Bitcoin Cash (BCH) is a digital currency frequently mentioned in the cryptocurrency world, but often raises the question, "Is it a copy of Bitcoin or a completely different vision?" So, what is Bitcoin Cash, and why is it so talked about? Born in 2017 as a hard fork of the Bitcoin blockchain to provide an alternative solution to existing problems as a result of disagreements within the Bitcoin community, BCH has been determined to forge its own path ever since. Noted for its low transaction fees, large block sizes, and speed-oriented structure, Bitcoin Cash strives to maintain the ideal of a "peer-to-peer electronic cash system."

So, what does Bitcoin Cash do, and what are the technical and philosophical differences that distinguish it from Bitcoin? In this comprehensive guide, we will examine many interesting topics, including what is Bitcoin Cash, what is the BCH coin, when was Bitcoin Cash released, how did the BCH hard fork process work, who owns the BCH coin, who are the key figures supporting the project, and how is the future of BCH coin shaping up.

The Definition and Origins of Bitcoin Cash

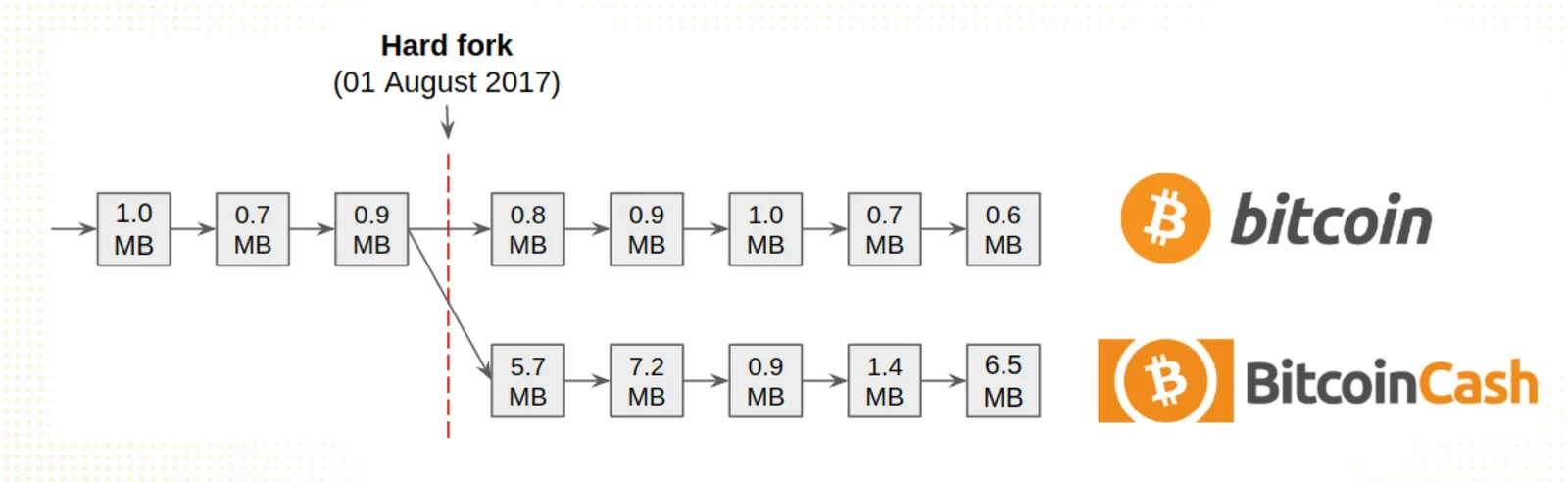

Bitcoin Cash is a cryptocurrency that entered our lives on August 1, 2017, with a hard fork of Bitcoin (BTC). In fact, its emergence stems from one of the most heated debates in the crypto world: Is Bitcoin scalable, or has it reached its limit? As the Bitcoin network grew more users, transaction times began to lengthen and fees increased. Then, disagreements erupted between developers and miners. Some said, "Let's increase the block size to over 1 MB and process more transactions faster." Others said, "No, let's handle this without scaling up the chain, with updates like SegWit or second-layer solutions like the Lightning Network." It was at this point that the community split in two, and a new chain emerged: Bitcoin Cash. This event, known as the Bitcoin fork, was the turning point that gave birth to BCH.

