In the crypto world, stablecoins have long been used as the digital equivalent of the dollar; however, most still rely on traditional financial institutions and bank reserves. Ethena USDe is taking a different path. Developed by Ethena Labs, USDe stands out as an innovative stablecoin, operating entirely on-chain and supported by the "synthetic dollar" model. Launched in March 2024, the project quickly gained significant traction and became a pioneer of the "yield-generating stablecoin" movement in the decentralized finance (DeFi) ecosystem. In this guide, we will thoroughly explore how Ethena USDe works, its delta-hedged strategy, the Internet Bond concept, the ENA token, and its future roadmap.

Definition and Origin of Ethena USDe

Ethena USDe (USDe) is a digital stablecoin based on the "synthetic dollar" model, collateralized and offset by on-chain derivative transactions. In short, the Ethena protocol offers a completely crypto-focused, decentralized dollar solution as an alternative to traditional stablecoins. USDe is pegged to a value of $1 using financial engineering techniques and allows users to earn yield while maintaining this value.

Developed by Ethena Labs, the USDe project was first introduced in March 2024. The Ethena Labs team is comprised of experienced professionals in financial engineering, derivatives markets, and risk management. Led by CEO Guy Young, the team is based in London and includes experts from previous positions at institutions such as Morgan Stanley, Jump Trading, and Chainlink Labs. Shortly after its launch, the project gained significant traction, becoming one of the largest stablecoin projects by market capitalization.

USDe's primary goal is to address the problems of decentralization and reserve transparency that are common in the stablecoin market. While many existing stablecoins rely on traditional financial institutions or bank reserves, Ethena aims to create a dollar that runs entirely on the blockchain and is independent of the traditional banking system. With their "internet bond" vision, the team aims to create a digital dollar that both generates returns and maintains a price fixed at $1. This allows users to generate passive income while using a reliable store of value within the crypto ecosystem. The USDe price, as seen below, has remained stable around $1 since its launch.

Ethena is considered a pioneer in the "yield-bearing stablecoin" category. USDe integrates with popular DeFi platforms such as Aave, Pendle, MakerDAO, and Uniswap and is actively used in these ecosystems. For institutional investors in particular, USDe aims to be a secure gateway to the world of decentralized finance. Traditional financial players can participate in blockchain-based applications with a transparent, dollar-denominated stablecoin through USDe.

Ethena USDe History: Key Milestones

Some key events and developments in the brief history of Ethena USDe are as follows:

- March 2024: Ethena Labs launched USDe's mainnet. The first public version was launched after closed testing, generating excitement in the DeFi community.

- April 2024: USDe was listed on major cryptocurrency exchanges like Bybit. (During the same period, Ethena Labs' governance token, ENA, was also available to users on major platforms like Binance.) This rapidly increased USDe's liquidity and accessibility.

- May 2024: Ethena introduced the innovative concept called "Internet Bond." Thanks to this feature, users began earning returns by staking their USDe. In other words, USDe not only maintained its value but also became a regular earning tool.

- July 2024: The Ethena protocol reached a major milestone by surpassing $3 billion in total locked value (TVL). Reaching such a high TVL in a short time demonstrated the trust and interest in the project.

- Late 2024: USDe, with its "staking + delta-hedging" model, began to be recognized as one of the most innovative stablecoin assets in the crypto market towards the end of the year. Many analysts described USDe as a groundbreaking example in the stablecoin space. 2025: Ethena began integrating with infrastructures like LayerZero and Chainlink to increase compatibility across different blockchains. This aimed to enable USDe to operate seamlessly across multiple chains and reach a wider audience.

Why is Ethena USDe Important?

Several aspects distinguish Ethena USDe from other stablecoin projects and make it significant. For example, unlike traditional stablecoins like USDT or USDC, Ethena maintains its $1 value entirely through on-chain mechanisms, without relying on a central issuer. This offers a significant alternative in terms of decentralization and censorship resistance.

On the other hand, USDe, thanks to its "delta-hedged" strategy, maintains its value while offering users regular returns (yield). This feature has opened up a new way to generate passive income in the DeFi ecosystem. Holding stablecoins now makes sense not only for storing value but also for earning returns.

Additionally, Ethena's "synthetic dollar" design is based on delta hedging, a technique used in traditional financial markets. The protocol balances assets held in spot markets (such as ETH) with short-term derivative (futures) positions of the same amount. This creates a highly price-stable asset that is resilient to market fluctuations.

