Aerodrome Finance is a fully decentralized exchange (DEX) and automated market maker (AMM) platform running on the Base network developed by Coinbase. While it may sound technical, the logic is simple: Aerodrome is the meeting point for anyone looking to trade, provide liquidity, and have a say in the governance of the Base ecosystem. It stands out with its low-cost transactions, fast confirmation times, and user-friendly structure. Moreover, the AERO coin (token) at the heart of the platform is central to both liquidity incentives and the governance mechanism. So, the answer to the question of what Aerodrome Finance is: it's an innovative and user-focused decentralized exchange protocol on the Base network, growing through community power.

So, how did this platform come about, what was its purpose, and why has it become so important in the DeFi ecosystem? What is Aerodrome Finance, what is AERO coin? What does Aerodrome Finance do? Let's take a step-by-step look at Aerodrome Finance's story, history, technical features, and role on the Base network.

Aerodrome Finance's Definition and Origin

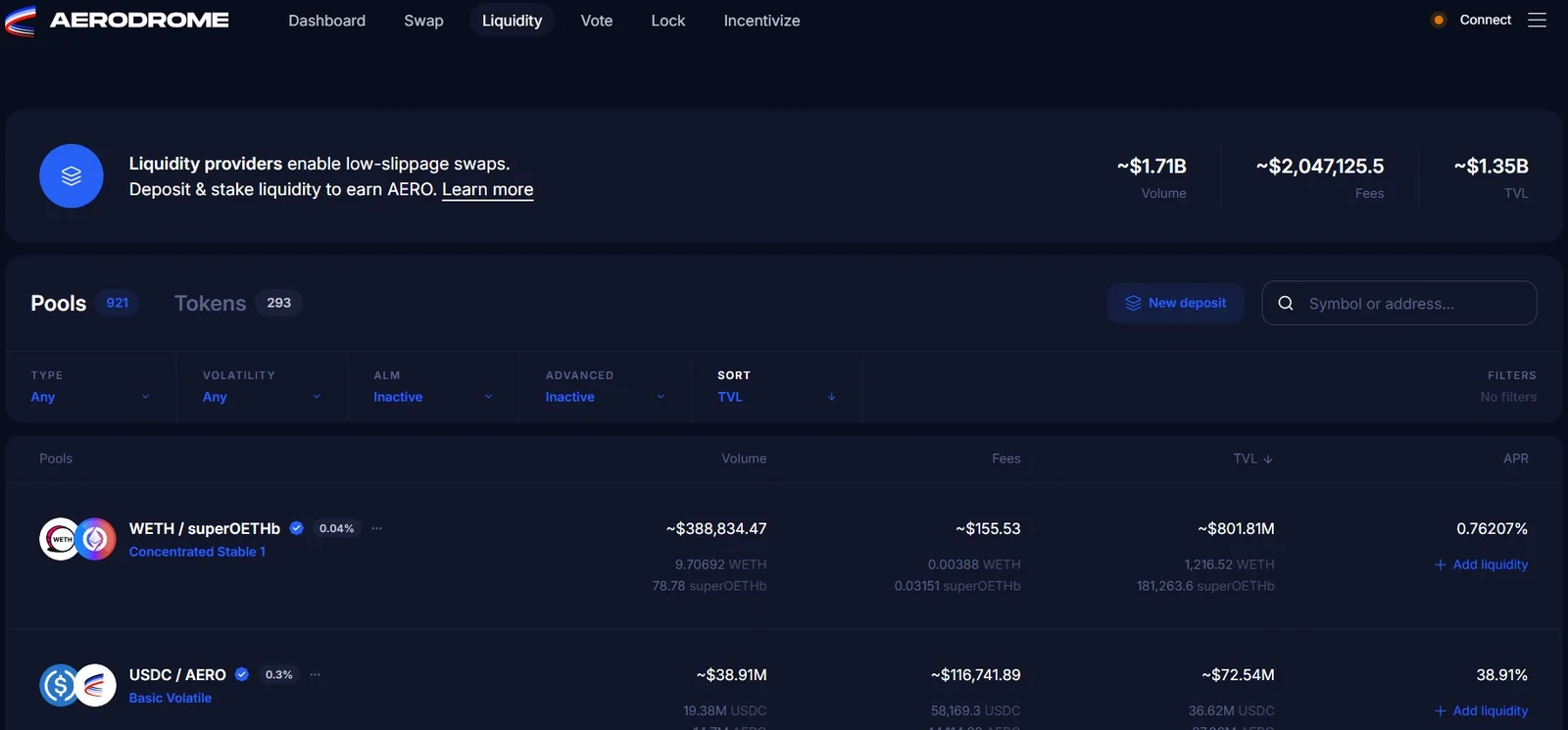

Aerodrome Finance is a decentralized exchange and liquidity protocol operating on the Base network, allowing users to trade tokens without the need for intermediaries. It's based on an automated market maker (AMM) approach like Uniswap, but it has a key difference from other DEX platforms: it combines multiple liquidity models under one roof. This includes classic token pools like Uniswap V2, stablecoin-focused pools like Curve, and concentrated liquidity pools inspired by Uniswap V3.

Bu çeşitlilik sayesinde Aerodrome, sermaye verimliliğini artırırken farklı türdeki varlık çiftleri için en uygun likidite çözümlerini sunabiliyor. Bir diğer dikkat çekici özellik ise ve(3,3) modeli. Bu sistemde tüm işlem ücretleri ve ödüllerin tamamı, doğrudan AERO token’larını kilitleyerek veAERO adı verilen oy hakkını elde eden kullanıcılara aktarılıyor. Böylece hem likidite sağlayıcıların hem de yönetişim sürecine katılan topluluğun çıkarları aynı noktada buluşuyor ve ekosistemin uzun vadede sürdürülebilir olması hedefleniyor.

