Aster (ASTER) is a next-generation cryptocurrency exchange platform that combines spot and perpetual trading under one roof and stands out for its decentralized structure. After launching in September 2025, it quickly attracted attention with its multi-blockchain support, up to 1001x leverage, and privacy-focused MEV-protected infrastructure. The project also received support from YZi Labs, the investment arm of Binance co-founder CZ, adding further credibility to the platform. In the first week after its launch, both trading volume and token price saw a significant surge. So, what is Aster, how did it come about, and why is it so popular? In this guide, we will delve into all of these questions in detail: what is Aster, what does Aster Coin do, and how does it work.

Aster's Definition and Origin

Aster is a hybrid DEX that strives to combine the trading quality of centralized exchanges (CEXs) with the freedom of the DeFi world. Users can trade while holding their assets in their own wallets, and both spot and perpetual trading can be conducted on the same platform. Because it can draw liquidity from different networks like Ethereum, BNB Chain, Solana, and Arbitrum, no additional steps are required for cross-chain transfers. One of the platform's most prominent features is its capital efficiency. Yielding assets, such as asBNB or USDF, can be used as collateral. This allows for passive income even when a position is open. This means you can not only trade but also continue to collect staking income.

Aster's foundations were laid in 2024 with the merger of two projects, Astherus and APX Finance. APX was already an experimental project focusing on perpetual transactions; after the merger, a new vision was launched under the name Aster DEX. The ASTER token was launched in September 2025. APX tokens were converted into ASTER tokens at a one-to-one ratio, and this transition generated considerable interest in the crypto world. Support from CZ and former Binance staff was rumored, adding significant confidence to the project. The development team designed Aster as an advanced yet user-friendly DEX that enables professional-level trading. It's no coincidence that it stands out with its multi-chain structure, detailed order types like stop-loss, and privacy features; the team targeted these gaps from the outset.

Aster's starting point was to combine the speed and depth of centralized exchanges with the free architecture of DeFi. The primary goal was to provide users with access to professional tools and high liquidity while maintaining control over their assets. Furthermore, the fragmented nature of cross-chain liquidity was also seen as a significant problem. Aster aimed to address this by combining assets from different networks within a single interface. When bringing traditional financial instruments like futures to DeFi, particular emphasis was placed on capital efficiency and transaction privacy.

Aster's History: Key Milestones

Despite being a relatively new project, Aster has made significant strides in a short time. Its foundation was laid by the merger of two separate protocols; The rapid growth that followed, the explosion of funds during launch week, and the widespread airdrop distributed to the community instantly propelled the project into the crypto spotlight. Now, let's take a closer look at the stages Aster went through and what happened when.

- 2024: The Project's Birth - Aster's first step was taken with the merger of Astherus and APX Finance. APX was previously a project focused on perpetual transactions; with the merger, this experience continued under the Aster umbrella with a broader vision. Throughout 2024, the team focused on building the multi-chain architecture and yield-generating collateral system.

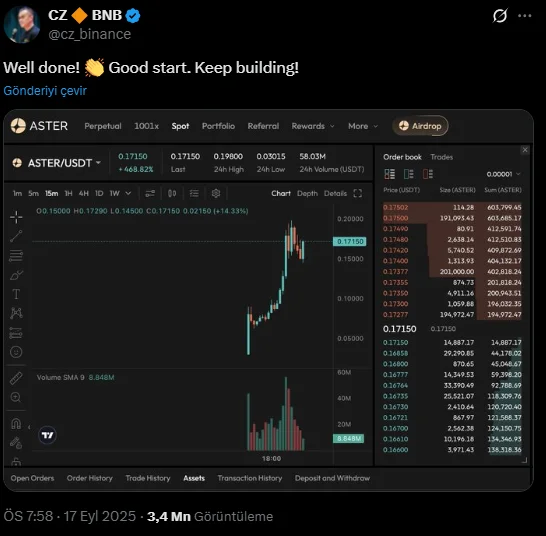

- September 2025: Token Launch and Rapid Rise - The ASTER token was launched in September 2025. APX holders exchanged their tokens for ASTER at a one-for-one rate. Immediately after the launch, the Aster DEX saw a significant influx of users. The ASTER price surged by over 2,000% in seven days, reaching a market capitalization of approximately $3.8 billion. This brought ASTER into the top 50 cryptocurrencies. That same week, Aster had days where it surpassed Hyperliquid in daily revenue. However, in terms of total trading volume, Hyperliquid still had a slight lead, reaching $5.39 billion for the week compared to $3.32 billion for Aster.