The Ethena protocol regularly publishes its reserves and collateral ratios on-chain. This means the collateral behind USDe can be viewed and audited by anyone. This transparency increases user trust and minimizes questions about stablecoin reserves.

Ethena aims to appeal to individual crypto users as well as funds, derivatives investors, and other institutional players. With its slogan, "DeFi-compatible dollar," it aims to offer a regulatory-friendly and reliable digital dollar alternative that aligns with the needs of the traditional financial world. This could make USDe a tool for institutional-level payments and financial transactions in the future.

Ethena Labs and the USDe Ecosystem

The value of Ethena USDe is also driven by the ecosystem and Ethena Labs. Ethena Labs is a finance and blockchain engineering team led by CEO Guy Young. Based in London, this team focuses on developing innovative products in the decentralized finance space. The team includes experts with prior experience at leading institutions in both traditional finance and the crypto world, including Morgan Stanley, Jump Trading, and Chainlink Labs. This strong team is the brainpower behind the vision behind Ethena USDe.

The Ethena project has received significant support from renowned crypto investors and companies. Dragonfly Capital, Binance Labs, OKX Ventures, and Bybit are just a few examples. Furthermore, financial giants such as BitMEX founder Arthur Hayes, Franklin Templeton, and Galaxy Digital have also provided various investments and support to Ethena. This broad investor base provides a significant indication of the project's credibility and potential.

The Ethena community is growing and gaining a voice in the project. Ethena Labs is taking steps to transition to a decentralized governance model. The governance token ENA, issued as part of this initiative, will ensure that future protocol decisions are made through community votes. By holding ENA tokens, community members will have the right to vote on the protocol's development and significant changes. This means the Ethena ecosystem will eventually evolve into a DAO (Decentralized Autonomous Organization) structure.

Ecosystem applications also contribute to the value of USDe. The ecosystem built around Ethena USDe includes a number of products and integrations. Some of these include:

- Internet Bond: This is the name given to the annual return system where users who stake USDe earn a set return. Staking USDe, in a sense, allows for regular interest income, similar to an "internet bond." Users can lock their USDe in the protocol and earn additional daily or annual income.

- Cross-chain integrations: While Ethena USDe initially runs on Ethereum, it is rapidly expanding to other chains. USDe can now be used on popular Layer-2 networks and sidechains such as Arbitrum, Optimism, and Base. These cross-chain integrations enable the seamless transfer and use of USDe across different platforms and applications.

- DeFi platform integrations: USDe is deeply integrated with many decentralized finance protocols. For example, USDe is actively used in futures transactions on Pendle, liquidity pools on Curve, and lending/borrowing on Aave. By working in harmony with protocols like Synthetix, USDe's liquidity and usage areas are expanded. This creates a rich usage network within the Ethena ecosystem, growing alongside other DeFi projects.

How Does Ethena USDe Work?

The operating principle of Ethena USDe is based on a clever strategy borrowed from the world of traditional finance. The protocol maintains the value of USDe at $1 through a delta-hedged stablecoin model. So, what does this mean, and how does it work? Let's explain it simply:

