exchanges, listed FDUSD, and the project immediately gained significant momentum. Binance launched zero-fee campaigns on trading pairs such as FDUSD/BNB, FDUSD/USDT, and FDUSD/BUSD, encouraging the use of the stablecoin. This move was quite similar to the strategy Binance had previously employed with TrueUSD (TUSD). The results were immediate: FDUSD supply, which was only in the millions at launch, grew to over hundreds of millions by the end of the summer. Thanks to Binance's aggressive promotional policy, FDUSD quickly became one of the leading stablecoins traded on the exchange.

Fall 2023: The Transition from BUSD to FDUSD

At the beginning of 2023, Paxos halted the issuance of Binance USD (BUSD) due to regulatory pressure, creating a significant gap in the stablecoin market. As BUSD's market value declined rapidly throughout the year, Binance turned to FDUSD to fill this gap.

In September 2023, Binance offered its users a 1:1 conversion of their BUSD holdings to FDUSD. By October, the exchange began removing most BUSD pairs and adding FDUSD pairs instead. In December 2023, Binance announced that it will automatically convert all remaining BUSD balances to FDUSD.

The expansion process created a massive surge in FDUSD supply. Hundreds of millions of dollars of liquidity trapped in BUSD were transferred to FDUSD, and the stablecoin's total market capitalization surpassed the billion-dollar mark. By the end of the year, FDUSD had become the world's fourth-largest stablecoin, behind USDT (Tether), USDC, and DAI. This success was largely due to the fact that FDUSD was traded almost entirely on Binance at the time, and the exchange's immense liquidity.

2024: Multi-network support and new partnerships

2024 marked the beginning of FDUSD's expansion into ecosystems beyond Binance. This year represents a critical milestone in the stablecoin's transformation into a multi-chain financial instrument. The first major development occurred in April 2024. Sui Network, a next-generation Layer-1 blockchain, announced that FDUSD would be the first stablecoin to be issued on its network. This marked the beginning of trading on Sui, following Ethereum and BNB Chain. This step paved the way for FDUSD to be available not only on centralized exchanges but also across various blockchain ecosystems.

At the same time, preparations for FDUSD integration accelerated on other popular networks such as Solana, Arbitrum, and Tron. This multi-network support aimed to increase the stablecoin's accessibility on DeFi platforms and digital wallets. Now, users could use FDUSD not only on Binance but also on various chains and across different protocols.

Furthermore, the First Digital team also embarked on expanding FDUSD's use cases beyond exchanges. The company sought partnerships with various fintech firms to expand FDUSD into areas such as international money transfers (remittances) and salary payments. The goal was to make FDUSD a digital dollar that could be used not only by investors but also by businesses and individuals in daily transactions.

Towards the end of 2024, Hong Kong's stablecoin licensing regulations came to the fore. The new bill mandated that stablecoin issuing companies obtain licenses. First Digital was prepared for this process and, working closely with regulators, took steps to fully comply with the upcoming regulatory framework for FDUSD. Company executives stated that they viewed Hong Kong's open approach to crypto and stablecoins as an opportunity and aimed to position FDUSD at the center of the region's financial innovation movement.

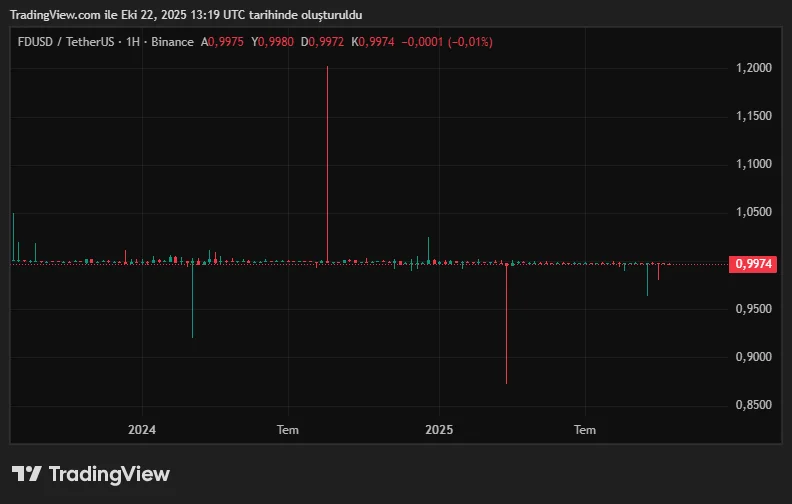

April 2025: The "Depeg" Incident

April 2025 presented the most challenging period for FDUSD. On April 2, Justin Sun, founder of Tron and the man behind the stablecoin TrueUSD (TUSD), posted on social media that cast doubt on First Digital's reserve adequacy and solvency. Sun implied that First Digital was in financial distress and that FDUSD might not be able to maintain its 1:1 peg.