Peki, AERO coin çıkış tarihi ne zaman? Aerodrome Finance, Ağustos 2023’te Base ağında hayata geçti. Ethereum Layer-2 (L2) çözümü olan Base’in henüz yeni yeni şekillenmeye başladığı dönemde devreye girerek, ağ üzerindeki merkeziyetsiz ticaretin ilk temellerini atan projelerden biri oldu. Geliştirici ekibi ise aslında Optimism ağındaki popüler DEX olan Velodrome Finance’ın çekirdek kadrosu. Alex Cutler ve Tao Watts gibi isimler, Base geliştirici ekibiyle yakın çalışarak Aerodrome’u inşa etti. Coinbase’in de destek verdiği Base ağı üzerinde, Velodrome’un ve(3,3) modelini uygulayarak Base’e özel bir likidite merkezi oluşturmayı hedeflediler. Üstelik bu lansman, geleneksel token satışı ya da VC desteği olmadan, tamamen topluluk odaklı bir şekilde gerçekleşti.

Aerodrome Finance’ın çıkış amacı net: Base ağı üzerinde verimli likidite sağlamak ve yeni projelerin ekosisteme sorunsuz bir şekilde adım atabileceği bir “likidite üssü” olmak. Base’in kendi yerel token’ı bulunmadığı için, ekosistemde teşvik unsuru olacak bir tokene ihtiyaç vardı. AERO token, bu boşluğu doldurmak ve Base ekosisteminin teşvik token’ı olmak için tasarlandı. Aerodrome, adeta Base üzerindeki projelerin iniş pisti gibi çalışıyor: Yeni bir token piyasaya sürüldüğünde, Aerodrome’daki likidite havuzları sayesinde hızla derin likiditeye ulaşabiliyor. Örneğin WETH, USDC gibi temel varlıklar için havuzlar açılarak kullanıcıların ihtiyaç duyduğu likidite sağlandı; Coinbase’in sarılmış Bitcoin’i cbBTC de kısa sürede Aerodrome havuzları sayesinde yüksek hacme ulaştı. Bugün Aerodrome Finance, Base ağında merkeziyetsiz ticaretin ve yield farming fırsatlarının önünü açan kritik bir altyapı. Dahası, Optimism-Base Superchain vizyonuna paralel olarak, Optimism’deki Velodrome ile kardeş protokol konumunda ve birlikte daha geniş bir süper zincir ekonomisinin temellerini atıyor.