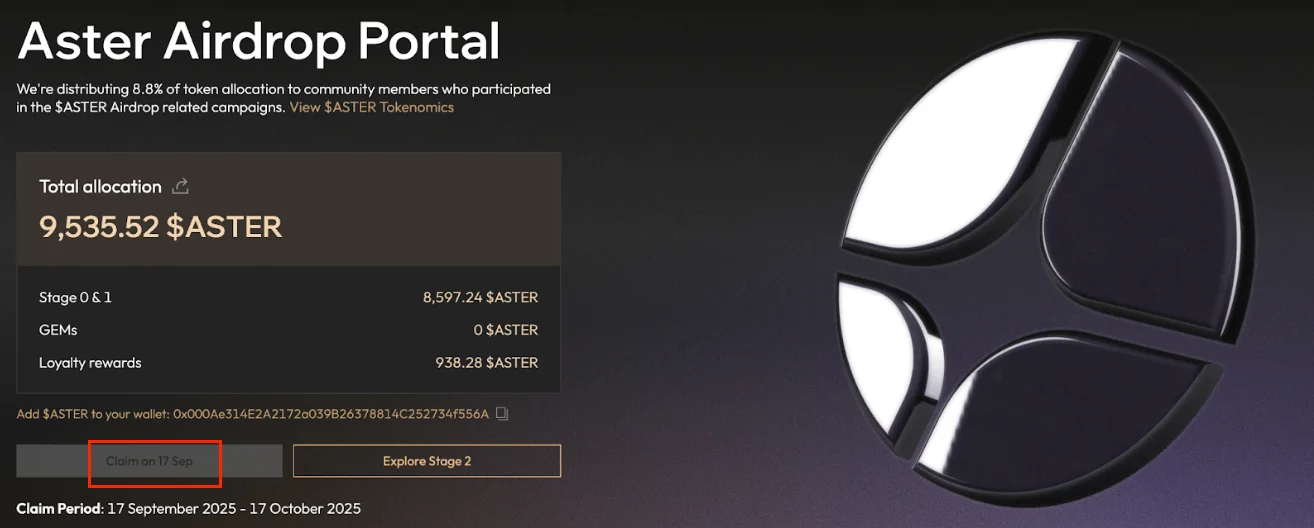

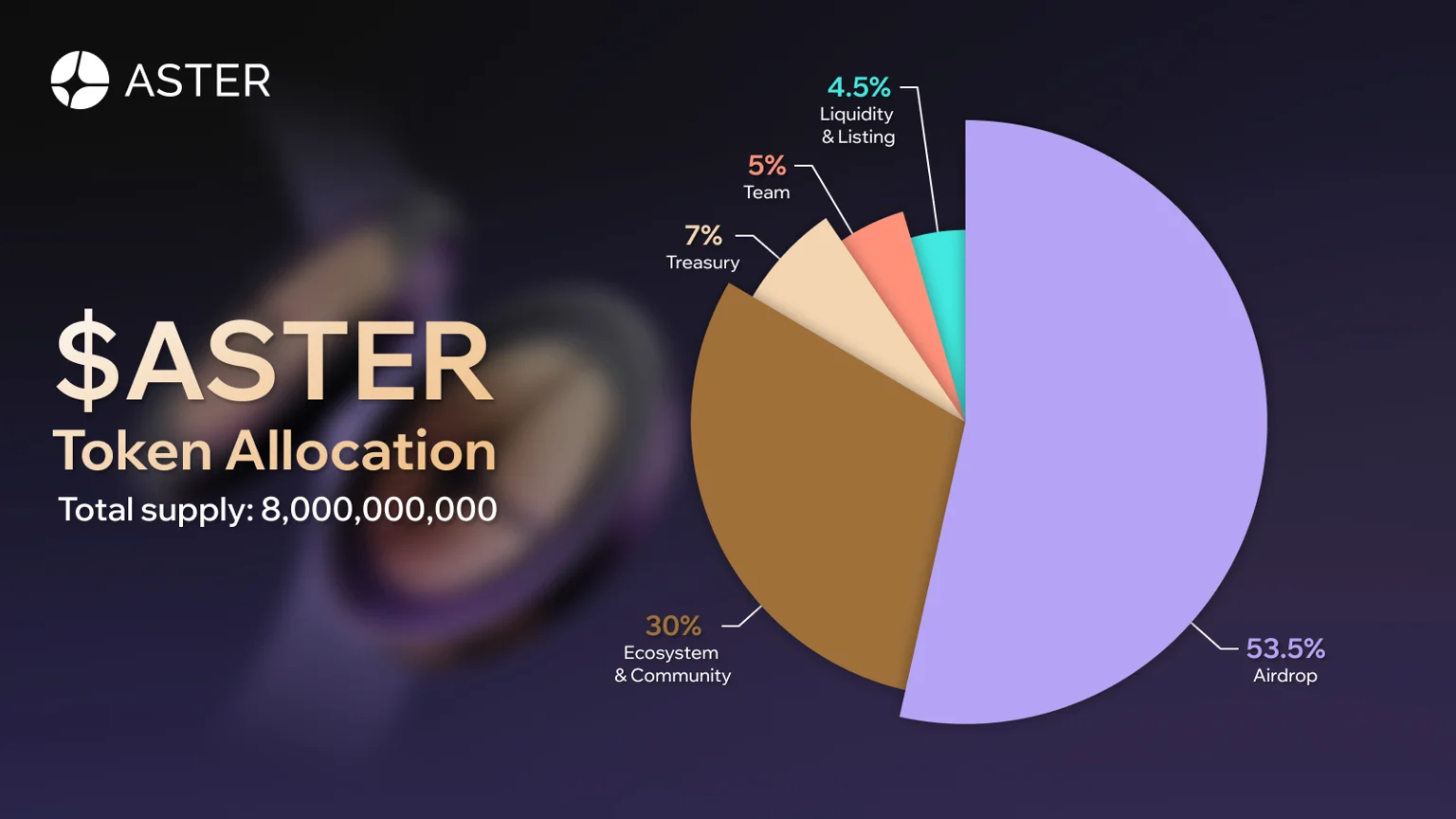

- October 2025: Exchange listing and airdrop - ASTER was listed on Binance in October and began trading with the "Seed Tag" tag. This tag is generally given to innovative and early-stage projects. A significant airdrop took place around the same time. 8.8% of the total supply, or 704 million ASTER, was distributed to users who participated in various campaigns. Airdrop winners included those who accumulated Spectra points, Aster Gems through community tasks, and early Aster Pro users. The deadline to claim tokens was October 17th. Tokens not claimed after this date were returned to the community reward pool. Since this pool comprises a large portion of the total supply, at 53.5%, a new airdrop is expected in the future.

After 2025: Aster Chain and Future Plans - After the launch, the Aster team announced its new goal: to launch its own Layer-1 blockchain. Aster Chain will work with privacy technologies like zero-knowledge proofs. The goal is to keep transaction details private while ensuring on-chain verification. Testing began by the end of 2025. With Aster Chain's launch, the multi-network architecture will be migrated to a single, high-performance, privacy-focused chain. The team is also working on new features such as an "intent-based" transaction system, which will intelligently route transactions based on user intent and automatically switch between different liquidity pools.

Why Is Aster Important?

Aster's rapid rise to prominence is no coincidence. The project has distinguished itself in both technology and user experience. While there are already many players in the decentralized exchange space, Aster stands out from the crowd thanks to its privacy-focused architecture, capital efficiency, and multi-chain support. Let's take a look at each of these elements that make Aster different.

Multi-chain liquidity and access

Aster was designed from the outset with multi-chain support at its core. It currently works with leading networks such as BNB Chain, Ethereum, Arbitrum, and Solana. This allows users to easily buy and sell their assets across different chains through a single interface. Concentrating liquidity typically dispersed across DEXs in one place significantly simplifies both time and transaction costs. With Aster, you can switch between chains with a single click, eliminating the hassle of token bridges, making the platform both practical and accessible.