These claims sparked panic in the market. The FDUSD price briefly broke away from its normal $1 level, experiencing a "depeg," dropping to around $0.87 on some exchanges. The First Digital team quickly issued a statement the same day. The company categorically denied Justin Sun's allegations and stated that the dispute was not directly related to FDUSD. The statement emphasized that the situation was, in fact, a distortion of a legal dispute between Sun and the TUSD.

The company stated that all FDUSD reserves are fully backed by U.S. Treasury bills, and that the ISIN numbers for these assets are clearly listed in audit reports. It also reminded them that FDUSD reserves are regularly audited by independent auditors.

First Digital described Sun's statements as a "baseless smear campaign" and announced that they would take legal action to protect their reputation. Thanks to this prompt communication and transparent approach, the panic quickly subsided. The FDUSD price recovered within a few days, approaching the $1 level again (the price returned to around $1 after the incident).

2025 and Beyond: Regulatory Compliance and New Plans

The Hong Kong Stablecoin Regulation Act came into effect in the second half of 2025. The new law mandates that all stablecoin issuers obtain official licenses. First Digital announced that it has begun working to become one of the first licensed stablecoin issuers in Asia. CEO Vincent Chok stated that they welcomed the strict but clear regulations introduced by Hong Kong. According to Chok, these regulations will establish a more secure foundation for both FDUSD and the stablecoin industry in general.

The licensing process is expected to be completed in early 2026. This step will further enhance FDUSD's credibility among both institutional and individual users. Not content with this, the First Digital team is working to make FDUSD available for listing on exchanges other than Binance. By the end of 2025, the total supply of FDUSD reach $2 billion.

By approaching its target, it has secured a permanent place in the league of major stablecoins.

Future plans include developing new stablecoin projects pegged to various fiat currencies. It is reported that work is underway on HKD or EUR-based stablecoins, particularly for the Asian market. Furthermore, ensuring the integration of FDUSD with global payment systems is one of the company's primary goals.

Why is FDUSD Important?

Although there are already many USD-pegged stablecoins in the cryptocurrency market, FDUSD quickly rose to prominence due to its unique features and the timing of its launch. Here are the key factors that make FDUSD significant:

Reliable reserve structure

One of the most striking aspects of FDUSD is its commitment to regulatory compliance and the transparent management of its reserves. The issuer, First Digital Trust, operates as an authorized trust company in Hong Kong and is subject to the Hong Kong Trust Law. This means that FDUSD reserves are held in accounts completely segregated from the company's other assets. Reserves are held only in cash or highly liquid instruments that can be quickly converted into cash (e.g., bank deposits, treasury bills). Furthermore, monthly reserve reports prepared by independent audit firms are shared with the public, regularly verifying that the amount of collateral in circulation is equivalent to the amount of FDUSD.

This transparency policy has given FDUSD a significant trust advantage, especially compared to stablecoins like Tether (USDT), which have been criticized for their reserve structure. Furthermore, the fact that FDUSD's minting and redemption transactions are completely free is an attractive feature for users. Anyone can purchase FDUSD directly from the issuer at a 1:1 ratio and exchange it for US dollars in the same manner.

Binance Support

FDUSD's rise is largely due to its strong partnership with Binance. After listing FDUSD in July 2023, Binance not only opened trading pairs but also launched commission-free trading campaigns to incentivize users. These steps rapidly increased interest in the stablecoin. The reason for these aggressive steps was that Paxos no longer offered Binance's own stablecoin, BUSD. The exchange announced its commission-free trading campaign to attract users to FDUSD as follows:

With the withdrawal of BUSD, Binance placed FDUSD at the center of its ecosystem. It prioritized those holding FDUSD balances in newly launched Launchpad projects and made FDUSD the default option for many trading pairs.

At the beginning of 2024, the market capitalization of FDUSD approached the $2 billion mark. Analysis shows that as of April 2025, approximately 94% of the FDUSD supply was held on Binance. This concentration translates to high liquidity depth and low slippage in the market.

The support of a trusted and global player like Binance enabled the rapid adoption of FDUSD by both individual investors and institutional users. However, this demonstrates the stablecoin's relative dependence on Binance.

Multi-blockchain support

A stablecoin's success also depends on its ability to be used in different ecosystems. FDUSD made a bold debut in this area. From its inception, it was issued on both Ethereum (ERC-20) and BNB Chain (BEP-20), allowing users to transfer FDUSD across multiple chains.

It quickly expanded to networks like Arbitrum, Solana, and Sui Network, becoming a multi-chain stablecoin. This made FDUSD more accessible not only on centralized exchanges but also on DeFi protocols and digital wallets.