Aerodrome Finance's History: Key Milestones

Although Aerodrome Finance is still a young project, it has quickly achieved many significant milestones that have made its name known. Since its launch, many notable milestones have been achieved both within the Base ecosystem and the DeFi world. Let's take a chronological look at these milestones that shaped Aerodrome's story.

Launch and Initial Activities: August 2023

Aerodrome Finance officially launched on August 28, 2023, immediately following the launch of the Base mainnet. That day, the platform's smart contracts began running on Base, and the first transactions were made. The launch was not a standalone project; it was a collaboration with approximately 20 other projects. This quickly provided the initial liquidity needed by the Base ecosystem. Among the first pools opened were critical pairs for both Ethereum and stablecoins, such as WETH-USDC and cbETH-WETH. This allowed Base users to trade their popular assets at low cost and with rapid confirmation from day one.

Another surprise of the launch was the AERO token airdrop. Aerodrome's governance token, AERO, was distributed to holders of the Velodrome platform and VELO tokens locked in Optimism. Furthermore, 40% of the total supply was allocated to this group.

First liquidity incentives launched: September 2023

Aerodrome immediately implemented yield farming incentives upon launch. Liquidity providers (LPs) began earning AERO token rewards by depositing tokens into pools and staking the LP tokens they received on the platform. The incentive model was designed to operate in weekly periods, or epochs. Each week, AERO rewards allocated to designated pools and the previous week's trading fees were distributed based on the preferences of the community's voting AERO holders. In the first weeks of launch, major pairs like WETH-USDC received the most votes, and as more rewards were distributed, liquidity quickly flowed into these pools. As a result, Aerodrome's total locked asset (TVL) quickly reached hundreds of millions of dollars. Aside from brief price fluctuations in October 2023, the platform maintained a steady growth trajectory, becoming the DeFi protocol with the highest TVL on the Base network by the end of its first months.

Exchange Listings and Trading Volume Increase: Fall 2023

As Aerodrome's popularity grew, the AERO token entered the radar of centralized exchanges. By the end of 2023, AERO began listing on several major crypto exchanges. In December 2023, the Coinbase Exchange listing followed, allowing users to buy and sell AERO directly on Coinbase. This move not only increased Aerodrome's awareness but also accelerated its trading volume. When daily DEX volumes on the Base network reached record levels in the first quarter of 2024, Aerodrome alone accounted for more than 10% of this volume. In March 2024, the total daily volume of decentralized exchanges on the Base network exceeded $1.2 billion, making Aerodrome the second-largest DEX with a 9.7% share.

Coinbase ecosystem fund investment: February 2024

In February 2024, a critical development occurred for Aerodrome. The Base Ecosystem Fund, led by Coinbase Ventures, strategically invested in the project and began holding a large amount of AERO tokens. This move clearly signaled that Aerodrome was indirectly supported by Coinbase. Following the news, the price of the AERO coin skyrocketed, rising from approximately $0.09 to over $0.60, gaining over 600% in a week. Coinbase not only invested; He locked the AERO he received and converted them into veAERO and began participating in the protocol's governance votes. By voting for pools that would benefit his ecosystem, particularly Coinbase's wrapped Bitcoin asset, cbBTC, he strengthened liquidity on Base and helped Aerodrome reach a wider user base.

All-Time Price High: December 2024

The general upward trend in the crypto market that began in late 2024 also had a powerful impact on the AERO token. In December, AERO reached an all-time high of approximately $2.3. This peak clearly reflected both Aerodrome Finance's success on the Base network and the growing demand for the ecosystem. At the time, the platform's total locked asset value (TVL) broke a record, exceeding $800 million. However, due to the volatile nature of the crypto market, these levels were not maintained for long. The market correction in the first quarter of 2025 led to a sharp pullback in AERO's price, bottoming out at around $0.28 in April. However, the platform's trading volume and user activity remained stable; on the contrary, the price began to recover, and AERO returned to above $1 within a few months. Currently, AERO is trading around $1.34.