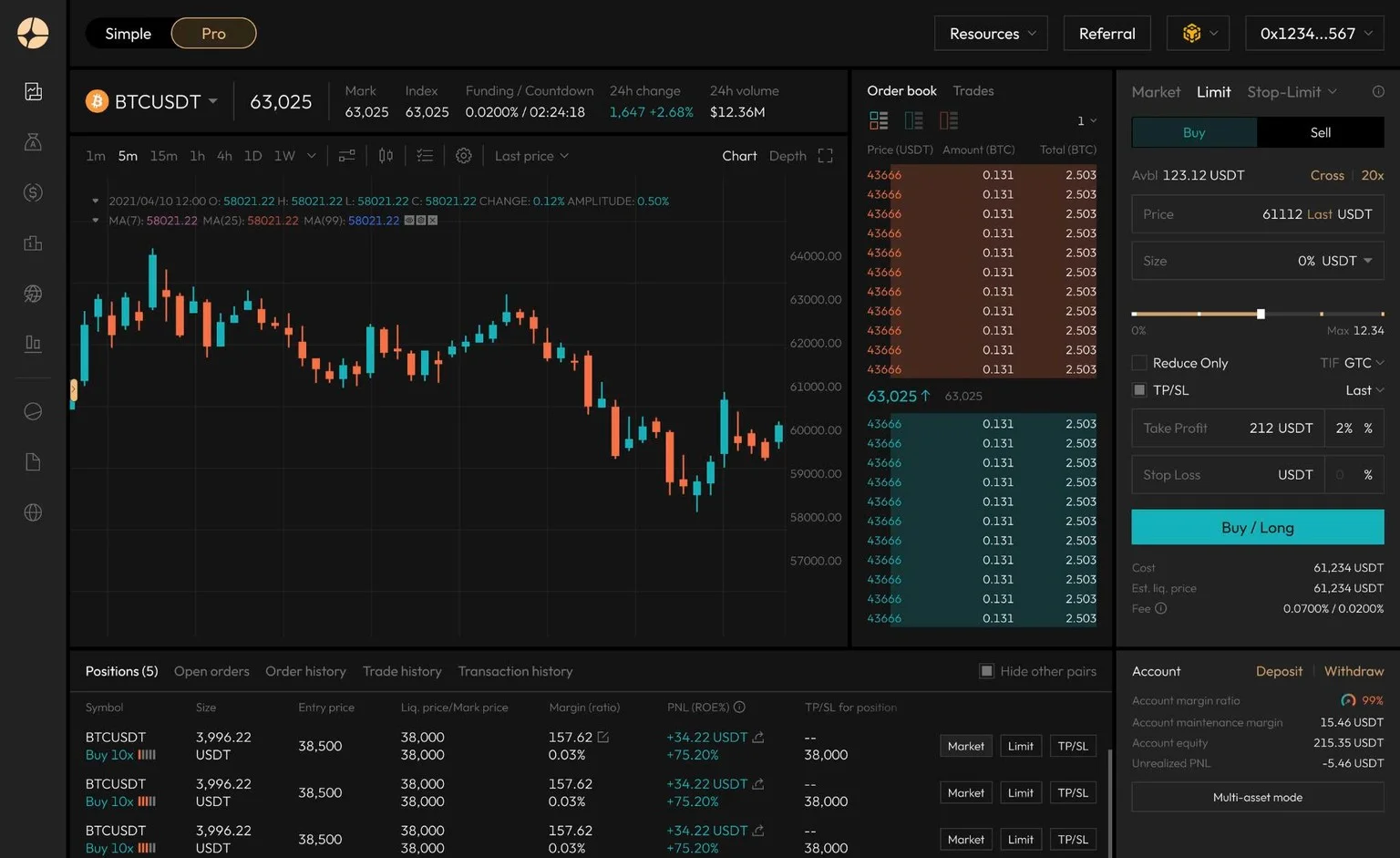

High leverage and advanced derivatives

One of the most striking aspects of the Aster DEX is its flexibility in leveraged trading. The platform offers leverage of up to 1001x on some currency pairs, exceeding industry standards. For comparison, Binance offers a maximum leverage of 20x, while Hyperliquid is limited to 40x. Such high leverage certainly creates an attractive platform for experienced and risk-averse investors; however, beginners should approach the market cautiously. Because Aster focuses on perpetual futures, users can open long or short positions without waiting for expiration. It also operates with the order book system familiar to professional traders, supporting advanced tools such as stop-loss, take-profit, and trailing orders. This allows for more precise strategy management and easier risk control.

Capital Efficiency and Innovative Collateral System

Aster takes capital efficiency to another level with its "earning collateral" approach. While assets deposited as collateral remain passive on most platforms, on Aster, these assets continue to earn returns even while trading. For example, when liquid staked BNB (asBNB) is used as collateral, BNB staking rewards continue to accrue throughout the transaction. Similarly, USDF, the yielding stablecoin within Aster's own ecosystem, can be used as collateral. This system both prevents capital from being wasted and reduces users' opportunity costs. This product line, called "Aster Earn," combines the liquid staking and interest-bearing token models of DeFi with derivatives trading to offer users a more efficient experience.

MEV resistance and privacy-focused transactions

One of the common problems in the DeFi world is front-running, where miners pre-empt transactions at the users' expense. Aster uses advanced solutions such as zero-knowledge proofs (ZK proofs) and hidden orders to address this issue.

Thanks to hidden orders, large investors can take positions without publicly disclosing the size of their trades. This makes market manipulation and "whale tracking" more difficult. CZ also stated in a statement in 2025 that fully transparent exchanges are not always ideal for large transactions, and that Aster's privacy approach offers a more balanced solution in this regard.