For example, while FDUSD can be used to lend or borrow on Ethereum, transfers can be made with high speed and low transaction fees on the Solana network. Direct issuance on the Sui blockchain supports the growth of the ecosystem by meeting the stablecoin needs of new Layer-1 projects.

FDUSD's technical infrastructure is designed to leverage the advantages of each network. BNB Chain's low transaction fees make it practical for everyday payments, while Ethereum's extensive DeFi ecosystem opens up FDUSD to various protocols. This flexibility makes FDUSD a digital dollar that can be used on a wide scale, without being tied to a single platform.

It can also be accessed on the following crypto trading platforms:

A Bridge for the Financial Ecosystem

Stablecoins are tools that bridge the gap between traditional finance and the digital asset world. FDUSD successfully fulfills this role. Its stable value provides crypto investors with a safe haven against market fluctuations. Users can preserve their value by converting their Bitcoin or altcoin investments into FDUSD during increased market volatility.

FDUSD also offers significant advantages in international remittances. Sending money across borders through banks can take days. But FDUSD allows for low-cost transfers in just a few minutes. This feature is highly attractive for companies doing business in different countries or individuals sending money abroad.

Stablecoins are also gaining prominence in payment systems and e-commerce. By accepting payments with FDUSD, businesses can earn fast and guaranteed dollar-based income without exchange rate risk.

FDUSD is also actively used in DeFi protocols. Users can earn interest by lending FDUSD on lending platforms or earn a share of transaction fees by adding it to liquidity pools. In short, FDUSD offers a fast, low-cost, and programmable digital dollar experience to a wide range of people, from individual investors to global corporations.

Asian Market Position

FDUSD's Hong Kong headquarters and focus on the Asian market distinguish it from other stablecoins. Since 2023, Hong Kong has adopted a forward-thinking approach to crypto assets and stablecoins, becoming a focal point of crypto innovation among financial centers in the region. Leveraging this environment, FDUSD has positioned itself as one of Asia's leading stablecoin solutions. As Circle executives stated, digital dollar stablecoins are expected to play a significant role in trading in the Asia-Pacific region.

Hong Kong's financial homeland and proximity to China provide a strategic advantage in fostering FDUSD adoption. Furthermore, the entry of FDUSD has added competition and diversity to the stablecoin ecosystem. In a market long dominated by players like USDT and USDC, FDUSD has helped users diversify their risks and find an alternative that suits their needs.

Binance's support for FDUSD following BUSD has ensured that the market is no longer dependent on a single stablecoin. Furthermore, FDUSD's success has encouraged other financial institutions to develop their own stablecoins, accelerating innovation in the sector.

As a result, FDUSD, a stablecoin originating in Asia and making its impact felt globally, contributes to both the regional economy and fosters a more balanced and competitive stablecoin market.

FDUSD Founders and Team

FDUSD is backed by a team experienced in traditional finance and digital asset management. Two prominent figures in the project are Vincent Chok and Gunnar Jaerv.

As CEO of First Digital Trust, Vincent Chok sets the strategic direction for FDUSD. With years of experience in financial technology and digital asset custody, Chok aims to make FDUSD a reliable and fully compliant product.

Gunnar Jaerv, as the company's COO (Chief Operating Officer), oversees the stablecoin's daily operations and ensures the seamless integration of blockchain technology into the FDUSD ecosystem. The two executives shape FDUSD's vision by combining the challenges of finance and crypto.

The First Digital Limited team has made significant strides in digital finance even before FDUSD. Initially operating under the name Legacy Trust, the company later rebranded as First Digital Trust. Since 2019, it has been providing custody, custody, and payment services for digital assets. In May 2022, First Digital Trust secured $20 million in Series A funding from investors such as Nogle and Kenetic Capital to expand its operations in Asia. This investment laid the groundwork for its plans to launch a stablecoin.

In early 2023, a new technology unit called First Digital Labs was established within the company. This team focused on FDUSD's technical aspects, such as smart contract design, multi-network integration, and security audits, while First Digital Trust's legal and finance teams handled regulatory processes, reserve management, and audit reports.

Although FDUSD lacked a single "crypto star" figure (such as Vitalik Buterin or Brian Armstrong), the project thrived with strong institutional backing. Binance founder Changpeng Zhao (CZ) announced the launch of FDUSD on social media in the summer of 2023, emphasizing the advantages of the stablecoin. While the First Digital team states that it has no direct management ties with Binance, the liquidity and promotional support provided by Binance as part of the strategic partnership has significantly accelerated the project. Additionally, fintech investors and venture capital funds in Hong Kong have also served as FDUSD advisors.

The team places great importance on community communication. Following the crisis with Justin Sun in April 2025, First Digital executives held an AMA (Ask Me Anything) event on Twitter (X) to directly answer user questions. Furthermore, reserve reports, project updates, and educational content continue to be shared regularly on FDUSD's official website and social media accounts. The development team has developed an open-source platform for FDUSD to integrate with various DeFi applications.