Integration with the Coinbase app: Summer 2025

One of the most significant milestones in Aerodrome's story came in the summer of 2025. In August, Coinbase announced the addition of decentralized exchange (DEX) integration to its mobile app for US users. In this system, trades were routed to liquidity on the Base network through aggregators like 0x and 1inch. This enabled the Coinbase app to scan the liquidity of DEXs on Base, such as Aerodrome and Uniswap, and offer users the best-priced swap opportunities. This move enabled millions of Coinbase users to trade directly from Aerodrome pools. Following the news, the price of AERO rose more than 30% in a week. The Aerodrome team worked closely with Coinbase to support the integration process and ensured that liquidity on Base reached a much wider audience.

Record total volume and current status: 2025

In just two years, Aerodrome Finance has become an indispensable project within the Base ecosystem. By mid-2025, the platform's total transaction volume exceeded $250 billion, representing a fivefold increase compared to 2024. The number of daily active users and the number of transactions continued to increase in line with the overall growth of the Base network. The development team was not idle either; innovations such as the concentrated liquidity feature promised with Velodrome V2 and the more user-friendly Night Ride interface were gradually implemented. By the second half of 2025, Aerodrome maintained its position as the largest DEX on Base and began pushing the billion-dollar threshold in total locked value.

Why Is Aerodrome Finance Valuable?

There are many reasons that make Aerodrome Finance valuable. It's no coincidence that it has quickly become such a central position in a new blockchain ecosystem like the Base network. Its innovative design and community-centered approach have made it an indispensable part of the ecosystem. Here are the key points that make Aerodrome stand out:

Decentralized trading on the Base network

Aerodrome Finance played a pioneering role as one of the first major DeFi projects to launch on the Base network. When the Base network launched in 2023, users were looking for a reliable, local decentralized trading platform. This is where Aerodrome stepped in, becoming Base's first DEX platform. But it wasn't just the first; it quickly grew to become one of the ecosystem's largest applications. Its high liquidity and growing user base directly contributed to the success of other projects on Base. In fact, during the boom in volume on Base during the memecoin boom, it became one of the most traded platforms alongside giants like Uniswap.

Highly efficient liquidity provider

Aerodrome Finance's design is packed with clever mechanisms to both attract and preserve liquidity over the long term. At its core, it's a "meta-DEX" infrastructure that combines the best aspects of different DEX models, such as Uniswap V2, Uniswap V3, and Curve, all in one place. This allows users to offer the best price and lowest slippage on both volatile token pairs and stablecoin pairs like USDC-USDT. For example, while trading with near-zero losses using Curve's StableSwap algorithm on stablecoin pairs, the simple and predictable pricing offered by Uniswap's x*y=k model comes into play on volatile pairs. To increase capital efficiency, it has also gradually added the concentrated liquidity system we saw in Uniswap V3.