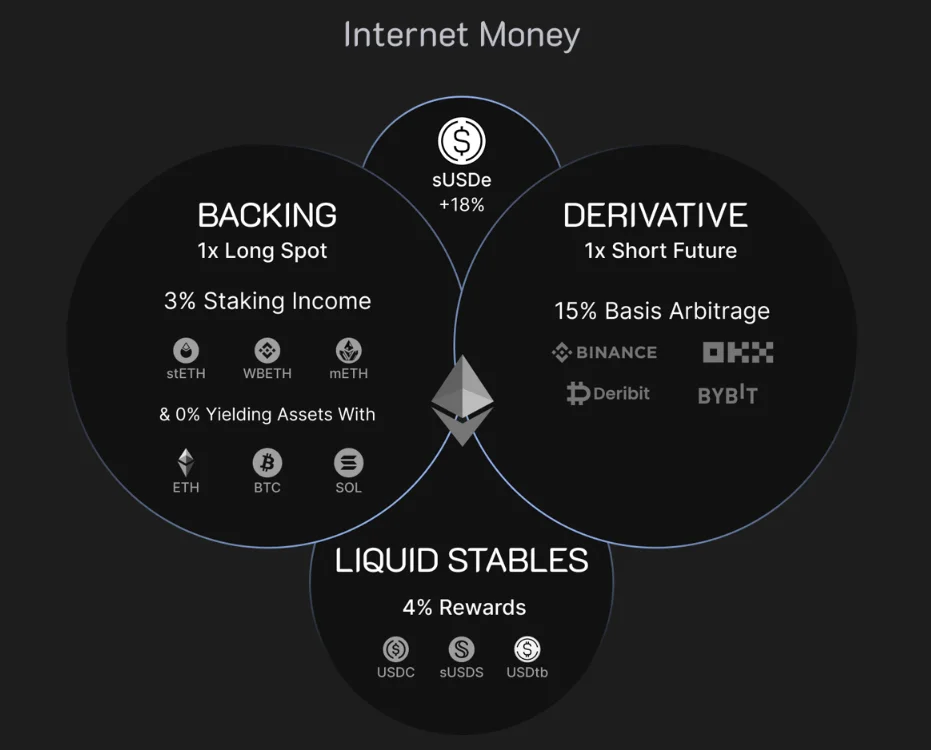

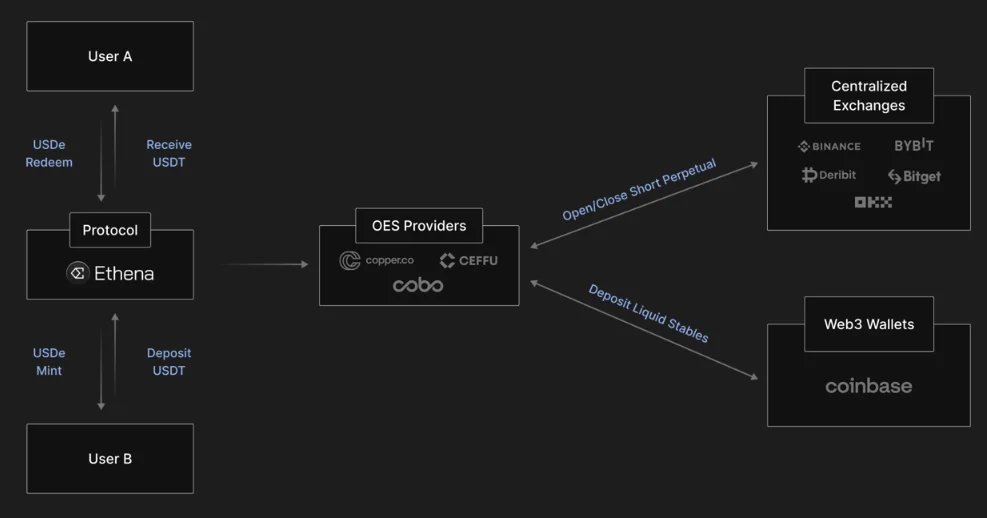

- The value of USDe is maintained by balancing the protocol's holdings with its positions in derivatives markets. To offset price fluctuations in collateral assets (such as ETH) received from its users, Ethena simultaneously opens short positions against these assets in the futures markets. This method creates a delta-neutral position. The steps are as follows:

- Collateral deposit: Users deposit ETH or similar crypto assets into the Ethena protocol as collateral. In exchange for this collateral, the protocol mints new USDe tokens and issues them to the user. Delta hedge position: The protocol simultaneously hedges the collateral it receives from the user. For example, if the user deposits 1 ETH of collateral, Ethena opens a short position of 1 ETH on centralized exchanges or supported platforms. This short position acts as insurance against price fluctuations of the ETH held as collateral.

- Price fixing: Thanks to this stabilization, the value of USDE remains approximately $1, regardless of whether the price of ETH rises or falls. How does this work? If the price of ETH rises, the protocol's ETH collateral gains value, but the short position loses value by the same amount – thus, the total value remains constant. Conversely, if the price of ETH falls, the value of the collateral decreases, but the profit from the short position is still made, preserving the total value. Consequently, the protocol's total portfolio value is fixed in dollars.