It also offers libraries and integration guides.

Frequently Asked Questions (FAQ)

Below are some frequently asked questions and answers about FDUSD:

- What is First Digital USD (FDUSD) and what does it do?: FDUSD is a fully reserve-backed stablecoin whose value is pegged one-to-one to the US dollar. Issued by Hong Kong-based First Digital Limited, it allows users to trade with the dollar in the crypto market. FDUSD provides protection against market fluctuations and enables fast and cost-effective international payments. In short, FDUSD is a reliable medium of exchange and store of value, offering the stability provided by the dollar in the digital world.

- Who issues FDUSD and who is behind it?: FDUSD is a subsidiary of Hong Kong-registered First Digital Limited. The institution responsible for the custody and management of reserves is First Digital Trust. The project is led by CEO Vincent Chok and COO Gunnar Jaerv. While Binance played a significant role in the popularization of FDUSD as a strategic partner, FDUSD is managed entirely independently by First Digital.

- When and how did FDUSD emerge?: FDUSD was launched in June 2023. It made its first major splash with a listing on Binance in July 2023. After Binance discontinued its own stablecoin, BUSD, it began supporting FDUSD as the primary stablecoin on its platform. When BUSD balances were converted to FDUSD towards the end of the year, the stablecoin's market value increased rapidly. In 2024, it expanded its usage by appearing on various blockchains.

- Which networks is FDUSD available on?: FDUSD operates on multiple blockchains. Initially, it was issued on Ethereum (ERC-20) and BNB Chain (BEP-20). It later became supported on networks such as Arbitrum (Layer-2), Sui Network, and Solana. Thanks to this multi-network structure, users can easily transfer FDUSD between different wallets and DeFi platforms via inter-network bridges.

- How to buy or use FDUSD: FDUSD can be most easily purchased on major cryptocurrency exchanges. Binance, in particular, offers FDUSD trading pairs; for example, you can exchange USDT or BTC for FDUSD. It is also listed on other international exchanges. If you want to withdraw FDUSD to your own crypto wallet, you can use the address corresponding to one of the supported networks (ETH, BNB, Solana, etc.). FDUSD can be used like a digital dollar for shopping, money transfers, or DeFi transactions.

- Does FDUSD's value always remain stable?: FDUSD's goal is to maintain its value at $1. First Digital maintains this stability by holding a dollar's worth of reserves for every FDUSD. Normally, the FDUSD price trades around $1 on exchanges. However, in rare cases, short-term fluctuations can occur during periods of low liquidity or market panic. For example, in April 2025, the price temporarily dropped to $0.90 due to rumors, but quickly returned to $1. In such cases, the issuing company quickly maintains price stability through reserve assurance.

- Is FDUSD reliable? Does it actually have reserves?: FDUSD maintains very high industry standards in terms of reliability. Reserves are managed by a regulated trust company in Hong Kong and are held in accounts completely separate from the company's other assets. Independent auditors publish monthly reserve reports, verifying the amount of USD equivalent to the FDUSD in circulation. During the speculation period in April 2025, First Digital announced that all of its reserves were held in US Treasury bonds and cash. While risk assessment is always necessary in stablecoin investments, FDUSD has a positive record of transparent reserve management to date.

- What distinguishes FDUSD from other stablecoins?: There are several key differences that distinguish FDUSD from other stablecoins like Tether (USDT), USD Coin (USDC), or TrueUSD (TUSD). First, as a Hong Kong-based initiative, it focuses on the Asian market and operates in a different regulatory environment than Western-based stablecoins. Second, FDUSD's reserves consist entirely of cash and liquid assets; these assets are audited monthly by independent auditors. Furthermore, its rapid adoption with Binance support has given FDUSD a significant advantage. Technically, FDUSD resides on multiple blockchains, and this multi-chain structure makes it highly flexible. In short, FDUSD is a stablecoin distinguished by its Hong Kong-Binance collaboration, high transparency, and multi-chain access.

- Can I invest in FDUSD, or should I just hold it in dollars?: FDUSD is designed as a means of preserving and transferring value, not an investment instrument. Because its price is fixed, it does not gain value on its own, always maintaining a target of 1 FDUSD ≈ 1 USD. However, there are ways to generate indirect income using FDUSD. For example, you can earn interest by lending FDUSD on DeFi platforms.Or you can add it to liquidity pools and earn a share of trading fees. Some exchanges also offer special campaigns and launchpad privileges to users who hold FDUSD balances. However, FDUSD should be used for value preservation rather than short-term gain. It's also important to remember that crypto assets inherently carry a certain level of market risk.

Follow the JR Kripto Guide series to stay up-to-date on the latest developments in the FDUSD and stablecoin world.