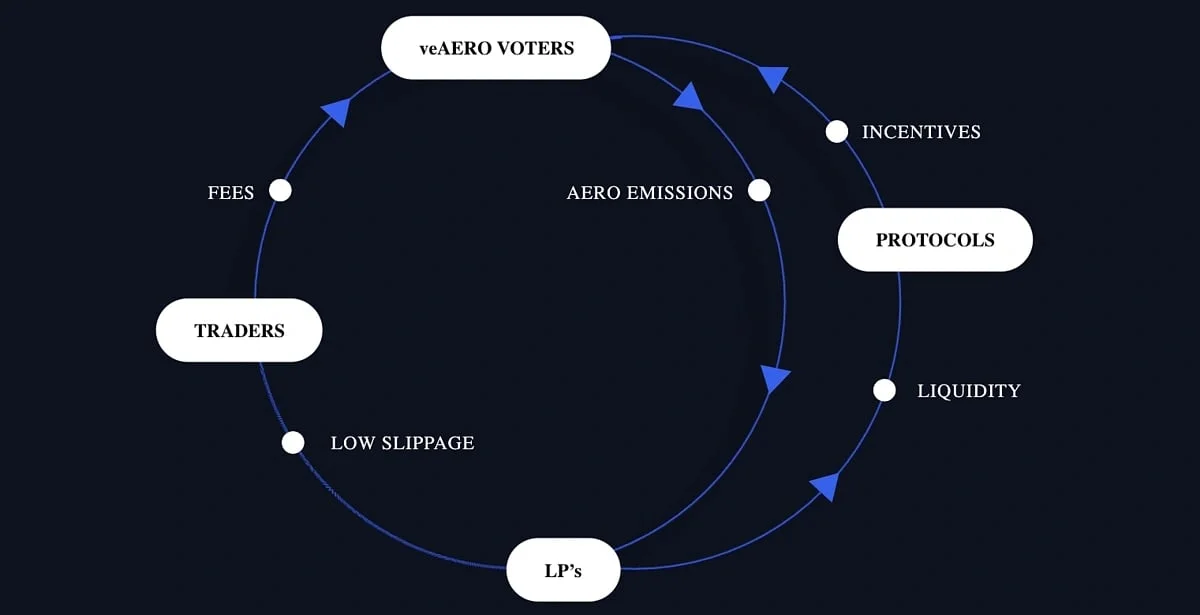

On top of this, Aerodrome's trademark ve(3,3) incentive model is implemented. In this model, all transaction fees and rewards go to users who lock their AERO tokens and convert them into veAERO. There is no intermediate commission layer; the user earns directly. Those who provide liquidity earn AERO tokens, while those who lock their AERO receive a share of all transaction fees on the platform.

Community Incentives and Staking Rewards

Aerodrome Finance has been a project that has placed the community at its core since its inception. The AERO airdrop at launch is a clear example of this. The platform operates entirely based on community incentives. Everyone who provides liquidity earns AERO token rewards. The reward amount is determined by votes cast in weekly epochs. Earned AERO can be sold or re-locked and converted into AERO to participate in governance.

Furthermore, users who lock their AERO for a specific period receive a share of the weekly transaction fees and collect additional rewards offered by other users for pool incentives (voter incentives). For example, a newly launched project on Base can offer additional rewards to AERO holders when they want to attract liquidity for their token on Aerodrome. AERO holders vote for that pool to receive these rewards, and the LPs of that pool earn more AERO.

It provides benefits.

Low transaction fees, fast transaction confirmation

Another strength of Aerodrome is the Base network it operates on. This Layer-2 solution, which offers much lower gas fees and high speed compared to Ethereum, makes transactions both cheap and fast. Swapping tokens on Aerodrome typically costs only a few cents, and the average confirmation time is around 2–3 seconds. Furthermore, the platform's smart contracts support solutions like "Flashbots," ensuring faster and more prioritized transactions.

Low slippage and low fees are a significant advantage, especially for users trading large volumes. Aerodrome maintains this advantage by keeping its pools deep and using advanced price discovery methods. Combined with Base's low-cost and fast structure, this results in a truly user-friendly trading experience.

Aerodrome Finance's Developers and Community

The team and community behind Aerodrome Finance play a significant role in its success, as much as its technical infrastructure. The founding developers, strong partners, and an active user base have combined to make the platform one of the most important projects on the Base network.

Founding Team and Project Partners

Who is the founder of Aerodrome Finance? Aerodrome's founding team consists of experienced individuals in the DeFi world. The core team of the Velodrome protocol on Optimism, led by Alex Cutler and Tao Watts, participated in this project. Bringing their Solidly/Velodrome experience to the Base network, the team developed the technical infrastructure and collaborated closely with the Base team. Support from Coinbase and the Base team was also crucial throughout the development process; in fact, official presentations specifically emphasized that Coinbase was developed in conjunction with the Base team.

During Aerodrome's launch, we collaborated with approximately 20 different protocols to provide liquidity to the ecosystem. These partners included various DeFi projects operating on the Base network, token-issuing startups, and decentralized applications. In early 2024, the Base Ecosystem Fund investment, led by Coinbase Ventures, provided institutional confidence in the project. Coinbase locked up its AERO tokens, participated in governance, and clearly demonstrated its long-term commitment to support. In short, Aerodrome Finance launched with an experienced team from Velodrome and the support of industry giants.

Community Contribution and Its Role in Growth

Aerodrome Finance was designed as a community-driven project from the outset. The launch of the veAERO airdrop gave thousands of DeFi users the right to vote and integrated them into the platform's governance process. The community decides which liquidity pools will receive the most incentives through weekly votes. This system ensures that incentives are shaped entirely by user preferences.