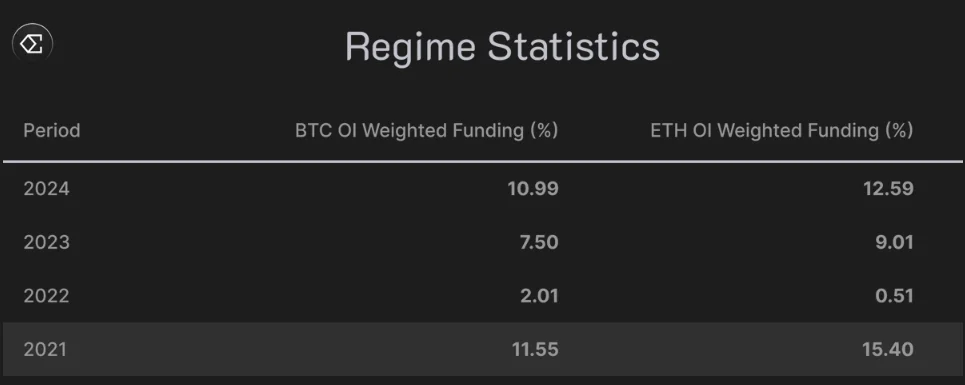

- Return generation: Ethena's delta-neutral strategy not only stabilizes the price but also generates returns. As the short position holder in futures markets, the protocol typically receives periodic payments called funding rates. In crypto markets, in particular, those who open long positions often pay funding fees to those who open short positions. Ethena accumulates the returns from these funding rates. It also earns staking rewards on the assets it holds as collateral (e.g., staked ETH). These revenues are shared proportionally with users who stake USDe.

Why is this model advantageous? Because USDe operates entirely through market-based mechanisms, without the need for bank reserves or fiat collateral. The value of collateral assets is protected by financial derivatives, ensuring decentralization. This minimizes the regulatory pressures and trust issues faced by traditional stablecoins. Thanks to this clever hedging mechanism, Ethena has created a stablecoin model that both maintains its 1:1 dollar value and generates income.

Ethena USDe Use Cases

In addition to being used as a stablecoin to store value, USDe is also an active tool in various DeFi and cryptocurrency applications. Here are some of USDe's primary use cases:

- Collateral in DeFi protocols: USDe is accepted as collateral (collalateral) in decentralized finance platforms. For example, in lending and borrowing protocols like Aave, users can deposit USDe to obtain loans or use USDe alongside other stablecoins in liquidity pools like Curve. This has made USDe a reliable collateral tool in the DeFi world. Liquidity Provision (LP) and Yield Farming: USDe is an ideal asset for participating in liquidity pools on various platforms. For example, it's possible to become an LP (Liquidity Provider) by adding liquidity to pools consisting of trading pairs such as USDe/ETH or USDe/USDT. Liquidity providers receive a share of pool fees and can also earn various yield farming rewards. This offers additional earning opportunities for USDe holders.

- Passive Income Generation: Thanks to Ethena's Internet Bond system, users can earn passive income by locking and staking their USDe within the protocol. USDe staking offers a set annual percentage yield (APY) from the protocol's funding rate revenues and other earnings sources. This means earning dollar-denominated returns in a digital environment, similar to bank deposit interest. While USDe staking returns can fluctuate depending on market conditions, they represent an attractive income stream for users.

- Corporate Payment Solutions: The Ethena project aims to leverage USDe not only on crypto platforms but also in real-world applications in the long term. In particular, enabling corporate-to-company payments and international transfers to be made with USDe on the blockchain is a significant goal. This will enable traditional financial institutions to utilize the speed and efficiency of blockchain to facilitate seamless and low-cost dollar transfers through USDe. Once this vision is realized, USDe could become not only an investment and trading tool but also a global digital payment instrument.

Ethena USDe Token Economics

Let's take a closer look at the technical and financial features of Ethena USDe:

- Token Name: Ethena USDe

- Symbol (Ticker): USDe

- Token Standard: ERC-20 (runs on the Ethereum network)

- Collateral Type: ETH and similar high-liquid crypto assets (e.g., supported collateral such as stETH, wBTC)

- Value Peg: $1 (targeted at 1 USDe ≈ $1)

- Governance Token: ENA (the Ethena project's governance and incentive token)

- Total Value Locked (TVL): Approximately $4 billion by 2025 (total asset value locked in smart contracts within the USDe ecosystem)

The above information summarizes the technical structure and economics of USDe. It's important to note here that USDe is collateralized at 100% or higher to maintain its value at $1, and this collateral is protected by a smart hedging strategy. The Ethena protocol maintains a collateral equivalent in value and a counter-hedge position for every USDe printed, ensuring the system's smooth operation.