BCH's main goal is to essentially increase the block size, allowing it to confirm many more transactions faster and more cheaply. Initially, this block size was set at 8 MB, but over time, it was increased to 32 MB as needs increased. By comparison, Bitcoin's block size is still around 1 MB (effectively increasing to 4 MB with SegWit), falling well short of BCH's capacity. If you're wondering what this means, Bitcoin Cash can cram thousands more transactions into a block; tests have even shown that a single BCH block can process up to 25,000 transactions. In Bitcoin, this number is generally limited to around 1,000–1,500. This means that no matter how congested the network, Bitcoin Cash has the potential to provide transaction confirmations with low fees and no waiting times.

Bitcoin Cash was originally conceived as a step toward remaining true to the famous vision put forth by Bitcoin founder Satoshi Nakamoto in 2008: a "peer-to-peer cash system." Satoshi's original whitepaper defined Bitcoin not as an investment instrument, but as digital cash that could be used directly for daily payments. Over time, Bitcoin (BTC) adopted a more "digital gold" identity, meaning people began using it not as a payment instrument but as a long-term store of value. This is precisely where BCH supporters stepped in, saying, "No, Bitcoin's primary purpose should be to be a part of everyday life and be used for payments." Therefore, Bitcoin Cash chose to scale the chain itself and process more transactions directly within blocks.

This is where the difference between BCH and BTC becomes clear: BTC prefers to proceed with small blocks and external scaling solutions, while BCH aims to directly scale on-chain transactions with larger blocks. Thus, BCH is positioned as a "cash payment system" that anyone can easily use when buying coffee, sending money to a friend, or making an e-commerce purchase. We can take a look at the key differences between Bitcoin and Bitcoin Cash in the following table:

| Feature | Bitcoin (BTC) | Bitcoin Cash (BCH) |

Block Size | 1 MB (effectively ~4 MB with SegWit) | 32 MB |

Block Time | ~10 minutes | ~10 minutes |

Transaction Capacity | ~7 transactions/sec | ~100–200 transactions/sec (theoretically higher) |

Average Transaction Fee | 1–10 USD (can be much higher during congestion) | 0.001–0.01 USD |

Congestion During High Load | High (fees increase rapidly) | Low (large blocks absorb transaction load) |

Micro Payment Suitability | Limited (high fees make small payments impractical) | Suitable (low-cost transactions possible) |

Layer-2 Requirement | Requires Lightning Network | On-chain capacity is generally sufficient |

Bitcoin Cash History: Major Milestones

When did Bitcoin Cash launch? This question is often one of the first asked by curious investors. The short answer is: August 1, 2017. That day, the Bitcoin network experienced a major fork, and Bitcoin Cash launched its own chain. But this was only the beginning. Since then, BCH has faced many challenging challenges, not only technically but also in the community; forks, disagreements, and updates have accumulated a rather eventful history. Now, let's take a look at the significant milestones that have emerged since Bitcoin Cash's launch:

- 2017: Bitcoin Cash split from Bitcoin on August 1, 2017, to create its own chain. As a result of this split, everyone who had held Bitcoin up until that point held an equivalent amount of BCH. Miners who produced the first blocks included major mining pools and players like Bitmain. BCH traded at around $240 on its first day of release.

- 2018: In November 2018, the Bitcoin Cash protocol experienced a second major fork. This fork resulted in the Bitcoin Cash network splitting in two, resulting in the emergence of a new cryptocurrency called Bitcoin SV (Satoshi's Vision). Bitcoin SV was the product of a faction led by individuals like Craig Wright, aiming to further increase the block size. With this split, two separate projects, BCH and BSV, continued.

- 2020: In November 2020, the community was once again divided by the Infrastructure Funding Plan (IFP) debate. Bitcoin Cash's lead development team, Bitcoin ABC, proposed implementing a controversial rule (known within the community as a "miner tax") that required 8% of mining rewards to be allocated to developers. However, the majority of the community and other developer groups (such as Bitcoin Cash Node) opposed this proposal. As a result, the network forked again, leaving the remaining minority Bitcoin ABC chain, BCHA (later rebranded as eCash (XEC)). The main BCH chain continued its work without the IFP rule.

- 2021–2023: After the 2020 split, Bitcoin Cash's developer community, although smaller in size, continued to work on the project. During this period, the protocol continued to be improved through routine network updates that occurred twice a year. In particular, improvements to increase transaction confirmation speed and the infrastructure for new features were discussed. Despite the decrease in the number of developers, existing teams continued to work to keep BCH current and increase its adoption.