User-friendly interface and dual-mode support

Aster offers two different trading modes for users of all levels. Simple Mode offers a simple interface with one-click trading. Users who prefer not to bother with technical details can easily trade through the Aster Liquidity Pool (ALP). Pro Mode caters to more experienced traders. It creates the feel of a centralized exchange with its order book view, depth chart, advanced charts, and various order types. This dual-mode structure makes Aster one of the few DEXs that appeals to both beginners and professionals. While its competitor, Hyperliquid, caters exclusively to professional users, many simple DEXs lack advanced tools.

Community-Focused Governance and Support

Aster's token structure and governance model are centered around community participation. The ASTER token is used not only to pay transaction fees but also to influence decisions about the platform's future. The total supply is limited to 8 billion units, 53.5% of which is allocated to airdrops and community rewards. This incentivizes early adopters and strengthens their commitment to the project. Token holders can participate in voting on protocol updates, fee rates, or treasury usage. While Aster enjoys strong support from YZi Labs and Binance, it prioritizes maintaining community-focused governance.

Aster's Founders and Team

Aster is backed by a team experienced in decentralized finance and strong strategic backers. The core team consists of developers who worked on the Astherus and APX Finance projects before their merger in 2024. This team combined their expertise in derivatives and DeFi infrastructures under the Aster umbrella to build both the technical structure and innovative features. While the project may not have a prominent face, CEO Leonard has spoken about the Aster Chain vision and future plans in interviews.

One of the details that makes Aster stand out is the strong investment support it has received. The project is funded by YZi Labs, an investment firm originating from Binance Labs. Binance founder CZ's interest in the project and his support on social media have built trust in the community. Furthermore, several venture capital funds and angel investors in the industry also contributed to Aster in the early stages. These backers not only provided financial resources but also facilitated the project's growth in terms of liquidity and collaboration.

On the community side, Aster quickly gained a large user base. Tens of thousands of people follow the project on its official social media accounts; airdrop and bounty campaigns in September and October 2025, in particular, accelerated this growth. Many users continue to trade on the platform for new bounty and airdrop opportunities. Community members also have a say in the future of the platform through governance votes.

The team places great importance on direct communication with users. Regular AMA (Ask Me Anything) events, guideposts, and educational content help the community better understand both the project and the DeFi world. On the developer side, open documentation and incentive programs are offered to independent developers who want to integrate the Aster protocol. This will eventually create a broader ecosystem and third-party application network around Aster.

Frequently Asked Questions (FAQ)

Below, you can find some frequently asked questions and answers about Aster:

- What is Aster (ASTER) and what does it do?: Aster is a multi-chain decentralized exchange that supports both spot and perpetual transactions. Users can buy and sell assets across different networks from a single location, open leveraged positions, and maintain full control within their own wallets. In short, Aster combines the convenience of CEX with the freedom of DeFi. The ASTER token is used for transaction fee reductions, staking, and governance voting.

- What networks does Aster operate on?: Aster currently operates on the BNB Chain, but it also combines liquidity from Ethereum, Arbitrum, and Solana networks. This means users can trade from a single interface without switching between different networks. With the Aster Chain, which will be launched in the future, transactions will be faster and more private.

- Who founded Aster?: The project was born in 2024 with the merger of the Astherus and APX Finance teams. While no official founder is identified, Leonard is known as the CEO. Aster is also backed by YZi Labs, a subsidiary of Binance Labs, so CZ also has indirect support.

- When was the ASTER coin released, and what was its price like?: The ASTER token was launched in September 2025. Its price increased by over 2,000% during its launch week, reaching a market capitalization of $3-4 billion. It quickly became a top-50 cryptocurrency, but its price is quite volatile because it's still a new project.

- What does the ASTER token do?: ASTER is at the core of the Aster ecosystem. It offers discounts on transaction fees, allows for revenue generation through staking, and voting rights in community polls. It is also planned to be used as the native token of Aster Chain in the future.

- Has an airdrop been made, and will there be more?: Yes. During the launch period, Aster distributed 8.8% of the total supply to early adopters. Unclaimed tokens after this campaign were transferred to the community reward pool. Due to the large pool, the possibility of a new airdrop is high, and the community is optimistic about it.

- Is Aster reliable and worth investing in?: Aster is a technically innovative project with strong supporters. However, because it's still new, the risk factor is high. Leveraged transactions may pose a risk of regulatory or technical issues. It's best to follow project developments and start with small amounts before investing.

- What other products does Aster offer?: With the Aster Earn system, users can earn passive income from staking or interest-bearing products. New products like tokenized stock futures are also being added. Commodity and index derivatives are expected to be available on Aster soon.

Follow the JR Kripto Guide series to stay up-to-date on the latest developments in the Aster and blockchain world.