Considering the differences between USDe and ENA: USDe is a synthetic stablecoin whose price is pegged to the dollar, while ENA is the governance and incentive token of the Ethena ecosystem. In other words, USDe's primary purpose is to maintain its value and serve as a kind of digital dollar in circulation. ENA, on the other hand, is used to provide a voice in project management, participate in voting, and participate in certain incentive mechanisms within the ecosystem. ENA holders will be able to vote on decisions regarding the Ethena protocol in the future. In short, USDe is for daily transactions and storing value, while ENA is for participation in protocol governance and long-term incentives.

The Future of Ethena USDe and Roadmap

The Ethena Labs team has set several goals for the future to develop USDe and the Ethena ecosystem in general:

- 2025 Goals: Throughout 2025, Ethena plans to increase its cross-chain integrations. One of the primary goals is to expand its user base by integrating USDe into more blockchain networks. Efforts will also be underway to ensure USDe plays an active role in payment solutions. This means that USDe use cases can be developed in areas such as e-commerce and international money transfers. Furthermore, the goal is to transition to a full-fledged DAO structure for Ethena's governance token, ENA. The ENA governance system is expected to be fully operational by the end of 2025, with a community-driven decision-making mechanism in place.

- Medium-term goal: In the medium term, Ethena aims to become an infrastructure service in the crypto world. The team frequently describes Ethena as a global "on-chain yield infrastructure." This means that Ethena plans to be a platform offering yield-oriented financial instruments that not only supports its own products but also allows other projects to build upon. For example, other projects could create their own stablecoins or derivative products using Ethena's USDe and delta-hedge model.

- Long-term vision: Ethena's long-term vision is to not only be a stablecoin project but also to create a financial layer that delivers the bond-like income mechanism of decentralized finance to investors worldwide. The concept of an "Internet Bond" can be thought of as a digital interpretation of traditional bonds, and Ethena aims to make this concept accessible to global investors. If successful in the long term, the Ethena ecosystem can become a reliable, transparent, and profitable digital financial infrastructure for both individual users and institutional investors.

Frequently Asked Questions (FAQ)

Below, you can find answers to some frequently asked questions about Ethena USDe:

- What is Ethena USDe?: Ethena USDe is a decentralized, yield-generating stablecoin whose value is pegged to $1 through a delta-hedged strategy. In other words, it is a synthetic digital dollar running on the blockchain, supported by collateral and a balance of derivative positions.

- When was USDe launched?: Ethena Labs first launched USDe in March 2024. After a closed beta period, USDe launched on the mainnet in March 2024 and has grown rapidly since then. Who developed Ethena?: The Ethena project was developed by the Ethena Labs team, led by CEO Guy Young. The team members are experienced professionals in finance and blockchain.

- How does the USDe remain stable?: The USDe's value remains stable at $1 thanks to the hedging of collateral assets like ETH through short positions. The protocol neutralizes the value of its collateral with reverse futures positions, keeping the USDe price unaffected by market volatility.

- How does it benefit USDe investors?: The Ethena protocol shares the funding rate revenue and other returns generated by delta-neutral positions with USDe holders. In other words, users who stake USDe earn passive income by sharing the protocol's interest and rewards.

- Is USDe secure?: USDe's collateral and reserves can be tracked on-chain with full transparency. The system's risk management is automated through smart contracts. This minimizes human error, and users can monitor the protocol's health themselves. Of course, as with any financial system, there are certain risks, but Ethena adopts an industry-leading approach to security and transparency.

- Which networks can Ethena USDe be used on?: USDe is currently available on various side networks and Layer-2 platforms, primarily the Ethereum mainnet. It is possible to transfer, exchange, or use USDe in various protocols, particularly on popular networks such as Arbitrum, Base, and Optimism.

- What is the difference between Ethena USDe and ENA?: USDe is a stablecoin whose value is pegged to the dollar. ENA is the governance token of the Ethena ecosystem. In short, USDe is traded as a digital dollar, while ENA is the token used to participate in project management and have a say in the ecosystem. ENA holders will have voting rights on future updates and decisions to the Ethena protocol.

If you'd like to stay up-to-date on Ethena Labs and the DeFi stablecoin revolution, continue watching our JR Kripto Guide series.