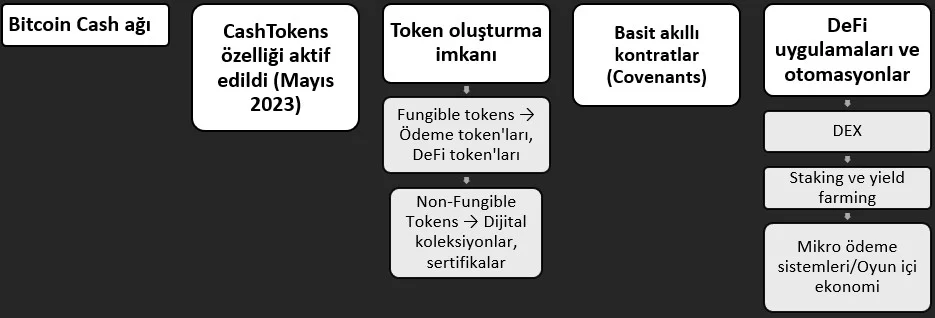

- 2024: With the protocol upgrade in May 2023, CashTokens were added to the Bitcoin Cash network. This update significantly increased BCH's compatibility with decentralized finance (DeFi) applications by 2024. CashTokens allowed developers to issue new tokens and develop smart contract-like solutions on the Bitcoin Cash blockchain, similar to the ERC-20 standard on Ethereum. So, what are CashTokens? In short, this is the name of this update that adds the ability to issue new digital assets (tokens) and basic smart contract operations to the Bitcoin Cash protocol.

Why Is Bitcoin Cash Valuable?

The factors that make Bitcoin Cash valuable stem from its technical features and usage advantages. It would be a serious mistake to see it merely as a "clone" of Bitcoin. On the contrary, Bitcoin Cash has a very clear purpose and strong technical features that support this purpose. Let's take a look at Bitcoin Cash's features and advantages. Why do some users still prefer it to BTC for daily payments? Why do people in some countries choose to use BCH for their daily purchases? The answers to these questions lie in the specific needs and solutions BCH offers.

Low transaction fees and fast transfer times

The BCH network operates with very low transaction fees thanks to its large block capacity. The average cost of a Bitcoin Cash transaction is typically less than 1 cent, and transactions can receive initial confirmation within a few seconds. The large block size prevents network congestion, enabling payments to be processed almost instantly and inexpensively. This makes Bitcoin Cash a practical payment tool for a wide range of purposes, from everyday coffee shopping to international money transfers.

Block sizes can be increased to 32 MB

The BCH block size limit can be increased to 32 MB if necessary. This means that, theoretically, hundreds of transactions can be verified per second. For example, with the current 32 MB block size, the BCH network can process over 100 transactions per second, while the Bitcoin network is limited to approximately 7 transactions. This greater transaction capacity allows the network to operate without incurring high transaction fees, even during peak periods. As a result, BCH offers a significant advantage over BTC in terms of scalability.

True to Bitcoin's vision of a "cash payment system"

Bitcoin Cash strives to fulfill Bitcoin's original goal of being a "peer-to-peer electronic cash." In line with Satoshi Nakamoto's vision, it aims to be a digital currency that everyone can use in their daily lives. While Bitcoin has been called digital gold and evolved into an investment and store of value, BCH supporters emphasize that it maintains its original mission as a payment tool.

On-chain transactions are processed more efficiently compared to Bitcoin

Thanks to its large block size and protocol optimizations, the BCH network can process on-chain transactions much more efficiently than BTC. Transactions on the network generally require low fees, even during busy periods, and the transaction doesn't wait for long confirmations. Especially for micropayments or frequent small-amount transactions, BCH offers a more cost-effective and faster solution than Bitcoin.

The developer community is focused on integrating its use into everyday payment systems

The community and developers behind Bitcoin Cash are working to make the cryptocurrency a widespread payment tool in the real world. Various wallet applications, payment processors, and business integration projects have been developed to achieve this. For example, as of 2021, PayPal began allowing its users to pay with Bitcoin Cash. Some businesses, such as the NBA team Dallas Mavericks, also accept BCH for game tickets and merchandise sales.

Who is the Founder of Bitcoin Cash?

There is no clear name behind Bitcoin Cash that can be attributed to "this person." Because BCH didn't originate as a single person's idea or a company's project; rather, it emerged as a result of disagreements within the Bitcoin community. In other words, this coin was launched when a large group of people decided, "We're charting a different course."