The community not only votes; they also share ideas for platform development on forums and social media, suggesting new features. For example, the decision to prioritize the concentrated liquidity feature was made directly through community requests. Thanks to the platform's transparent communication approach, the roadmap is shared with users, and feedback is quickly evaluated.

Decisions at Aerodrome are made directly through the votes of veAERO holders under the veDAO structure. Important issues such as emission rates, new pool additions, and protocol fees are put to a vote. Thus, the entire management of the project operates completely transparently through smart contracts. As of 2025, more than 600,000 addresses are known to hold AERO.

DAO Governance Model and Decision Processes

With its governance structure, Aerodrome Finance operates exactly like a DAO. The AERO token is both central to incentives and serves as the key to governance. Users lock their AERO and convert them into AERO NFTs, gaining voting rights. These votes determine which pools will receive weekly emissions. Pools with the most votes earn more AERO rewards that week.

All decisions made within the protocol are recorded on-chain, and the results are automatically implemented. For example, monetary policy management, called the "Aero Fed," has been delegated to the community according to a set schedule, and emissions changes are now determined entirely by user votes. Furthermore, Aerodrome's public goods fund is managed by community votes, and this fund provides support for projects that will add value to the ecosystem.

This entire structure makes Aerodrome Finance a decentralized, community-driven project. Because users are involved in the project as both investors and decision-makers, a sense of belonging is strengthened. This democratic model contributes to the platform's long-term durability and sustainability. As a result, Aerodrome Finance maintains its leadership position within the Base ecosystem as a protocol growing under the joint ownership of both the development team and the community.

Frequently Asked Questions (FAQ)

Below, you can find frequently asked questions and answers about Aerodrome Finance…

- What is Aerodrome Finance, and when was it released?: Aerodrome Finance is a decentralized exchange (DEX) and liquidity protocol running on the Base network. It offers users token swaps with low fees and fast confirmations. The project launched in August 2023 and was one of the first major DeFi platforms on the Base network.

- Who developed Aerodrome Finance?: The team behind Aerodrome is the founding team of Velodrome Finance on the Optimism network. Velodrome's core developers, Alex Cutler and Tao Watts, collaborated with the Base team to launch Aerodrome. Coinbase Ventures is also among the project's supporters, having invested in Coinbase's Base Ecosystem Fund.

- What does the AERO token do?: AERO is the native token of the Aerodrome platform and has a multitude of functions. It is primarily distributed as a reward to liquidity providers; users earn AERO by adding liquidity to Aerodrome pools. The AERO token is also used for governance – users who lock their AERO and AERO gain voting rights, thus having a say in the platform's incentive allocation and other decisions. AERO is both the fuel of the incentive mechanism and the key to Aerodrome's governance.

- How does Aerodrome Finance work?: Aerodrome is a DEX operating on an automated market maker (AMM) principle. It creates liquidity pools of two tokens through smart contracts, and users swap across these pools. Transaction fees are distributed directly back to the community that provides liquidity to the pool. Aerodrome's innovative approach is that it combines different AMM models (such as Uniswap V2, Curve, and Uniswap V3) and directs all fee revenues to users who lock up AERO. This enables both low-slippage and fast swap transactions, and users receive a share of the protocol's revenues.

- Is Aerodrome Finance suitable for investment?: Aerodrome Finance's AERO token has been quite volatile since 2023. Its rise to $2+ by the end of 2024, followed by a subsequent decline, was noteworthy. While the project is central to the Base network ecosystem, it's important to assess the risks before investing. Investment suitability depends on an individual's risk tolerance and confidence in the project. Aerodrome is seen as having long-term potential due to its strong community and innovative model, but it's important to remember that it also carries the general risks of the crypto market.

- Which network does Aerodrome Finance run on?: Aerodrome Finance runs on Base, Coinbase's Ethereum Layer-2 network. The Base network is a blockchain that uses Optimism technology, parallel to Ethereum but faster and lower-cost. Aerodrome operates completely decentralized thanks to its smart contracts on the Base network. Because it operates on the Base network, transaction fees are paid in ETH, and confirmations occur within seconds. In short, Aerodrome is a Base network-based DeFi platform that has built its entire operation on Base.

Follow the JR Crypto Guide series for the latest information on Aerodrome Finance and DeFi projects on the Base network.