In 2017, there were serious debates about how to make Bitcoin more scalable. Some argued that the block size should be increased, while others believed it made more sense to proceed with second-layer solutions. The disagreement grew, and as a result, a segment of the community created their own chain. This new chain became Bitcoin Cash.

Technically, among the teams that took the first steps in BCH were developer groups like Bitcoin ABC and Bitcoin Unlimited. These teams modified Bitcoin's open-source code, creating software that increased the block size and operated with new rules. This software was used to launch the BCH chain. So, the answer to the question, "Who owns the BCH coin?" is a somewhat strange but accurate one, "everyone and no one."

On the other hand, some familiar names come to mind when Bitcoin Cash is mentioned. Chief among these is Roger Ver, known in the crypto world as "Bitcoin Jesus." So, who is Roger Ver? He joined the cryptocurrency ecosystem quite early, as early as 2011, investing in Bitcoin in its early days and contributing significantly to its widespread adoption. During that time, he funded numerous initiatives, gave conferences, created content, and championed Bitcoin's "global, free currency" philosophy. However, things changed during the 2017 fork. Ver began to believe Bitcoin had strayed from its original vision and shifted its focus to Bitcoin Cash. He even started using a large domain name, bitcoin.com, for BCH, thus helping to bring Bitcoin Cash's name to a wider audience.

Jihan Wu is another name that made a name for himself during Bitcoin Cash's emergence. A co-founder of the China-based mining giant Bitmain, Wu was one of the strongest supporters of big block advocates in 2017. Thanks to his mining power, he significantly contributed to the smooth operation of the BCH network in its early days. In other words, he played a significant role in both the establishment of the technical infrastructure and the continued support of BCH.

In short, we can't say "this person founded" Bitcoin Cash, but figures like Roger Ver and Jihan Wu are prominent figures in this journey. On the technical side, teams like Bitcoin ABC are among the groups that developed BCH's code and generated its first block. The project continues to this day without a central administration, working with developers and community members. No one makes decisions alone; everyone has a say.

Frequently Asked Questions (FAQ)

Below are some frequently asked questions and answers about Bitcoin Cash (BCH):

- What is Bitcoin Cash and how is it different from Bitcoin?: Bitcoin Cash is a cryptocurrency that was split from Bitcoin (created through a hard fork) in 2017. Its main difference is that its larger block size allows it to process many more transactions with lower fees. In short, while BTC is more commonly seen as "digital gold," BCH focuses on becoming digital cash that can be used for everyday expenses.

- Why did Bitcoin Cash emerge?: The scalability issues and high transaction fees in the Bitcoin network were the primary reasons for BCH's emergence. In 2017, the Bitcoin community proposed different solutions to these problems, leading to a division of opinion: One group wanted to increase network capacity by increasing the block size, while others preferred to maintain the current structure. As a result of this disagreement, Bitcoin Cash was born as a separate chain, offering an alternative path for those who wanted to maintain Bitcoin's original vision.

- Who owns BCH coin?: BCH coin isn't the project of any single person or company. Bitcoin Cash is an open-source, decentralized project built by the community. While it certainly has prominent supporters like Roger Ver, BCH is owned by a global community of volunteer developers and users, not a central government.

- Is BCH centralized or decentralized?: Bitcoin Cash is a completely decentralized blockchain. Just like Bitcoin, transactions on the BCH network are verified by a distributed network of miners and nodes, with no central authority. Network governance is ensured by protocol rules and a consensus mechanism; no single government, company, or individual controls the network.

- Is BCH as reliable as BTC for investment?: While each investor's definition of "reliability" varies, Bitcoin Cash is a long-established cryptocurrency that has been around for a long time. However, it's also true that it's not as strong as BTC in terms of market capitalization and adoption. While BTC, the cryptocurrency with the largest market capitalization, is considered a "safe haven" by many, BCH can experience more volatile price movements. BCH's success from an investment perspective will depend on its future widespread adoption and technological advancements.

- What is the future of Bitcoin Cash?: While the community is generally optimistic about the future of BCH, it's difficult to make a definitive prediction. According to its supporters, BCH has the potential for greater adoption, particularly in everyday life and developing countries, thanks to its advantages of low fees and fast transactions. Updates like CashTokens, arriving in 2023 and entering the smart contract and DeFi space, could expand BCH's use case. However, due to the competitive and uncertain factors inherent in cryptocurrency markets, only time will tell how successful Bitcoin Cash will be in the future.

Don't forget to follow our JR Kripto Guide series for details on Bitcoin Cash and other major forks.